Thoughts For Thursday: Correction Day!

The market remains agitated and it looks like it may be a long week from here to Thanksgiving 🦃.

Yesterday the market remained chiefly in corrective mode, down from the outset with very little good news showing up on the charts.

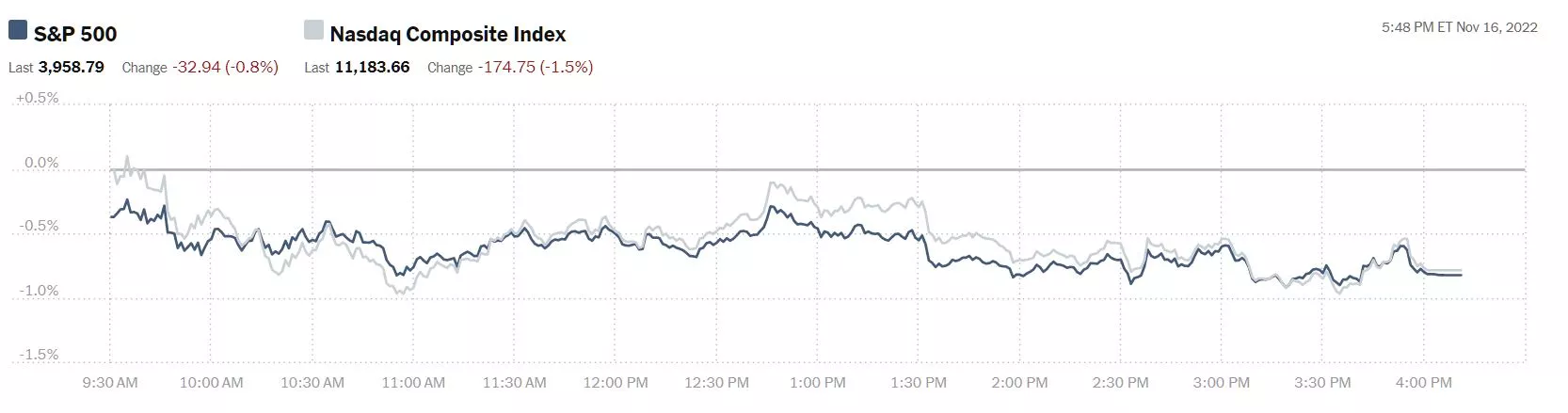

Chart: The New York Times

Most actives were all in the red with early in the week gainers like Advanced Micro Devices (ADM, -4.8%) taking hits. Others hit hard were Carnival Cruise lines (CCL, -13.7%) and Target (TGT, -13.1%).

All in all the S&P 500 closed Wednesday at 3,959, down 33 points, the Dow closed at 33,554, down 39 points and the Nasdaq Composite closed at 11,184, down 175. It's worth noting that when said and done the S&P 500 continues to flirt with 4,000, the Dow 34,000 and the Nasdaq 11,000, which are still recovery levels from earlier in the quarter. Currently in early morning futures trading S&P 500 market futures are up 5 points, Dow market futures are up 22 points, and Nasdaq 100 market futures are up 29 points.

Fed interest rate hikes unsurprisingly have burst the housing bubble that was created during the pandemic. Contributor Jill Mislinski has the latest: NAHB Housing Market Index: "Builder Confidence Declines For 11 Consecutive Months".

"The National Association of Home Builders (NAHB) Housing Market Index (HMI) is a gauge of builder opinion on the relative level of current and future single-family home sales. It is a diffusion index, which means that a reading above 50 indicates a favorable outlook on home sales; below 50 indicates a negative outlook. The latest reading of 33 is down 5 from last month's 38.

Here's an excerpt from this morning's blog update:

Elevated interest rates, stubbornly high building material costs and declining affordability conditions that are pushing more buyers to the sidelines continue to drag down builder sentiment.

Builder confidence in the market for newly built single-family homes posted its 11th straight monthly decline in November, dropping five points to 33, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today. This is the lowest confidence reading since June 2012, with the exception of the onset of the pandemic in the spring of 2020.

Here is the historical series, which dates from 1985."

When the charts looks bad, it's ugly. See the full article for housing market and consumer sentiment correlations.

Additional housing market updates come from contributor Tyler Durden who writes Housing Affordability Worsens As Homeownership Out Of Reach For Anyone Making Under $100k.

"The US housing affordability crisis continues to worsen as mortgage rates skyrocket to two-decade highs while the cost of an average home is still at bubbly levels. Financing costs are through the roof, and anyone earning less than $100,000 has been priced out of homeownership.

A new report via real estate brokerage firm Redfin Corp. found that in October, the average buyer needed to earn $107,281 to afford the monthly mortgage payment of a median-priced home, up a whopping 46% from a year ago of $73,668."

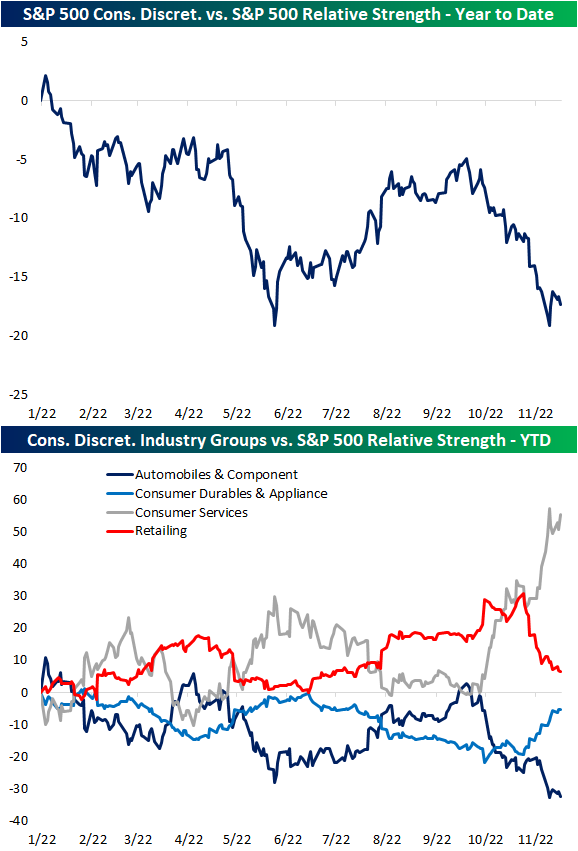

Contributors at the Staff of Bespoke Investment Group take note of Consumer Discretionary’s Muddled Relative Strength.

"Ranging from today’s retail sales report to homebuilder sentiment to the earnings of some of the largest retailers like Target and Lowe’s (LOW), the economic and earnings calendar this week has given Consumer Discretionary stocks plenty of news to digest. Outside of the spring to late summer, the sector has generally been on the decline relative to the S&P 500 in 2022. Last week, that relative strength line bounced right as it reached the late May low. However, over the past few days, it has been resuming its move lower, meaning it is back to underperforming...even with some positive responses to earnings from the likes of Home Depot (HD) or Lowe’s (LOW), the retailing industry has seen a sharp grind lower in its relative strength line versus the S&P 500. Similarly, autos have seen a turn lower although it has been underperforming the S&P for a longer period of time since the early fall. Meanwhile, Consumer Durables and Appliances (which includes stocks like the homebuilders and home appliance makers) has been moving higher.

On the other hand, "The Food & Staples Retail industry is a component of the Consumer Staples sector, and its relative strength line has been trending higher since the spring lows. In fact, after the past week’s move higher thanks in part to a strong response to Walmart (WMT) earnings, its relative strength line is approaching some of the highest levels of the past year, entirely recovering the massive drop from May in the wake of another, much more negatively received, WMT earnings report.

In the "Where to Invest Department", TM Contributor Tracey Ryniec says if you are Looking For High Yields? Check The Dividend Aristocrats.

"Dividends are “back” and are popular with investors seeking some passive income.

On Twitter recently, a dividend investor tweeted his goal was to get $100,000 a year in income from a $2 million portfolio. That would be a yield of 5%.

Some argued that a 5% yield was too difficult to obtain and he would either make less or need a bigger portfolio in order to get it.

Is it really that difficult to get a yield of 5% through stock investments?"

"One way to cut through the noise is to search for “dividend aristocrats.” This is a category of companies that pay dividends, but are called aristocrats, because they are among the elite few who have paid the dividend, uninterrupted for more than a decade, AND who have also increased the dividend payout during that time period."

Ryniec gives readers some suggestions:

5 Dividend Aristocrats Still Raising Their Payouts

1. Walgreens Boots Alliance, Inc. (WBA)

Walgreens Boots Alliance, known previously before the Boots merger, as simply Walgreens, has paid a dividend for 90 years. It has actually raised its dividend 47 consecutive years.

Shares of Walgreens Boots Alliance are down 21% year-to-date. It’s cheap, with a forward P/E of just 9.

However, earnings are expected to fall 11.1% this fiscal year.

Walgreens Boots Alliance is paying a juicy dividend, currently yielding 4.7%.

Should income investors be putting Walgreens Boots Alliance on their short list?

2. T. Rowe Price Group, Inc. (TROW)

T. Rowe Price Group is a global investment management company. In Feb 2022, T. Rowe Price Group raised its dividend 11.1%. It has raised its dividend 36 consecutive years.

Shares of T. Rowe Price Group have fallen 35% year-to-date. Earnings are expected to decline 38% in fiscal 2022.

T. Rowe Price Group’s dividend is now yielding 3.6%.

Should T. Rowe Price Group be on your short list just for that dividend?

3. Illinois Tool Works (ITW)

Illinois Tool Works, an industrial company with 7 business segments including in auto, construction, food equipment, welding, specialty products, polymers and fluids and test and management and electronics.

Illinois Tool Works has a long-term strategy for a dividend pay out ratio of about 50%.

Shares of Illinois Tool Works are down 6.9% year-to-date, outperforming the S&P 500. It’s not cheap, with a forward P/E of 23.9.

It pays a dividend yielding 2.3%.

Is Illinois Tool Works too hot to handle in 2022?

4. Nu Skin Enterprises (NUS)

Nu Skin Enterprises is a mid-cap beauty and wellness company with a market cap of $1.9 billion. It’s one of the mid-cap companies that has not only paid, but has raised, its dividend for at least 15 consecutive years.

Shares of Nu Skin have fallen 22.6% year-to-date. It’s cheap with a forward P/E of just 12.8.

Nu Skin pays a dividend, currently yielding 4%, and had $185.4 million left on its stock repurchase authorization at the end of the last quarter.

Is Nu Skin a hidden dividend aristocrat?

5. Williams-Sonoma, Inc. (WSM)

Williams-Sonoma is also a mid-cap dividend aristocrat but it has a larger market cap of $9.2 billion. In 2021, Williams-Sonoma raised its dividend 20% and this year, it raised it another 10%, along with a new $1.5 billion stock repurchase authorization.

Shares of Williams-Sonoma are down 18.6% year-to-date even though earnings are expected to be up 12.4% this fiscal year.

Williams-Sonoma pays a dividend yielding just 2.3%.

Is Williams-Sonoma’s dividend good enough for income investors?"

Rounding out today's column, also in the "Where to Invest Department", TalkMarkets contributor Marc Lichtenfeld looks at ZIM: A Stock With A 100% Yield?

"It’s true…

Zim Integrated Shipping (ZIM) has paid out $27.10 in dividends over the past year, and the stock currently trades at around $27.

But can shareholders expect to receive the same amount going forward?

Absolutely not.

Management stated that in the first three quarters of the year, it will pay out 20% to 30% of net income, with a possible step-up to 50% of annual net income in the fourth quarter.

That means next year, a dividend cut is almost a sure thing.

In 2022, Wall Street expects the company to earn $40.07 per share. But for next year, that forecast drops to $8.13, followed by another decline in 2024 to $3.03.

Even if Wall Street gets it very wrong and earnings next year and in 2024 are triple what analysts forecast, the dividend will still come down sharply.

The Israeli shipping company has paid a dividend for only five quarters, starting at $2 per share in August 2021. It bumped the dividend up to $2.50 the next quarter, then paying a whopping $17 per share in the first quarter of 2022, followed by $2.85 and $4.75 in the next two quarters.

Kudos to management for making the most out of the post-pandemic supply-chain disaster, "But investors should not expect to continue to receive dividends anywhere close to what they did this year."

Still, Zim could be one to watch.

I'll be back on Tuesday.

Photo: D.E.Marshall

Have a good one.

More By This Author:

TalkMarkets Image Library

Tuesday Talk: A Little Bit Of This, A Little Bit Of That

Thoughts For Thursday: Should Yesterday Have Been A Market Holiday?