As China Stocks Crash, Beijing Proposes Multi-Trillion Market Rescue Package

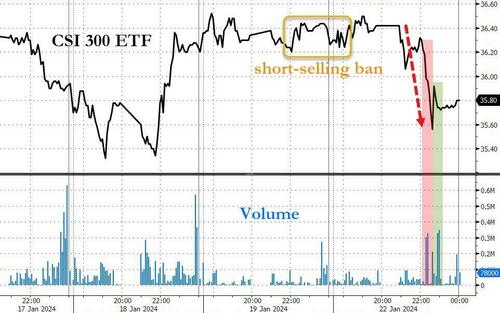

Earlier today, we lamented the latest implosion in Chinese markets, which we discussed in "China Stocks Crash Through 'Snowball Derivatives' Trigger Levels Overnight", in which we pointed out the unprecedented failure of the centrally-planned market to halt its collapse be it through short selling bans, or even the latest impotent intervention by the "National Team", China's Plunge Protection Team, which today failed to spark even a modest rebound in the relentless selling which had triggered key liquidation levels.

We then summarized just how badly Beijing had boxed itself, noting that "after short selling ban did nothing, China PPT stepped in... and couldn't do jack. Beijing trapped." We concluded that "either they watch liquidation cascade as snowball derivatives are knocked in sparking rout and leading to social unrest, or they stop talking and finally do something."

This is bad: after short selling ban did nothing, China PPT stepped in... and couldn't do jack. Beijing trapped: either they watch liquidation cascade as snowball derivatives are knocked in sparking rout and leading to social unrest, or they stop talking and finally do something pic.twitter.com/rMpV5UQVwr

— zerohedge (@zerohedge) January 22, 2024

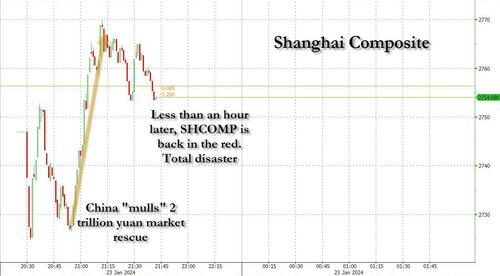

Well, just a few hours later we were proven correct again, because shortly after China reopened on Tuesday, Bloomberg reported that according to "people familiar with the matter, asking not to be identified" - i.e., government sources eager to do a market test, China is considering a package of measures to stabilize the plummeting stock market, after earlier attempts to restore investor confidence fell short and prompted Premier Li Qiang to call for “forceful” steps.

Specifically, Beijing is reportedly seeking to "mobilize" about 2 trillion yuan ($278 billion), mainly from the offshore accounts of Chinese state-owned enterprises, as part of a stabilization fund to buy shares onshore through the Hong Kong exchange link; it has also earmarked at least 300 billion yuan of local funds to invest in onshore shares through China Securities Finance Corp. or Central Huijin Investment Ltd.

In other words, what was already a nationalized stock market is about to get even more nationalized, and instead of ad hoc interventions by the Plunge Protection Team, such market purchases by official state authorities will now become institutionalized.

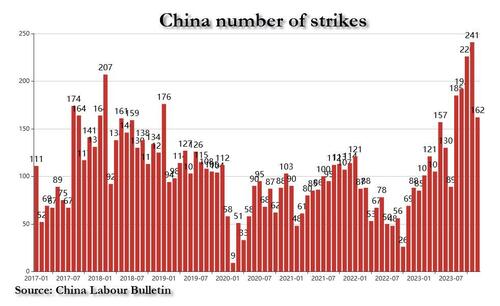

Or maybe not: after all, China isn't actually doing anythjing. Yes, it is mulling stuff, just like it has been mulling a 1 trillion yuan fiscal stimulus and a 1 trillion yuan "special "bond stimulus. but nothing has actually happened yet, because Beijing is absolutely terrified of the market reaction if and when the country with the 300% debt/GDP stats layering on more trillions in debt. Alas, at this point that's just a matter of time, because either Beijing keeps mulling stuff and does nothing as it watches it cities burn amid the recent surge in strikes and protests...

... or it goes back to what it has been doing for the past 25 years, and floods the economy with new debt to boost contain the property crash, stabilize the economy and normalize the soaring youth unemployment. And since it really has no choice, it will be the latter... the only question is how much pain will Beijing suffer first before it capitulates.

Anyway, going back to the official Bloomberg report, it notes that "officials are also weighing other options and may announce some of them as soon as this week if approved by the top leadership", but again, "the plans are still subject to change." And they will, because either stocks soar and don't drop, thereby obviating the need for an actual rescue package, or they resume their plunge and China will be forced to do even more when it actually does something in the very near future.

*HANG SENG CHINA STOCK GAUGE EXTENDS GAIN TO 3.5%

— zerohedge (@zerohedge) January 23, 2024

Enjoy it while it lasts. it won't

In any case, the report of panicked deliberations underscores that just as we predicted earlier today, there is an "elevated level sense of urgency" among Chinese authorities to stem a selloff that sent the benchmark CSI 300 Index to a five-year low this week. Calming the nation’s retail investors - many of whom have also been bruised by the protracted property downturn - is also seen as key to maintaining social stability. And if there is anything Beijing fears more than anything in this world, it is 1 billion angry lower and middle-class Chinese heading toward Beijing, armed with torches and pitchforks.

Which brings us to the next question: as even Bloomberg admits, it is unclear is these measure will be enough to end the rout is far from certain. We can help Bloomberg: it won't be anywhere near enough, and indeed, after a modest bounce in the Shanghai Composite which pushed it in the red on the Bloomberg report, the index has once again slumped in the red, just as we said it would.

We weren't the only ones to unleash a gusher of cynicism in response to the news: others agreed as well that this is a disaster..

Daisy Li, fund manager at EFG Asset Management HK.

“The biggest question I have is how the SOEs will come up with 2 trillion yuan from their offshore accounts and why they will choose to invest onshore through the Hong Kong exchange link. We are in need of a white knight to boost some confidence, given how bad things have been."

Aninda Mitra, a macro and investment strategist at BNY Mellon

“The stock market package is a welcome measure, and shows some responsiveness from the authorities. But at under 2% of its GDP, we fear this is still inadequate. This amount falls short of even the reduction in the market cap, from early December to now, of Chinese enterprises listed in the Hong Kong stock exchange. These measures also need to be twinned with longer-term reforms to boost confidence in broader corporate sector.”

Michelle Lam, economist at SocGen’s HK Branch.

"Larger stimulus aimed at turning around the economy is needed for a sustained rally. What I think is critical for us to see a turnaround in market confidence is a step-up in PBoC’s PSL to support project completion and urban village redevelopment and a decisive increase in fiscal deficit which partly support household income."

Rajeev De Mello, macro portfolio manager at GAMA

"The boost to China’s markets from any rescue package will only lead to a short-term rebound as more fundamental changes are needed. Frequently, packages which target the stock market do have an effect but it can be very short-lived if not accompanied by more fundamental changes.Without more forceful economic and regulatory policy actions, it will not lead to the beginning of a bull market in China.”

Alvin Tan, head of Asia FX strategy at RBC in Singapore

“I am doubtful that the rebound in Chinese equities on the back of this rescue package news is sustainable so long as the fundamental growth trajectory doesn’t change"

And now that the market has called Beijing's bluff in less than an hour, the panic will be truly palpable and instead of just focusing on the market, China will now be bombarded on all sides by a relentless collapse: the property crisis, depressed consumer sentiment, tumbling foreign investment and diminished confidence among local businesses after years of volatile policymaking are exerting strong downward pressure on both the economy and financial markets.

Which means China now has two options: pretend that the failed policies it has been doing (or pretending to do) so far has been successful, which it likely will until there is just too much blood on the streets, or it will finally capitulate and unleash the biggest fiscal stimulus ever seen in China: we are talking multiple trillions here, and in dollars not yuan, consequences be damned, because we are nearing the point of peak panic where Beijing will do anything at all to buy social order and stability for just a few more months. And once all those tens of trillions in Chinese deposits start fleeing, that's when the real meltup in non-fiat assets - read gold, silver, crypto, fine art, wines, etc - will truly start.

More By This Author:

India Set To Cement Role As New GDP Growth Champion

EVs In Chicago Are No Match For Polar Vortex

S&P 500 Surges To New All-Time High Despite Wrecked Rate-Cut Hopes

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more