Market Briefing For Tuesday, June 13

This market's framework is not quite the complex puzzle some perceive. It is a great 'debt issuance' challenge (for that matter I wasn't thrilled NASDAQ's acquiring a very pricey software company leveraging themselves excessively) and of course there are bank-reserve liquidity issues that still percolate a bit.

The economics of this Country 'are' different than an individual, because the Government can print money and thus the challenge is really different, more about 'debt service payments', which do encroach on what you can spend in a higher rate environment (especially). Pretty exciting pre-Fed day.

So you get esteemed money managers (like Ray Dalio) emphasizing the debt dilemma that does exist based on holding debt that is done in value with costs of service that debt going higher, which has become unsustainable. However, we've heard this before, it indeed has been 'kicking the can down the road', at the same time we are going to have a rising debt problem.. which makes U.S. Treasury bonds more risking than the global perception.

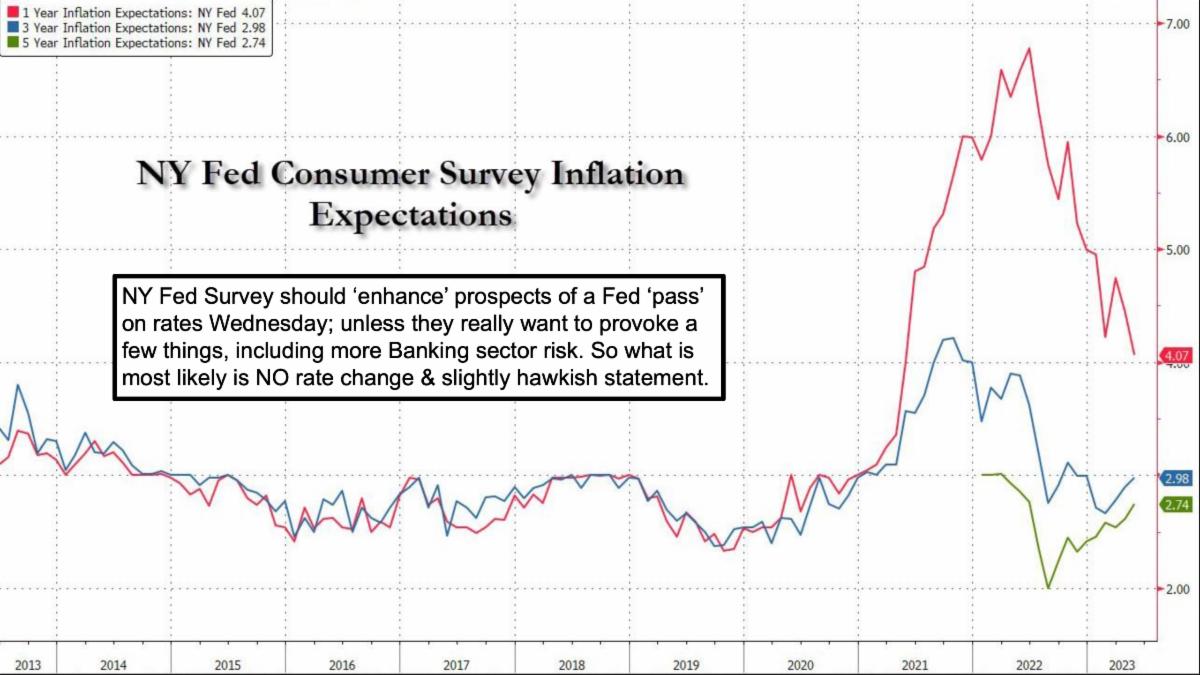

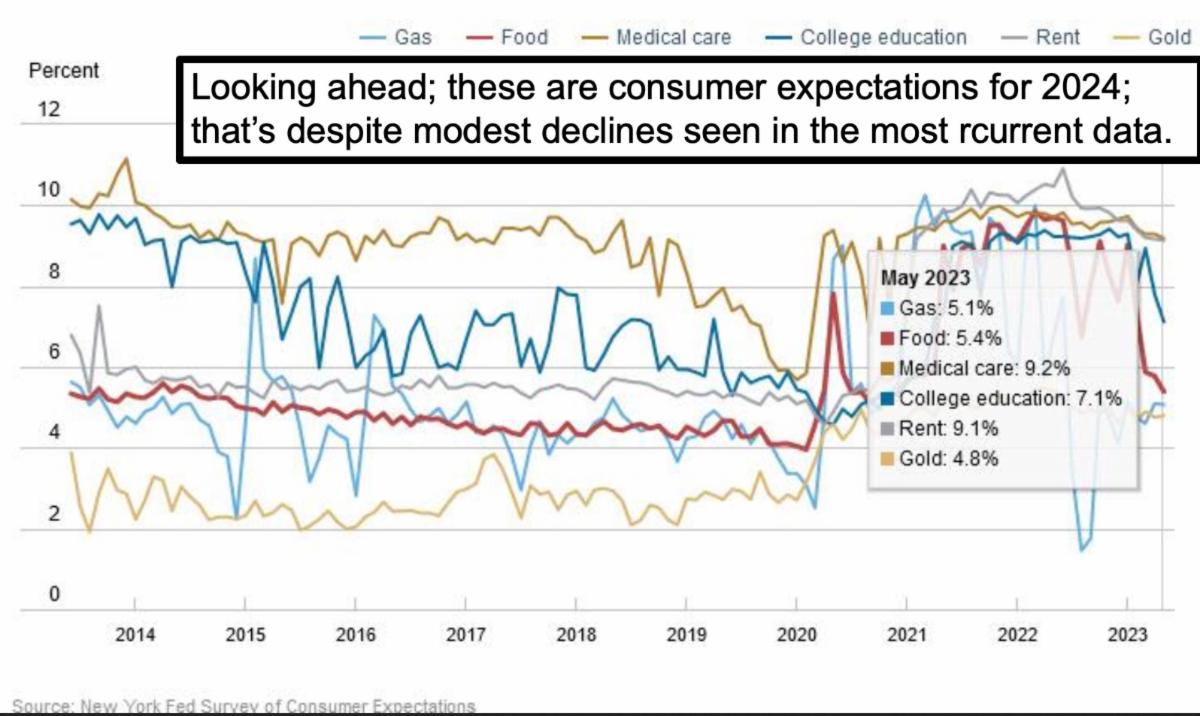

But they can let that fail, so you get a devaluation of currency (like I said for a number of years.. efforts to offset debt with 'depreciated Greenbacks)... but it is so obvious a challenge that while the equilibrium level to balance factors as relate to all this is more difficult, it also means accepting higher inflation rates, as I've suggested, probably more like 3-4% not 2%. The Fed has to know this and it's how you get degrees of 'stagflation' as I've outlined for over a year in this cycle, while warning the Fed's belated rate hike 'program' was hurtful.

To simplify this, the valuation of money had to decline (policy Fed won't admit) to pay debt down with less valued currency. Being anti-debt is fine, but there's no real motivation to correct the problem meaningfully, unless the Fed keeps hiking, and thus crashes the big-cap sector of the equity market (along with a slew of additional bank failures). But again they know it, so they should stop.

If the Fed doesn't 'grasp' the risks of promulgating another 'financial crisis', of course that changes the prospects of continuing to muddle-through all of this. It's a highly uncertain world, and you can't drive 'organic inflation' much lower due to factors beyond the Fed's influence, such as 'climate change', the war, and the battle between economic groups 'trying' to offset U.S. hegemony. My opinion is that even with the philosophical divisions (that's being too kind as a label for the stupid extremes we're dealing with these days) the Fed and even Congress (they avoid saying due to pandering to perceived constituencies) do know what happens if they carry things too far. The debt ceiling deal has little long term significance, but a sign of what they do when reality stares at them.

In-sum: it's a financial focus week, so had to depart from 'generative AI' for a moment. I'm aware of the media coverage about disorderly chaos resulting as a consequence of uncontrolled AI. However, AI can also counter abusive AI, as oddly enough the CEO of Quantum Computing (QUBT) recently indicated. So yes it's a sort of time-warp we're going through as humanity, and future variables are somewhat coming into vision.

Disruptive AI will proceed regardless, and in a military way (even medical) if we don't push this, others will, and you'd cede the future to China or even the EU. There are numerous red-line issues with China, and some experts say it is impossible to talk. Not so. In fact Secretary Blinken is talking there this week. Are we on the 'brink of war'. Nope, not yet. Could we be? Yes, if China hawks (not so much our own) push brinkmanship beyond 'Party' decision making.

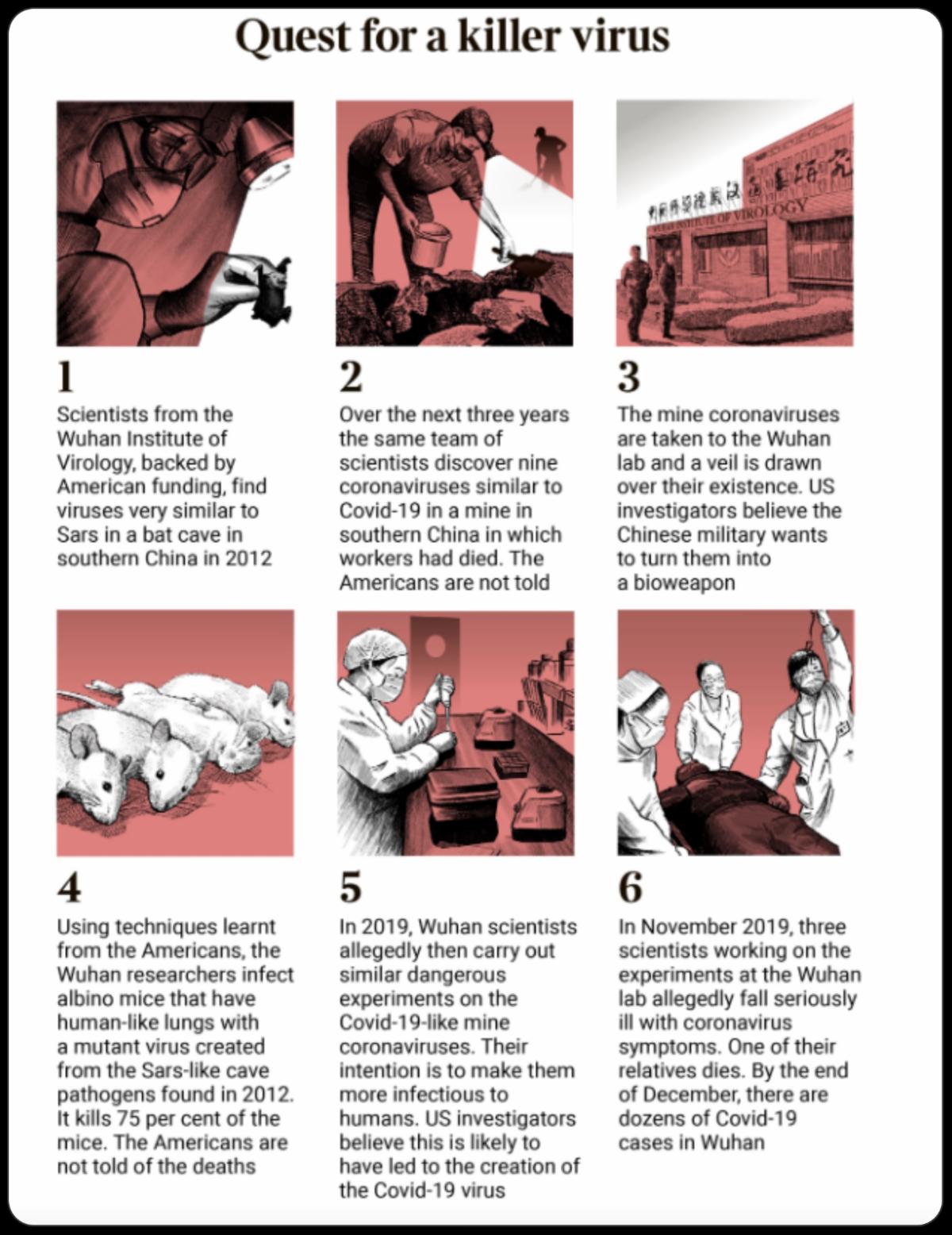

At the same time, 'if' the revelations by the London Times about COVID are confirmed (hard to do, and basically has been but not revealed to the public it seems) .. well that diminishes 'trust' by anyone towards China, and possibly triggers an internal investigation here (Fauci...he did ok some of the 'gain of function funding' that his colleague proceeded with but I'm not alleging conspiracy just stupidity and fast-loose dealing with virus.)

Again many variables, due for some sort of shakeout, Fed ahead, Expiration's on-tap later this week, and there is a play on 'softish landing' if Fed pauses.. and then does not hike next month instead. Data supports taking it easy now.

Financial activity should actually increase in 2023's second half. Wall Street's failed to embrace the inverse 'head & shoulders' bottom late last year, and for sure it's all tricky and remains a bifurcated (mega-cap heavy) market. So they aim to do more IPO's (a dearth so far), and when Reddit goes public, if that's a hot IPO (should be, then comes down after lockup and so on) it will signal the better times for smaller tech, AI, and similar issues.

More By This Author:

Market Briefing For Monday, Jun 12

Market Briefing For Thursday, June 8

Market Briefing For Tuesday, June 6

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more

fascinating discussion. i remember "someone" calling it the china virus and denial firestorm ensued.