Tuesday Talk: Magnificent Monday?

After last week's downward trajectory the market seemingly reversed direction and headed back upwards. One can't call it a trend, yet, most likely correction hiccups.

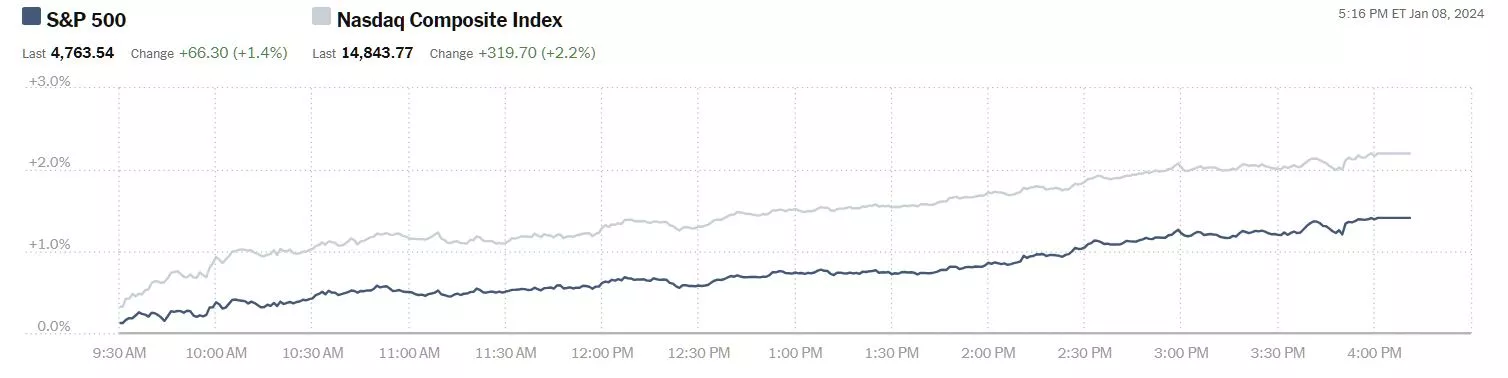

Yesterday the S&P 500 closed at 4,764, up 66 points, the Dow closed at 37,683, up 217 points, and the Nasdaq Composite closed at 14,844, up 320 points.

Chart: The New York Times

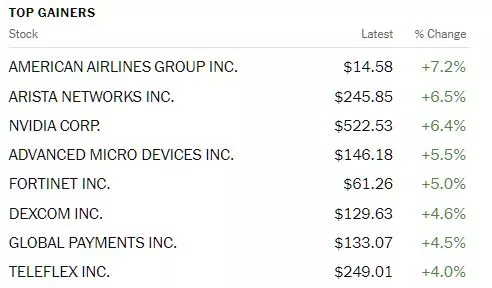

Top gainers for the session were led by American Airlines (AA), +7.2%, followed by Arista Networks (ANET), +6.5% and Nvidia Corp. (NVDA), +6.4%.

Chart: The New York Times

In morning futures trading S&P 500 market futures are trading down 17 points, Dow market futures are trading down 142 points and Nasdaq 100 market futures are trading down 77 points.

TalkMarkets contributor Mark Vickery writes that Markets Party Like It's 2023.

"Market activity was so healthy today, you’d think it was still 2023! After taking the air out of valuations across the board over the past week of trading, market participants saw fit to run a bit higher ahead of Q4 earnings season, which unofficially gets underway later this week. The Dow gained +216 points on the day, +0.58%, while the S&P 500 grew +66 points, +1.41%. The Nasdaq, boosted by a new graphics chips announcement from NVIDIA (NVDA), beat the field, +319 points, +2.20%. The small-cap Russell 2000 rose +1.94%...

As far as the run-up ahead of Q4 earnings, there may be some questions about how much higher the market wants to push overall multiples. NVIDIA’s growth is all well and good — and makes sense, even at these high P/E levels — but JPMorgan (JPM), which reports ahead of the bell Friday morning, is already trading +25% since this time last year. This is not to say it, as well as the other big banks reporting that day, won’t be meeting or beating estimates — they very well may. But a lot of the good news for giant banks like these already look somewhat priced in for the quarter about to report.

Fed members will be making spot appearances throughout the week, as will additional inflation prints like CPI and PPI for December. None of this is expected to make a dent in the Fed’s dot-plot blueprint of a hold at interest rates in the 5.25-5.50% range a few weeks from now. There is always a chance we could see a surprise move up or down on any of the more important economic metrics, but unless they gather consensus among other data points, we don’t expect to see the Fed move quickly on cutting rates."

Contributor Declan Fallon notes that Solid Buying Kicks Off The Development Of Indices Swing Lows.

"It was a good start to the week across all indices as buyers began the day in buoyant mood and didn't let up all day. If there is a caveat to the buying it was that there was little in the way of a pause or a test of buyer resolve over the course of the day. Volume was down for the Russell 2000 (IWM), although the Nasdaq and S&P (SPX) registered as accumulation days.

The S&P 500 recovered its 20-day MA with technicals unchanged, but improving.

The Nasdaq had the most ground to make up against its 20-day MA but it managed to achieve this goal by the close of business today. Technicals continue to improve although the index is still underperforming relative to the S&P.

The Russell 2000 also banked a solid day, edging above its 20-day MA, but on lower buying volume. Technicals remain slightly more bearish than for the Nasdaq or S&P with 'sell' triggers in the MACD and On-Balance-Volume, but the index is still outperforming the Nasdaq. There is probably enough momentum here to see a challenge of $205 highs.

For Tuesday, we will want to see indices start where they closed and continue to build on their nascent rallies. What we don't want is to see a pause or neutral candlestick, like a doji, that could attract sellers later in the week."

In an "In the Spotlight" column contributor Herb Blank asks Will 2024 See A Regime Shift To Value And Small Cap Or Will It Be Just More Of The Same?

"Unlike at this time last year, most equity market strategists are not bearish. Instead, they are looking for a rotation away from overbought large-cap tech and growth stocks to value and small-cap...

The fact is that far more active equity managers are oriented a bit more toward value than growth. They pride themselves on selling disciplines and using stocks that "have gotten ahead of themselves" as sources of funds for overlooked gems - normally stocks not in the S&P 100 or well-known stocks trading below the manager's target price. This strategy underperformed in 2023 and underperformed in 2019, 2020, and 2021. The question is whether this very prevalent prediction will come true in 2024. Is this the year that value stocks outperform growth stocks? Is this the year that the 10 largest stocks in the S&P 500 and in the Nasdaq-100 finally underperform?

OBSERVATIONS

- The dominant leadership of large-cap technology and communication stocks came back with a vengeance in 2023 capping off what has been a 5-year run since the end of 2018. Even with the bear market in 2022, the leadership went up so much more in the few up months in the market than other stocks that the higher decline during the first six months of 2022 was quickly reversed. QQQ, the Invesco ETF that tracks the Nasdaq-100, beat everything except beat every other benchmark index in every time period.

- Our predictive model expects much of the same during the next 12 months. Both QQQ and the broader IWF representing large-cap growth receive the system’s highest rating of 5 (Strong Buy).

- Our valuation model, however, considers the portfolios of stocks held by these ETFs to be very overvalued. Especially noteworthy is the fact that only 19% of the 100 stocks in QQQ are considered undervalued.

- The S&P 500 Equal Weight Index tracked by RSP underperformed its capitalization-weighted underlying index SPLG (the lowest fee of the ETFs that track the S&P 500) by 12% in 2023, the most in any calendar year since the index’s inception. This may be a warning sign that the S&P 500 leadership is very narrow. Historically, major corrections have followed narrow leadership.

- Looking at the 1-month price gain row, the leadership began to reverse with IWM which tracks the small-cap Russell 2000 benchmark gaining 12%, MDY, tracking the S&P Midcap 400 gaining just shy of 9% in comparison with just 6% for QQQ.

- Small-cap (IWM) stocks are very cheap relative to large-cap stocks on a relative basis – especially by historical standards. This is true both according to traditional valuation measures and ValuEngine’s proprietary valuation model. Breadth is also something to consider as IWM outperformed the equal-weighted S&P ETF (RSP) on a 12-month basis.

As has been the case lately, there has been distinct differentiation between return performance among the S&P 500 GICS Sectors as characterized by the Select Sector SPDR ETFs as shown here:

|

Symbol |

Name |

1 Year Returns |

3 Year Returns |

5 Year Returns |

Div. Yield % |

Standard Deviation |

P/E Ratio |

# of Holdings |

|

Technology |

60.37% |

14.93% |

27.05% |

0.8% |

23.1% |

36.5 |

66 |

|

|

Financial |

13.64% |

11.14% |

12.14% |

1.9% |

21.2% |

17.1 |

73 |

|

|

Health Care |

2.70% |

8.50% |

11.75% |

1.6% |

14.6% |

23.1 |

65 |

|

|

Energy |

1.26% |

35.86% |

13.70% |

3.6% |

30.5% |

7.8 |

25 |

|

|

Consumer Discretionary |

43.73% |

4.87% |

14.02% |

0.9% |

24.8% |

27.9 |

54 |

|

|

Industrial |

19.25% |

10.76% |

14.36% |

1.6% |

20.1% |

24.5 |

80 |

|

|

Communication Services |

58.05% |

3.62% |

13.12% |

0.8% |

21.2% |

27.4 |

23 |

|

|

Utilities |

-7.28% |

4.20% |

7.07% |

3.4% |

18.1% |

22.3 |

31 |

|

|

Consumer Staples |

-1.10% |

4.88% |

10.14% |

2.7% |

14.7% |

24.6 |

39 |

|

|

Materials |

13.33% |

8.61% |

13.74% |

2.0% |

21.8% |

16.5 |

30 |

Conclusions

- ValuEngine maintains somewhat positive outlooks for both QQQ and SPY but only somewhere in the 3% - 5% range.

- Election years in the 2000’s have been a mixed bag return-wise but are generally characterized by increased price volatility.

- My own analysis using historical charts and calendar trends indicate a strong beginning and end to 2024 but possibly as low as -10% by the end of September.

- Statistically, timing the Stock Market is generally a loser’s game. If you have a sufficiently long-time horizon and enough of a safety net, most investors would have been better off ignoring all market news and advice and to stay invested in broad equity market index funds, and a mixture of short-duration and long-duration bond index funds based upon your time horizon and ability to tolerate short-term losses.

- Statistical analysis tells us past incidences of returns. This provides us with interesting insights into how markets have worked and what factors have been correlated in the past. We do not know the probabilities of what could occur in the future..."

These are some of the main excerpts from Blank's article. Read the full article for additional analysis. Seems he is not sold on the value/small-cap thing.

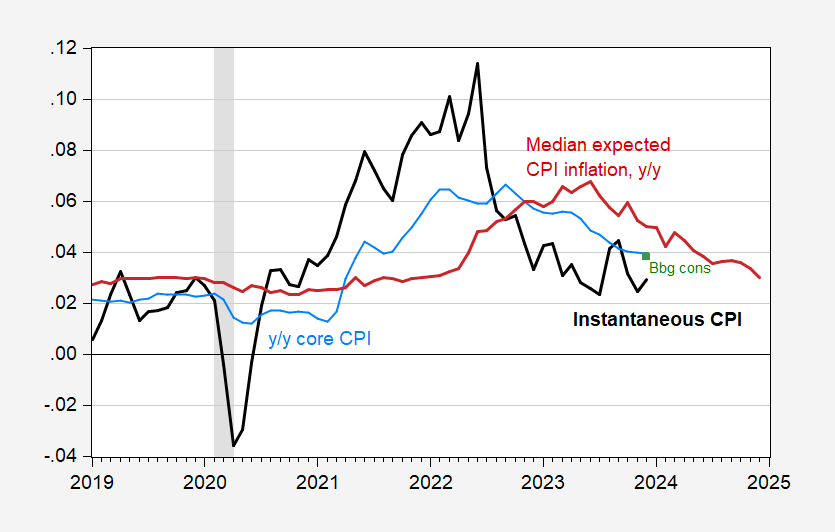

Economist and contributor Menzie Chinn updates current Inflation Nowcasts And Expectations.

"NY Fed median expected y/y CPI inflation at 3%. Nowcast for core y/y at 3.9%.

Figure 1: Instantaneous CPI inflation (bold black), y/y core CPI (blue), Bloomberg consensus (green square), median expected CPI y/y CPI inflation from NY Fed (red). December observations for CPI, core CPI 1/8/2024 Cleveland Fed nowcasts. NBER defined peak-to-trough recession dates shaded gray. Instantaneous inflation per Eeckhout (2023), T=12, a=4. Source: BLS, NY Fed, Cleveland Fed, Bloomberg, NBER, and author’s calculation."

TM contributors Robert Carnell and Min Joo Kang bring us Asia Morning Bites For Tuesday, January 9.

"Global markets: US Treasury markets had another choppy day on Monday but finished roughly unchanged. 2Y yields traded in a 10bp range, but ended only 0.6bp lower than the previous day, and it was a similar story for 10Y yields, which ended only 1.5bp lower at 4.030%. EURUSD is similarly unchanged at about 1.0950. The AUD didn’t move much either, but the JPY and GBP both made small gains against the USD. Asian currencies had a quiet day on Monday too, with only the THB registering anything notable, and losing a further 0.87% to take it to 35.028. USDCNY is roughly unchanged at about 7.15. Equity markets were the standout on Monday. After a grim start to the year, the S&P 500 gained 1.41%, and the Nasdaq rose 2.2%. Chinese stocks fell. The Hang Seng dropped 1.88% and the CSI 300 fell 1.29%.

G-7 macro: European confidence measures posted some gains yesterday. The region released data on consumer confidence, economic confidence, industrial and service confidence. And all of the indicators made gains, though some of them were quite small (consumer confidence). Arguably, these data suggest that the Eurozone is slowly moving out of recession. Today, we get the US NFIB small business survey, as well as US trade data for November. In Europe, we get November unemployment figures and German industrial production for November.

Australia: November retail sales data should show a statistical bounce back from the weak October reading of -0.2% MoM. The consensus looks for a 1.2% gain with the latest data. Building approvals data for November are also published today and will likely do the opposite after a decent 7.5% MoM October gain.

Japan: Today, Japanese data showed inflation and household spending weakening. Together with the recent major earthquake in Ishikawa, this likely means that the Bank of Japan will maintain its current policy settings at its January meeting. Tokyo CPI inflation slowed to 2.4% YoY in December (vs 2.7% November, 2.5% market consensus) mainly due to the high base last year. In a monthly comparison, inflation was unchanged. Cost-push inflation seems like it is easing as utilities and fresh food prices declined. But entertainment prices gained smartly, suggesting demand-driven cost pressures are still intact. In a separate data report, household spending fell -1.0% MoM (sa) in November (vs -0.1% in October), but the three-month change is still higher than 3Q23 so we expect household spending to improve in the 4Q23 GDP release. Regarding the BoJ decision, we think that the BoJ will wait and see until the earthquake aftermath becomes clearer. We estimate the damage of the earthquake will be limited and temporary. If so, then the Bank of Japan will be able to shift its policy by the end of 2Q24 after the Spring wage negotiations season.

Taiwan: December export growth should build on the slight gains registered in November – a combination of base effects dropping away and some genuine pick up in demand for high-end semiconductors."

That's a wrap for today.

Peace.

More By This Author:

Thoughts For Thursday: A Bumpy Ride At The New Year

Thoughts For Thursday: With War Clouds As A Backdrop The Market Is Set To End The Year On A High

Thoughts For Thursday: Everything That Goes Up Comes Down