Tuesday Talk: Spiking

Spiking seems to be what the magnificent seven is doing. Comprising 29% of the market value of the S&P 500 its outsize clout in the index is making waves. All fine when things go up, but look for the spike to come down, too.

For the record the "magnificent seven" are Microsoft (MSFT), Apple (AAPL), Alphabet (GOOGL), Amazon (AMZN), Meta (META), Tesla (TSLA) and Nvidia (NVDA). As of Friday both Microsoft and Apple were tied for number one in terms of market value.

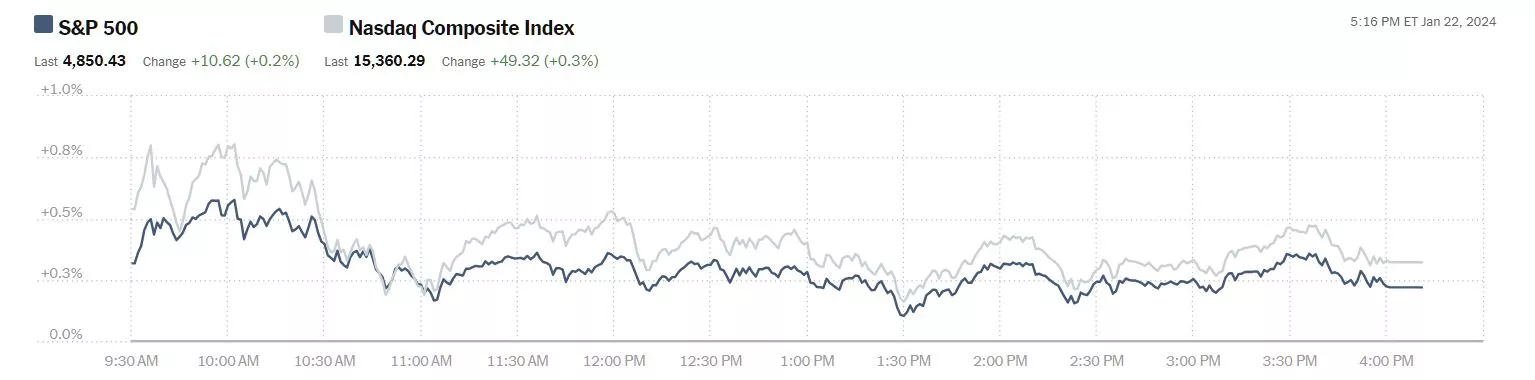

Monday the S&P 500 closed at 4,850, up 11 points, the Dow closed at 38,002, up 138 points and the Nasdaq Composite closed at 15,360, up 49 points.

Chart: The New York Times

Most actives were led by Advanced Micro Devices, (ADM), down 3.5%, followed by Tesla (TSLA), down -1.6% and Carnival Corp. (CCL), down 4%.

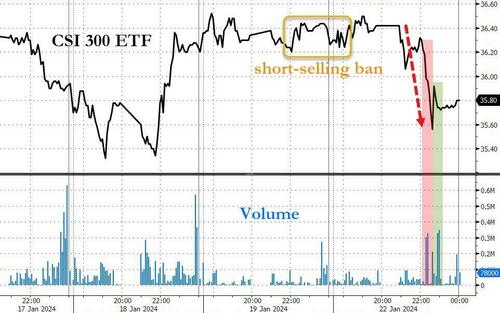

Chart: The New York Times

In morning trading activity S&P 500 market futures are up 2 points, Dow market futures are down 59 points and Nasdaq 100 market futures are up 17 points.

The Staff at TalkMarkets contributor Just Markets takes note that The US Stock Indices Have Once Again Hit All-Time Highs.

"At Monday's stock market close, the Dow Jones Index increased by 0.36%, while the S&P 500 Index gained 0.22% yesterday. The Nasdaq Technology Index closed positive by 0.32%. All three indices once again set new record highs. Stocks rose on Monday amid optimism about the US economic outlook and expectations of strong quarterly corporate earnings results...

European equity markets opened higher on Tuesday, likely extending gains from the previous session amid improving risk sentiment. However, investors remained cautious ahead of the European Central Bank's decision later this week. The ECB is expected to keep interest rates unchanged, but policymakers have disagreed with predictions of an imminent rate cut...

WTI crude oil prices held just below $75 a barrel on Tuesday, near their highest levels in four weeks, as fresh strikes by US and British troops on Houthi targets in Yemen heightened fears of a wider conflict in the region that could disrupt supplies. Meanwhile, the resumption of production from Libya's largest field and signs of rising output, especially from non-OPEC countries, continued to weigh on the oil market..."

Contributor Bill Smead looks at Stock Market-Interest Rate Rhymes, finding sometimes we should be elsewhere than invested in the market.

"Warren Buffett regularly reminds his shareholders that interest rates are a gravitational pull to stock prices. History shows that the movement of stock prices and interest rates don’t necessarily happen simultaneously but play out over time. Where are we now in this continuum between long-term interest rates and stock prices?

Thankfully, John Authers shared his thoughts at Bloomberg and provided the following chart:

The CAPE ratio is the cyclically adjusted price-earnings ratio. By averaging earnings over a ten-year period, Professor Robert Schiller attempted to give investors a view of stock prices that took out any short-term earnings movements. Its purpose was realism, and with the stock market riding a multi-decade run of growth stock success, realism hasn’t done investors a whole lot of good.

However, this chart compares long-term interest rates to the CAPE earnings. A few observations. First, 1921, 1930, 1940, 1981 and 2009 were very good times to be aggressive with your common stock purchases, as the overall market was low in relation to interest rates. Second, the absolute best time to buy stocks in my adult lifetime happened to be in 1981-1982, when I started in this business. This sounds great in theory, but as you can see, Treasury bills and bonds were offering 14% to 15%. Equity ownership, as measured in the Fed’s Z-1 report, was at a lifetime low of 8% of household assets. Just so you know, investors were afraid to buy those bonds because of double-digit inflation. Therefore, they sat in interest-bearing CDs and money market funds, rather than locking in those rates for the long- haul.

Second, stocks got disconnected from interest rates in 1901, 1929, 1966, 2000 and 2021. We have had the weirdest feeling to start this year because of how similar our large cap value strategy is trading in relation to the S&P 500 Index, much like it did in the early 2000 time period...

Lastly, what did you want to buy in common stocks in 1966 and in 2000 with the money you kept in those expensive stock markets? The answer was oil and gas/commodities. In the first case, the inflation of the 1970s and higher oil prices made energy the only game in town as an S&P 500 Index sector. The same kind of phenomenon happened in the 2000-2010 period as the growth in the nation of China led to dramatic increases in oil and other commodity prices.

If you were wondering why we are sitting through a major correction in our oil and gas stocks Occidental Petroleum (OXY), ConocoPhillips (COP), Ovintiv (OVV), APA Corp. (APA) and Devon Energy (DVN), look no further than the chart of the S&P 500 CAPE ratio versus long-term interest rates. Hear the rhyme and fear stock market failure."

Well, that's one analysis...

One of the places where bad news is coming from is China. We have looked at some of China's talk about revitalization plans which so far has come to naught, TM contributor Tyler Durden takes a look at the sordid reality in As China Stocks Crash, Beijing Proposes Multi-Trillion Market Rescue Package.

"Earlier today, we lamented the latest implosion in Chinese markets, which we discussed in "China Stocks Crash Through 'Snowball Derivatives' Trigger Levels Overnight", in which we pointed out the unprecedented failure of the centrally-planned market to halt its collapse be it through short selling bans, or even the latest impotent intervention by the "National Team", China's Plunge Protection Team, which today failed to spark even a modest rebound in the relentless selling which had triggered key liquidation levels.

We then summarized just how badly Beijing had boxed itself, noting that "after short selling ban did nothing, China PPT stepped in... and couldn't do jack. Beijing trapped." We concluded that "either they watch liquidation cascade as snowball derivatives are knocked in sparking rout and leading to social unrest, or they stop talking and finally do something."...

Shortly after China reopened on Tuesday, Bloomberg reported that according to "people familiar with the matter, asking not to be identified" - i.e., government sources eager to do a market test, China is considering a package of measures to stabilize the plummeting stock market, after earlier attempts to restore investor confidence fell short and prompted Premier Li Qiang to call for “forceful” steps.

Specifically, Beijing is reportedly seeking to "mobilize" about 2 trillion yuan ($278 billion), mainly from the offshore accounts of Chinese state-owned enterprises, as part of a stabilization fund to buy shares onshore through the Hong Kong exchange link; it has also earmarked at least 300 billion yuan of local funds to invest in onshore shares through China Securities Finance Corp. or Central Huijin Investment Ltd...

Nothing has actually happened yet, because Beijing is absolutely terrified of the market reaction if and when the country with the 300% debt/GDP stats layering on more trillions in debt. Alas, at this point that's just a matter of time, because either Beijing keeps mulling stuff and does nothing as it watches it cities burn amid the recent surge in strikes and protests...

The property crisis, depressed consumer sentiment, tumbling foreign investment and diminished confidence among local businesses after years of volatile policymaking are exerting strong downward pressure on both the economy and financial markets.

Which means China now has two options: pretend that the failed policies it has been doing (or pretending to do) so far has been successful, which it likely will until there is just too much blood on the streets, or it will finally capitulate and unleash the biggest fiscal stimulus ever seen in China: we are talking multiple trillions here, and in dollars not yuan, consequences be damned, because we are nearing the point of peak panic where Beijing will do anything at all to buy social order and stability for just a few more months. And once all those tens of trillions in Chinese deposits start fleeing, that's when the real meltup in non-fiat assets - read gold, silver, crypto, fine art, wines, etc - will truly start."

There's more where that came from, but that seems to be enough,

Contributor James Harte has the Copper Market Commentary for today in which expects China to increase its demand.

"Copper prices are rising today as traders digest news that China is considering a huge new stimulus package aimed at reviving falling stock markets. Reports overnight point to plans to mobilize around $300 billion in funds held in offshore accounts by state owned businesses. The capital will be used to invest in onshore business through state owned investment vehicles...

For now, the lift in Chinese stocks is helping drive copper prices higher. However, with broader concerns over the economy still a major issue, the lift might prove temporary unless we see accompanying measures announced alongside the stock market purchases. As such, copper remains vulnerable to fresh downside unless more announcements are made...

The sell off in copper from the 3.9410 level has stalled for now into a test of the broken bear trend line. With the 3.6745 level below, this is a key support area for the market. While this area holds, a further rotation towards the 3.9410 level can be seen. However, below this area, 3.5475 is the next support to note. "

.webp)

Plenty of risk in copper, given the myriad crisis in China.

In the "Where To Invest" department one of TM's resident bears Tim Knight in Teetering Tesla ventures that this is not a good time to buy Tesla.

"Hoo boy. On a day when the S&P 500 and the Dow 30 Industrials reached their highest points in human history, Tesla kept slipping. This does NOT look good for Tesla bulls. I could easily see this down to $170-$180 within days, as crazy as that may sound. I have no position at all, but that Fibonacci could fail with just a sneeze in the bleachers."

Caveat Emptor.

That's a wrap for today.

Peace.

More By This Author:

Thoughts For Thursday: What Kind Of A Week Is This?

Tuesday Talk: Walking Back From The Holiday

Tuesday Talk: Magnificent Monday?