S&P 500 Surges To New All-Time High Despite Wrecked Rate-Cut Hopes

'Good news' was initially 'bad news' for stocks to start the week, but as 'hard' data surged, 'soft' data slumped...

Source: Bloomberg

...but the strong 'hard' data prompted a biig (hawkish) repricing of rate-cut expectations (initial timing and velocity)...

Source: Bloomberg

...and stocks didn't care either way - we were getting to record highs on this large OpEx (Gamma unclench) no matter what. All the majors exploded higher today with Nasdaq the major winner on the week. Small Caps actually ended the week in the red (the 4th weekly loss in a row)...

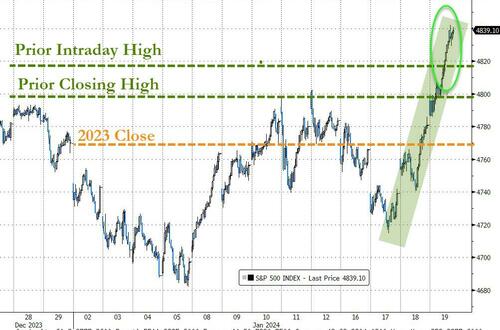

The S&P 500 finally joined the Nasdaq at new record highs, surpassing its record high close (4796.6 1/3/22) and intraday record high (4818.6 1/4/22)...

Source: Bloomberg

2024 has been very good to L/S Hedge Fund managers, erasing (admittedly in our proxy index below) the ugly losses from December...

Source: Bloomberg

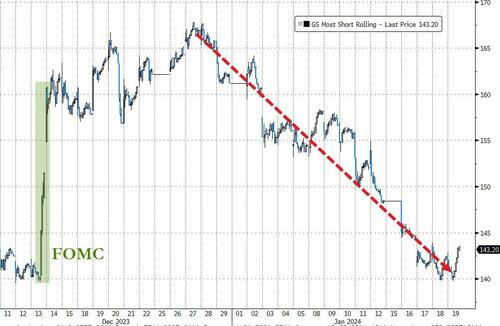

As their 'most shorted' stocks plunged non-stop - erasing the squeeze pain after the FOMC...

Source: Bloomberg

And MAG7 stocks ripped to new highs this week

Source: Bloomberg

AI leaders have dominated YTD, helped by a massive surge off Wednesday's opening lows...

Source: Bloomberg

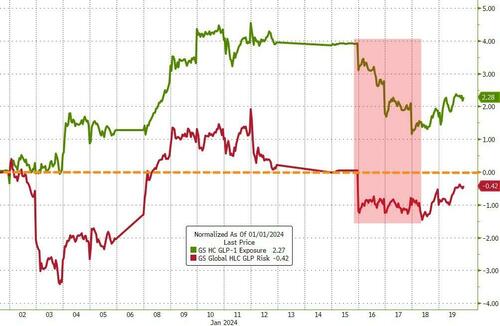

Interestingly, while the anti-obesity drug names have outperformed YTD, this week saw both the GLP-1 winners and losers get punished...

Source: Bloomberg

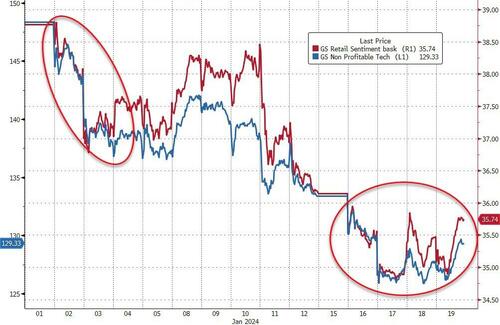

Lower-quality stocks suffered this week and YTD...

Source: Bloomberg

US equity markets melted up in the second-half of this holiday-shortened week, completely decoupling from the Treasury market - which saw yields rocket back higher, roundtripping the post-FOMC move entirely...

Source: Bloomberg

Treasury yields were higher every day this week, with the long-end the laggard YTD (30Y +33bps, 2Y +16bps)...

Source: Bloomberg

The yield curve (2s30s) ended back in 'inverted' territory after bear-flattening this week...

Source: Bloomberg

The dollar ended the week higher - though saw selling pressure the last two days...

Source: Bloomberg

Bitcoin has been punched in the face at the cash equity trading open in the US every day since spot ETFs began trading. Today was different though as buyers appeared near $40k and bid the cryptocurrency back above $42k -practically unchanged on the week...

Source: Bloomberg

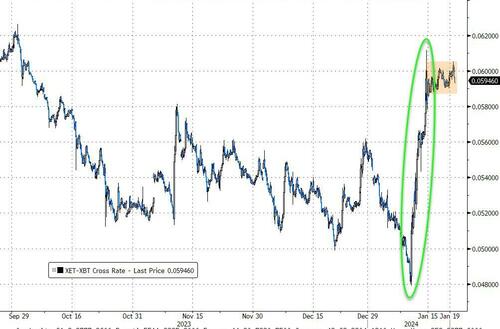

And while Ethereum also ended the week slightly lower, it held on to its massive outperformance relative to bitcoin last week...

Source: Bloomberg

Spot Gold prices ended the week lower but saw a healthy bounce off the $2000 level midweek...

Source: Bloomberg

Oil prices ended the week higher (yes, higher), but reverted back into the YTD range after breaking out yesterday...

Source: Bloomberg

Finally, be careful what you wish for on 'encouraging' hard-date signals being positive. The lagged effect of the unprecedented loosing of financial conditions is about to strike...

Source: Bloomberg

...and with it 'animal spirits' will be reborn - and the threat of re-inflation.

More By This Author:

Ford Prepares To Cut F-150 Lightning Electric Truck ProductionRegulator Readies For End Of Fed Bank Bailout Fund As 'Arb' Volumes Explode Higher

China's Plunge-Protection Team Buys Billions In ETFs To Halt Market Rout

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more