Thoughts For Thursday: Should Yesterday Have Been A Market Holiday?

With such forceful amounts of volatility running through the stock market one can but wonder if the day after the US midterm elections shouldn't have been a market holiday. Given the uncertainty about the outcome of the election and anxiety surrounding today's forthcoming October CPI numbers it's not surprising that the market slalomed downwards.

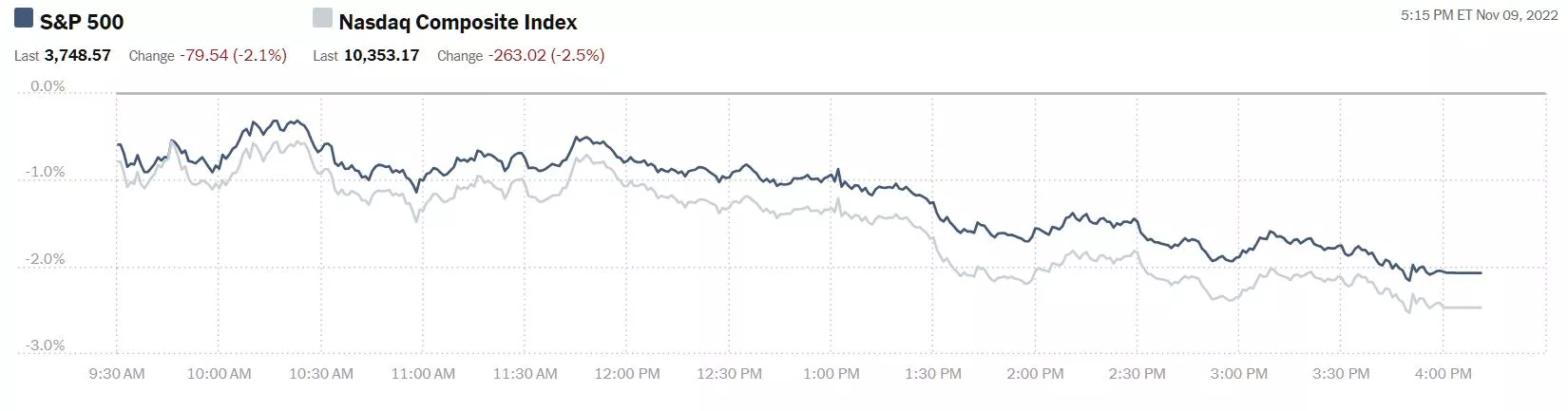

Yesterday the S&P 500 closed at 3,749, down 79 points, the Dow closed at 32,514 points, down a whopping 647 points, while the Nasdaq Composite closed at 10,353, down 263 points.

Chart: The New York Times

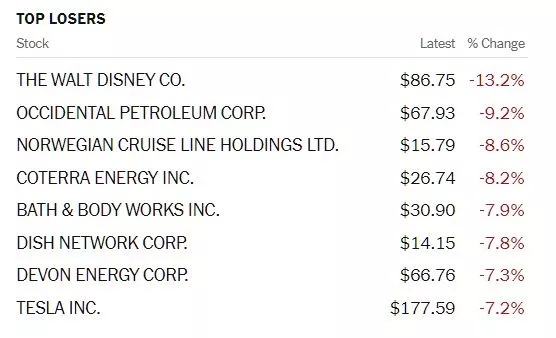

The top loser on Wednesday was Disney (DIS), down 13.2%, followed by Occidental Petroleum (OXY), down 9.2% and Norwegian Cruise Lines (NCL), down 8.6%.

Par for the course, the markets are up in morning futures trading. S&P 500 market futures are up 12 points, Dow market futures are up 66 points and Nasdaq 100 market futures are up 58 points.

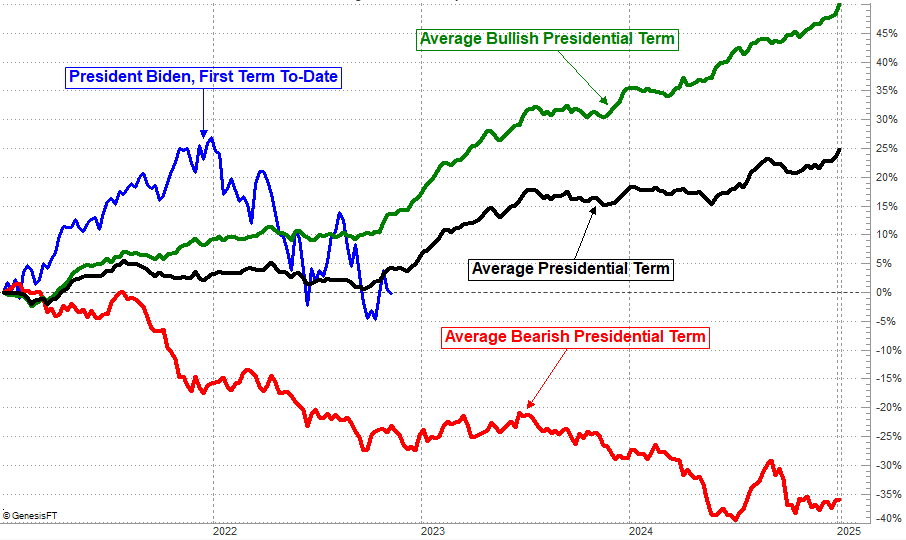

Talkmarkets contributor J. Brumley posits Political Gridlock Or Not, The Coming Year Should Be Bullish.

"The official counting may not be over for weeks. But, enough ballots have been counted to know our political leaders are pretty evenly distributed among both major parties... ensuring little will get done at least for the last couple of years of President Biden's first term as U.S. President. It's a situation called gridlock.

But, that's not necessarily a bad thing for stocks. It's typically a good thing for the market, in fact, since capitalism continues on without either party in a position to disrupt these efforts.

Better still is the fact, however, that we're beginning the third year of a presidential term with or without gridlock, which for some reason tends to be a very good year."

"Note that President Biden's current term is following the same basic path as the stock market's performance under most other presidents... just more exaggerated. That is, a good start followed by a rough second year that sets up a year-three recovery.

This action actually makes a modest amount of sense. Electioneering takes place over the course of a President's second year in office, casting doubt as to who will be in charge the following year; campaign ads also do a bit of fear-mongering. With doubts in mind, voters/investors act accordingly. Once all the campaigning suddenly stops and investors get all the certainty they've been missing for months, they can confidently buy stocks. Corporations feel better about the knows rather than too many unknowns as well...If you're playing the odds, 2023 should be one to net-bullish in. Underscoring this prospect is how most of the indices are still finding strong technical support in all the right places even if they're struggling to get -- and stay -- back in bullish mode."

Contributors Christopher Vecchio and John Kicklighter bring us a short video discussing The Fate Of The US Dollar, The Dow, And Gold After US Midterms, US Inflation Data.

"Overall, the US midterm elections had a modest impact on financial markets on Tuesday and Wednesday – the US Dollar rallied, gold prices slumped, and US stocks dropped back. The impact on the Federal Reserve’s plans may play out over the course of 2023, as a drop off in US fiscal stimulus weighs on the US growth trajectory, helping slow inflation."

As we enter the middle of the 4th quarter contributor Hamish Preston takes a look at market weighting in 2022: Watch Your Weighting Scheme. Preston's article includes several charts and I have included perhaps the most interesting of them below.

"Although outperformance in equal-weight indices has typically been driven by equally weighting within each sector, Exhibit 4 shows that the S&P 500 Equal Weight Index particularly benefitted this year from its lower exposure to Information Technology and Communication Services (which underperformed), and its higher exposure to Energy and Industrials (which outperformed)."

"2022’s challenging environment has left few places for investors to hide, but the varying impacts of news flow on market segments contributed to record-breaking sector spreads. The impact of different weighting schemes on sector exposures, and the resulting impact on index performance, means that market participants may wish to watch their weighting scheme."

TM Contributor Michael Kramer also reported that Stocks Drop Sharply On November 9 Ahead Of The Big CPI Report.

"Stocks finished sharply lower on November 9, with the S&P 500 declining by around 2%. The sell-off in the market accelerate after the 10-Year auction at 1 PM. The auction didn’t go very well, pricing at 4.14% versus a when-issued yield of 4.106%.

I have been looking for a hotter-than-expected CPI report, and I expect that tomorrow. The VVIX has moved up quite a bit over the last couple of days due to the VIX’s rising implied volatility. Sometimes, a rising VVIX can act as a leading indicator to the VIX rising and the S&P 500 falling. I believe the market could be preparing for a hotter-than-expected CPI report, and the need for traders to look for hedges post-CPI."

And then there's Bitcoin (BITCOMP). "Bitcoin is on the verge of cutting through support at 16,650. BTC could trade down to around 10,200 by the time all is said and done."

For those following crypto and the drama in the crypto exchange space contributor Shelly Palmer gives readers this short brief on the Biance-FTX rumble: The Great Crypto Crisis Of ’22.

"Yesterday, while all eyes were (and are) on election results, a battle between two centralized cryptocurrency exchange owners sucker-punched the world of decentralized finance, destroying billions of dollars of market cap in the process.

The dispute pitted Sam Bankman-Fried (SBF), founder of trading firm Alameda Research and crypto exchange FTX, against rival crypto tycoon Changpeng Zhao (CZ), founder of Binance, the world’s largest exchange.

The aftermath of the altercation included SBF taking a $14 billion hit to his net worth (he has about a billion left) and Binance signing a nonbinding agreement to buy FTX...Collateral damage to the broader crypto markets from this 72-hour, $6 billion “run on the bank” has been brutal. Almost every cryptocurrency (including BTC and ETH-X) was hit hard.

To make matters worse, Binance eating FTX makes the world’s biggest centralized exchange even bigger...However, CoinDesk reports that after just a half-day of due diligence, Binance may back out of the deal and that it is unlikely that Coinbase or OKX would step in. I’m not sure about the consequences of letting FTX die, but we’ll know soon enough.

We must watch this closely. It’s the second major meltdown this year; remember what the Terra LUNA crash did to stablecoins and the broader crypto markets in May."

Rounding out the column today is a video update on the housing market from the Staff of Wealthion.com, The Math No Longer Works As Sky-High Mortgages Pop Housing Bubble.

"After mind-boggling ridiculous spikes, home prices in most markets are dropping. And in some markets, they’re plunging at the fastest pace on record. And in some cases, they’re going down faster than they’d spiked on the way up. And it’s just the beginning."

"So says analyst Wolf Richter in his recent post "The Housing Bubble Has Popped, and the Fed Can Let it Rip"

Just how bad may things get from here? We sit down with Wolf to find out." The video is an in-depth look and is a little over an hour long.

Have a good one.

More By This Author:

TalkMarkets Image Library

Tuesday Talk: Election Market

Thoughts For Thursday: Looking For Honey, Bear Rally Continues