Tuesday Talk: CPI Data And FOMC Meeting Hold Back Market Breakout

While the market continues towards making new highs, it is falling short of making a breakout rally. Forthcoming CPI data and the upcoming FOMC meeting may be the catalyst for a breakout.

On Monday the S&P 500 closed at 4,622, up 18 points, the Dow closed at 36,405, up 157 points and the Nasdaq Composite closed at 14,432, up 29 points.

Chart: The New York Times

Top gainers for the day were Cigna Group (CI), up 16.7%, followed by Broadcom (AVGO) and Etsy (ETSY), up 5.8%.

Chart: The New York Times

In morning future trading, S&P market futures are up 2 points, Dow market futures are up 28 points and Nasdaq 100 market futures are up 22 points.

TalkMarkets contributor Patrick Munnelly writes in his Daily Market Outlook - Tuesday, Dec. 12 that November CPI data is expected to be influenced by lower oil prices.

"Asia - Most Asia-Pacific stocks were positive following gains on Wall Street. The Nikkei 225 surged initially but steadily gave up nearly all of its gains as the effects of a firmer currency seeped through. Hang Seng and Shanghai Comp. were initially underpinned by China's Central Economic Work Conference and measures on integrated development of domestic and foreign trade, but the mainland index ultimately lagged.

Europe - The latest UK employment data indicates a shift in employment conditions and a more substantial than expected decline in wage growth. In October, the experimental unemployment rate held steady at 4.2%, but November saw a decrease in both payroll employees and job vacancies. Annual regular pay growth decelerated from 7.7% to 7.3% in October. As policymakers approach Thursday's Bank of England update, they may find encouragement in the easing of employment market pressures and the slowdown in wage growth. However, they are cognizant that wage gains, though moderating, still surpass levels consistent with sustaining the inflation target.The upcoming German ZEW survey is expected to provide an early insight into Eurozone economic trends in December. However, it should be noted that as a poll of financial analysts, its readings may be less reliable than other surveys such as the PMIs. In the previous month, there was a slight increase in the current conditions index and expectations rose for the fourth consecutive month. Despite these positive trends, both indices remain historically low. The forecast for December predicts a modest increase in both measures.

US - Stateside, this afternoon's update on US CPI inflation for November is the final significant data release preceding tomorrow's US Federal Reserve monetary policy announcement. In October, annual headline inflation experienced its first decline in four months, dropping from 3.7% to 3.2%, primarily due to lower oil prices. Core inflation, excluding food and energy, also saw a slight decrease from 4.1% to 4.0%. The November data is expected to be influenced by lower oil prices once again, projecting an overall inflation decrease to 3.1%, while the core rate may remain at 4.0%. This positive trend in inflation is likely to prompt the Fed to affirm on Wednesday that interest rates have likely peaked. However, the timing of when they will be confident enough to implement rate cuts remains uncertain."

See the full article for a more detailed forecast.

Contributor Declan Fallon notes Markets Inch Higher As Semiconductors Make All The Running.

"Bulls came into the week with a small edge, but it was left to Semiconductors (SOX) to push beyond its 'bull flag' and July swing high resistance. Gains in the Semiconductor index coincided with a new MACD trigger 'buy' and an acceleration in relative performance to the Nasdaq 100.

The Dow Industrial (DIA) pushed above last week's consolidation. Having committed to this break, we need to watch for a potential 'bull trap' as this is a breakout coming off an extend rally of nearly 4,000 points.

The Russell 2000 (IWM) is on course to test the August swing high around $191. I would be looking for some sideways action should the index make it to this resistance level.

Go to the article for the Nasdaq and S&P 500 charts.

Contrubutor Shelly Palmer reports that EU Sets Global Precedent With Comprehensive AI Regulation.

Image: Shelly Palmer.com

Create an image that captures EU regulation of AI technologies, including ChatGPT. Aspect ratio: 16:9.

"The European Union has finalized a groundbreaking law to regulate AI, potentially setting a global standard. This legislation, part of the EU’s AI Act, aims to balance the rapid advancement of AI technology with necessary oversight and risk management. Key aspects include stringent requirements for AI applications deemed “high risk” in sectors like autonomous vehicles and medical devices.

The AI Act also addresses contentious issues like facial recognition. While it prohibits the creation of facial recognition databases from internet or security footage, it grants exceptions for law enforcement in specific scenarios, a point that has raised concerns among human rights groups.

Additionally, the legislation differentiates between proprietary and open-source AI models. Open-source models, developed with publicly available code, are exempt from certain restrictions, benefiting European AI firms like France’s Mistral and Germany’s Aleph Alpha.

Many believe the law’s impact will likely extend beyond Europe, echoing the global impact of GDPR (General Data Protection Regulation). Maybe. I haven’t read the fine print yet – that’s my weekend project – but the summary documents I have read seem to be trying to solve for future issues as EU regulators understand them today, which feels like a bad strategy.

The biggest risk is that these stringent regulations will impede AI innovation within the EU, putting it at a disadvantage against less regulated markets like the U.S. and the UK… but that risk never seems to bother EU regulators. With provisions for fines up to 7 percent of global revenue, they think it’s more profitable to regulate than to innovate."

TM contributor Rod Raynovitch writes Biotech Is Coming Back, Can The Run Last?

"Biotech stocks are coming back against a backdrop of negative policy actions from the Biden Administration to lower drug prices. First, there was the Inflation Reduction Act which targeted 10 prescription drugs for which Medicare can negotiate drug prices directly with manufacturers. Now you have challenges to the historic Bayh-Dole Act where Biden asserts power to seize drug patents in cases where prices are deemed too high. Despite this onslaught from government biotech stocks have rallied over the past six weeks from the early November bottom with one brief sell-off..."

"Our top large cap picks are holding up nicely: ABBV MRK REGN VRTX but LLY was off 2.7% today after a study showed that weight gains could come back after you stopped taking the drug.

Biogen (BIIB) was up 2.5% today on recent upgrades for their Alzheimer's drug prospects for 2024.

We will be tracking our MOMENTUM SMID picks below this week. We did notice an emerging rally in genomics stocks like Twist Bioscience (TWST) and 10X Genomics (TXG) and bought positions early last week. We also bought a small position in Illumina a great Company with a lot of issues from their GRAIL deal.

Cognition Therapeutics is up 19% as a Neuroscience play with potential biomarkers."

TalkMarkets contributor Steve Sosnick asks is Chair Powell: Grinch Or Goldilocks?

"It’s that time again, one of the eight weeks a year that we prepare ourselves for the next scheduled FOMC meeting. To say that expectations are riding high for Wednesday’s outcome would be an understatement. Considering the huge changes in both market expectations and liquidity, it is important to wonder whether Chair Powell will push back against some of the enthusiastic projections for rate cuts that are currently priced into markets. If so, he runs the risk of playing Grinch ahead of the hoped-for “Santa Claus rally.”

Remember how we approached the last meeting on November 1st. Major US equity indices had just completed their third straight down month, with some ticking into correction territory, and 10-year notes were flirting with 5% yields. Fast forward just six weeks and things have changed dramatically. The S&P 500 (SPX) and Nasdaq 100 (NDX) are closer to all-time highs than correction lows, and while 10-year yields have risen from their recent lows, they are still yielding only 4.27%. More importantly there has been a sea change in expectations for future Fed rate cuts. Prior to the November meeting, Fed Funds Futures were pricing in a 41.5% chance for a January hike, a 50% chance for a June cut, and three cuts for 2024. By the end of that week, just two days later, odds of a further hike had fallen to 32.5% and the likelihood of a cut in June had risen to 87.6%...

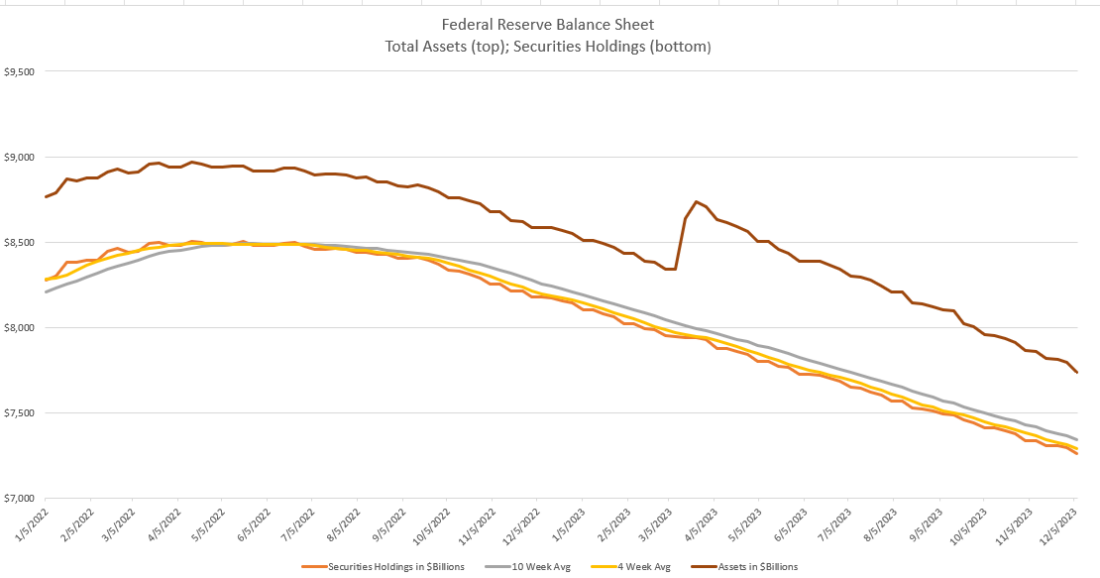

The chart below shows the current pace of quantitative tightening (QT) on the Fed’s balance sheet. The latter table shows the reaction of SPX to recent FOMC meetings. Bear in mind that this week is a quarterly expiration, so the dates in bold may hold more sway.

Source: Interactive Brokers, Federal Reserve

In the "Where To Invest Department" contributor Tim Knight reports in Macy’s Parade Float that the company may be taken private.

"Storied retailer Macy’s (M), which has been public for decades, is apparently going to get taken over at a steep premium. This chips away at the remaining inventory of stocks that even exist. Indeed, the number of public companies out there is about one-third what it was when I started trading. Being public has simply become not-that-great in recent years.

The bump in price aligns nicely with the cycle going on with retail, by way of XRT, which continues to push toward what looks like an apex very late this month or in the first few days of 2024."

That's a wrap for today.

Peace.

More By This Author:

Thoughts For Thursday: Waiting For Santa

Thoughts For Thursday: No Pre-Santa Rally Correction In Sight But No Rally Either

Tuesday Talk: A Pause Before The Santa Claus Rally