Tuesday, January 9, 2024 1:25 AM EST

Image Source: Pixabay

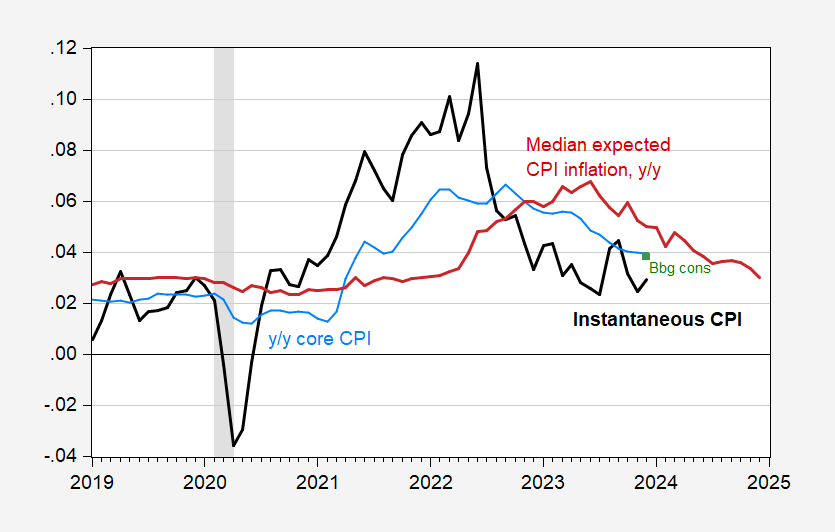

NY Fed median expected y/y CPI inflation at 3%. Nowcast for core y/y at 3.9%.

Figure 1: Instantaneous CPI inflation (bold black), y/y core CPI (blue), Bloomberg consensus (green square), median expected CPI y/y CPI inflation from NY Fed (red). December observations for CPI, core CPI 1/8/2024 Cleveland Fed nowcasts. NBER defined peak-to-trough recession dates shaded gray. Instantaneous inflation per Eeckhout (2023), T=12, a=4. Source: BLS, NY Fed, Cleveland Fed, Bloomberg, NBER, and author’s calculation.

More By This Author:

Are We In Recession? The Sahm Rule Now & 2007 What’s The Actual Strength Of The Labor Market? CPS vs CES vs ADP vs ISMThe Employment Release & Business Cycle Indicators

Disclaimer: This information is presented for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy any investment products. None of the ...

more

Disclaimer: This information is presented for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy any investment products. None of the information herein constitutes an investment recommendation, investment advice, or an investment outlook. The opinions and conclusions contained in this report are those of the individual expressing those opinions. This information is non-tailored, non-specific information presented without regard for individual investment preferences or risk parameters. Some investments are not suitable for all investors, all investments entail risk and there can be no assurance that any investment strategy will be successful. This information is based on sources believed to be reliable and Alhambra is not responsible for errors, inaccuracies, or omissions of information. For more information contact Alhambra Investment Partners at 1-888-777-0970 or email us at info@alhambrapartners.com.

less

How did you like this article? Let us know so we can better customize your reading experience.