Thoughts For Thursday: With War Clouds As A Backdrop The Market Is Set To End The Year On A High

The market looks set to end 2023 on a high note, but 2024 is less certain, particularly because though, the US does not want further action in the Gulf, it seems, Iran via its proxies is gaming for just that.

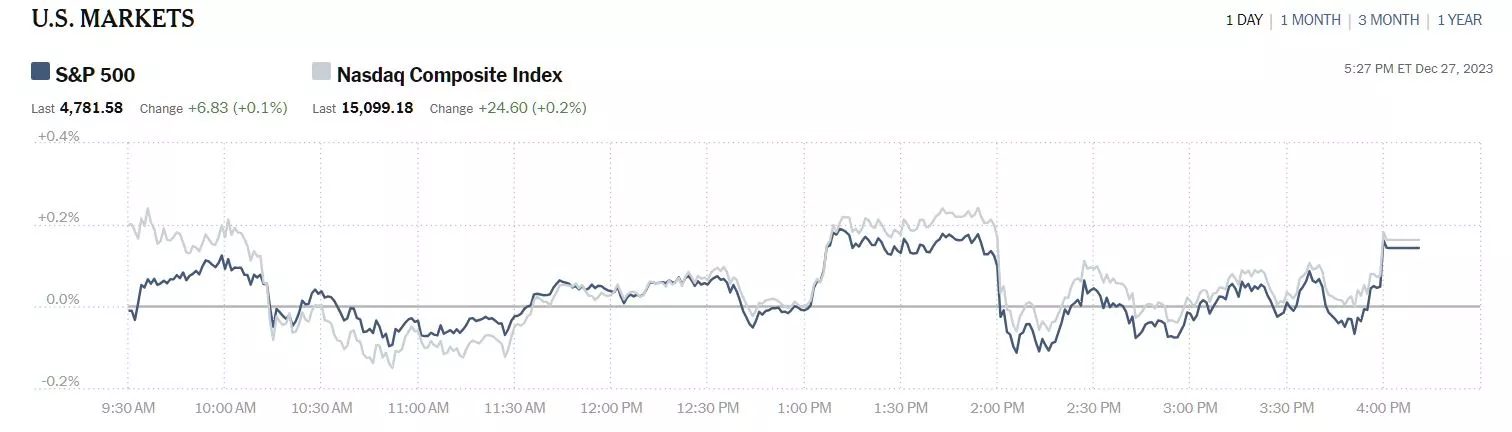

On Wednesday, the S&P 500 closed at 4,782, up 7 points, the Dow closed at 37,657, up 111 points and the Nasdaq Composite closed at 15,099, up 25 points.

Chart: The New York Times

Top Gainers on the session were led by Moderna (MRNA), up 3.5%, followed by Regeneron (REGN), up 2.9% and Carmax (KMX), up 2.4%.

Chart: The New York Times

In morning futures action, S&P 500 market futures are up flat, Dow market futures are down 64 points and Nasdaq 100 market futures are up 36 points.

TalkMarkets contributor Lallalit Srijandorn notes WTI Rebounds Above $74.00, Focus On Red Sea Developments.

"Western Texas Intermediate (WTI), the US crude oil benchmark, is trading around $74.30 on Thursday. The recovery of WTI prices is bolstered by the softer US Dollar (USD), which lends some support to USD-denominated commodities...

Market players will closely monitor the developments in the Red Sea as a drone attack on an oil tanker prompted fears of shipping disruption. Furthermore, the ongoing Israeli military attack in Gaza remained a major driver of market sentiment. Central Gaza was pummeled by land, sea, and air by Israeli forces on Wednesday, one day after Israel's Chief of Staff Herzi Halevi, stated that the conflict would last for many months...

According to the American Petroleum Institute weekly report on Wednesday, US crude oil inventories increased by 1.837M barrels for the week ending December 23 from the previous reading of 0.939M barrels gain..."

Contributor Candy Matheson notes 2024 Market Forecast: 'Black Swan Event' In 2024 It Is Then...

"Perhaps this CBS news reporter's prediction of a 'Black Swan Event' for 2024 is not so far off...either when it comes to U.S. national security, or in the stock markets...especially when one considers the reluctance of traders/investors to convincingly push markets above the December 2021 high for the past two years, as shown on the following monthly S&P 500 Index (SPX) chart.

Source: ZeroHedge

Perhaps such reluctance stems from Joe Biden's epic multiple failures as a leader since he became President in January of 2021, about which I've written extensively.

Conclusions:

As I hypothesized in my 2023 Market Forecast, and, as long as Joe Biden remains President, I think we'll see more whipsaw, volatile moves occur in all markets in 2024, until such a 'Black Swan event' does occur...particularly since it's a presidential election year and each one has become more contentious and controversial.

Any push to new highs may be met with a swift retreat to new lows...possibly to retest 3200, or lower."

TalkMarkets contributor Shelly Palmer discusses The New York Times Vs. OpenAI And Microsoft: A Landmark Legal Battle Over AI And Copyright.

"The New York Times has sued OpenAI and Microsoft, alleging copyright infringement. The suit claims that millions of The Times’s articles were used to train AI chatbots like ChatGPT, which now compete with traditional news sources.

The complaint does not specify a monetary figure, but demands “billions of dollars in statutory and actual damages” for the “unlawful copying and use” of The Times’s content. It also seeks the destruction of any AI models and training data incorporating The Times’s copyrighted material.

The Times’s case centers on the accusation that OpenAI and Microsoft have used its journalism to create competing products, thereby impacting its audience and revenue. The lawsuit follows failed negotiations between The Times, Microsoft, and OpenAI, where The Times sought a resolution that might include a commercial agreement and specific guidelines for AI products.

Some news outlets – such as The Associated Press and Axel Springer (the German publisher that owns Politico and Business Insider) – have already signed licensing deals with OpenAI. This lawsuit may just come down to agreeing on terms.

This legal action is indicative, however, of a broader trend of copyright concerns in the creative industry. High-profile cases include Sarah Silverman, Jonathan Franzen, and John Grisham suing over the use of their works in AI training, as well as Getty Images’ lawsuit against Stability AI for using its copyrighted visual materials.

The lawsuit also highlights AI’s potential impact on traditional journalism. It cites instances where AI-generated content, based on The Times’s work, is made available without proper attribution or compensation, leading to potential revenue losses.

This lawsuit is one to watch. If the future of generative AI models requires vast amounts of training data, determining what data is protected and what data may fall under fair use is “the” question."

Contributor Crispus Nyaga notes Wall Street Banks Give Their S&P 500 Forecast For 2024.

"The S&P 500 index (SPX) had a strong performance in 2023 as it surged by over 25% and pared back its 2022 losses. Its other peers like the Nasdaq 100 and Dow Jones also surged to record highs.

The main lesson from this is that American equities always rise...

Therefore, I suspect that 2024 will be a good year for American equities. The economy has successfully avoided a hard landing as consumer spending held quite well. Also, the Federal Reserve is expected to start cutting interest rates in March now that inflation is nearing its target of 2.0%.

I also see corporate earnings will do well since wage growth is growing quite well in the US. According to FactSet, analysts are now predicting a double-digit growth in 2024. They see them rising by 11.4% during the year, higher than the trailing ten-year average. The top-performing sectors will be health care, communications, and technology,

My base case is a situation where the SPX index jumps to $6,000 in 2024, implying another 25% increase from the current level.

This view is much more optimistic compared to that of Wall Street banks. The most optimistic analysts are from Yardeni Research, who expects the S&P 500 index to rise to $5,400. In an interview this week, Ed Yardeni said that the American economy will continue being resilient during the year. He sees China’s slowdown as the biggest risk.

The other aggressive estimates are from Oppenheimer, Goldman Sachs, BMO, Citigroup, and Deutsche Bank. These analysts believe that the S&P 500 index will surge to $5,000 in 2024 as investors cheer the start of rate cuts.

Not all Wall Street firms are optimistic about the SPX index. Those at Cantor Fitzgerald, JPMorgan, Scotiabank, and Wells Fargo believe that the index will end lower than where it is today. Morgan Stanley sees stocks remaining in a consolidation phase in 2024...

There are several risks to have in mind as we start a new year. The biggest risk is a full-blown war in the Middle East, where tensions are continually rising. Yemen terrorists have pledged to continue causing havoc in the region..."

Contributors from the Staff at Bespoke Investment Group zero in on JP Morgan (Performance) Chase.

"Just about every price chart lately looks like a one-way move higher, but in scanning through various charts earlier, we were struck by how steep and one-directional the move in JP Morgan Chase (JPM) has been over the last two months. Besides a handful of days with red bars, the stock has seemingly done nothing but go higher each day."

"So, just how impressive has the move over the last two months been? In the last 40 trading days, JPM has finished the day higher 30 times. While we don't have price data going back to the days of J.P. Morgan himself, going back to 1980, the current frequency of positive days over a 40 trading day period has never been seen."

Caveat Emptor.

Here's to the market pulling higher through its 2023 close.

Peace.

More By This Author:

Thoughts For Thursday: Everything That Goes Up Comes Down

Tuesday Talk: CPI Data And FOMC Meeting Hold Back Market Breakout

Thoughts For Thursday: Waiting For Santa