China's Plunge-Protection Team Buys Billions In ETFs To Halt Market Rout

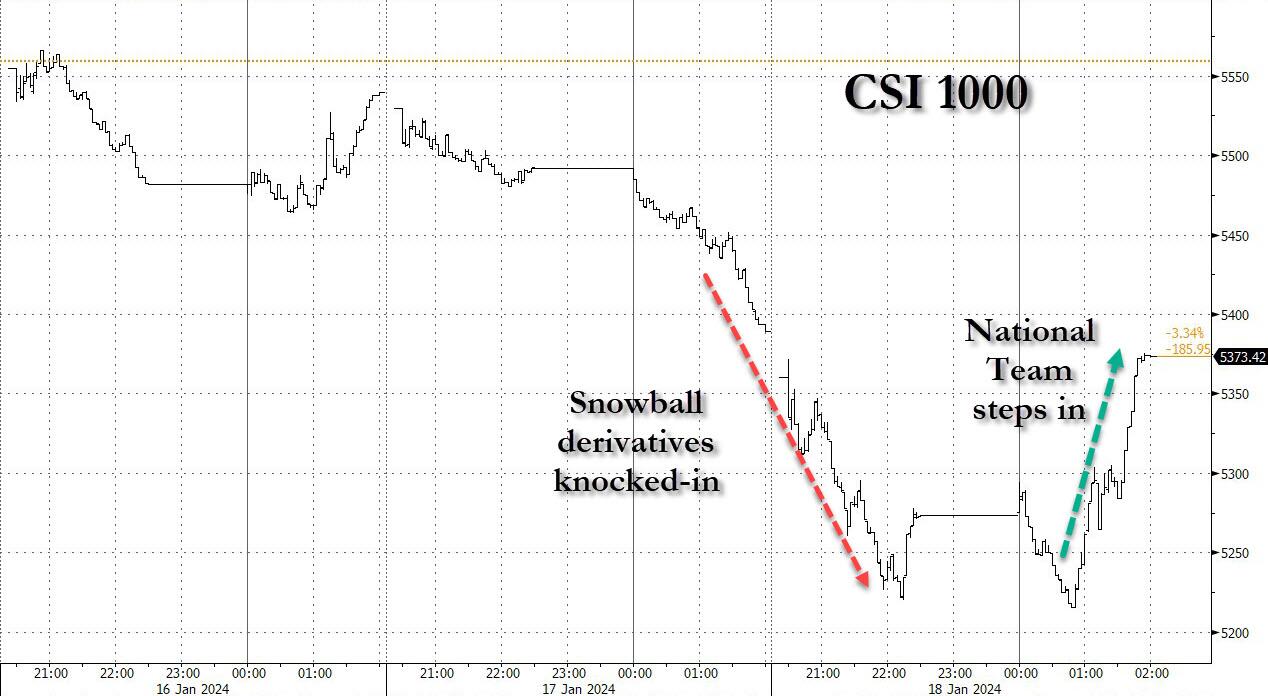

Last night we warned that as a result of the ongoing rout in Chinese capital markets, the CSI 1000 index had tumbled just shy of the key 5180 level which would knock-in (i.e., trigger) over 30 billion yuan ($4.2 billion) in snowball derivatives products tied to the Index, which would in turn unleash a selling cascade and could spark a wholesale market crash.

(Click on image to enlarge)

Well, it seems that Beijing also read the warning, because just minutes later Chinese equity indexes rebounded furiously in afternoon trading, with a volume explosion in some major ETF, a hallmark of aggressive buying by state funds - i.e., China's Plunge Protection Team - who stepped in to halt the slide.

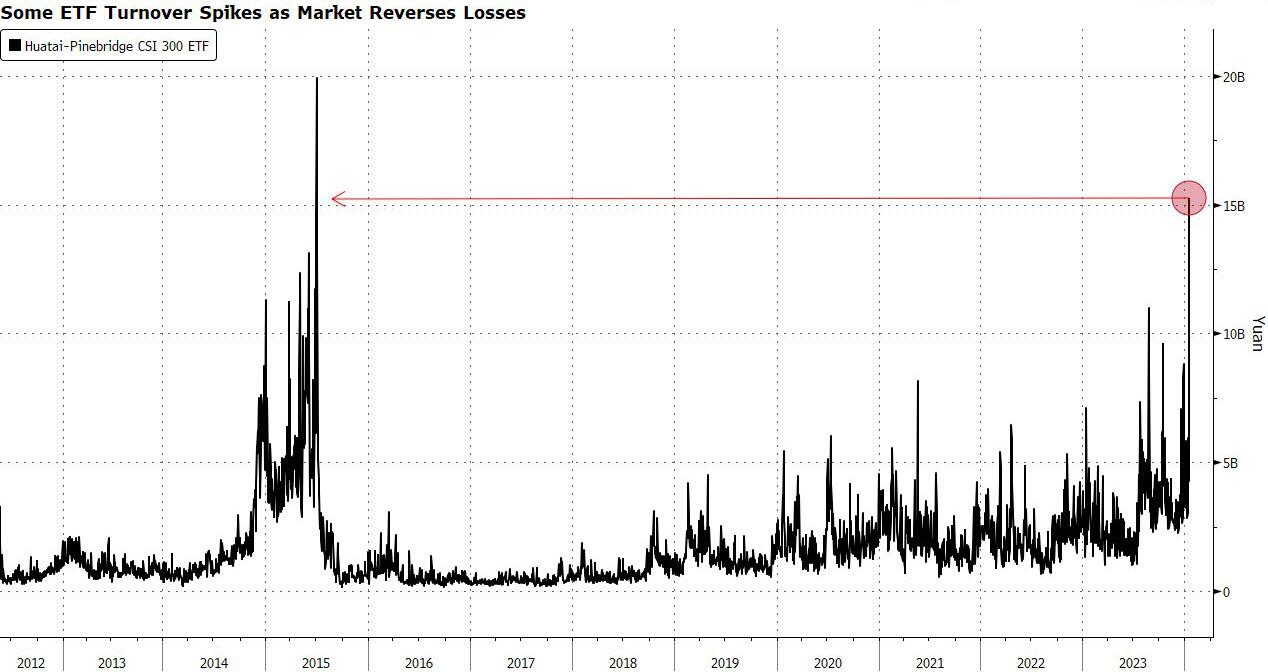

As shown in the chart below, the total traded value of the Huatai-Pinebridge CSI 300 ETF surged to 15.3 billion yuan ($2.1 billion) on Thursday, the highest since 2015 as the National Team made its presence known, while those for Harvest CSI 300 Index ETF and E Fund CSI 300 ETF also saw extraordinary spikes. That coincided with gains in the CSI 300 benchmark of mainland shares, which closed 1.4% higher after declining as much as 1.8%.

(Click on image to enlarge)

During previous market slumps, state funds were suspected to be behind surges in turnover of such ETFs as they stepped in to rescue the market. For instance, Central Huijin Investment Ltd., a sovereign wealth fund, bought an undisclosed amount of ETFs in October and vowed to keep increasing its holdings.

"The national team is likely stepping to stabilize the market as they have done in previous market crashes," said Marvin Chen, a strategist at Bloomberg Intelligence.

And as Beijing bought, foreign investors were again aggressive sellers of mainland stocks after they dumped 13 billion yuan ($1.8 billion) worth of shares in the previous session, the most in more than a year.

Meanwhile, the Hang Seng China Enterprises Index finished the day 0.8% higher, reversing an earlier decline of 0.6%. Down 10% this year, the HSCEI gauge is the world’s worst-performing major index. As for the CSI 1000, it was the familiar diagonal "PPT is here" line as Beijing didn't leave any doubt about its presence.

(Click on image to enlarge)

The rare advance in Chinese gauges comes after selloff extended into the new year amid even greater doubts about the slowing economy. The latest economic data showed the country’s property crisis deepening, while geopolitical tensions with the US and Beijing’s policy whims continue to put investors on edge. Meanwhile, the bedrock of China's middle class - property prices- continues to sink: China December property prices fell month over month at fastest pace since 2015.

And while occasional intervention by the Chinese PPT may help arrest a liquidation now and then, it is powerless to contain the flood of selling that will not stop until China capitulates and - despite its 300% debt/GDP - launches the next massive stimulus bazooka. Sure, Xi can pretend he can survive without one, but a few more months of economic freefall coupled with continued collapse in housing and an all time lows in stocks, and the communist party will find out just how little debt matters when faced with 1 billion very angry Chinese marching on Beijing, pitchforks in hand.

More By This Author:

Dis-Inflation & Disappointment For Philly Fed Survey In January

Single-Family Home Starts Plunged In December

Tesla Slashes Prices In Germany, Throwing A Wet Blanket On European Auto Stocks

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more