Market Briefing For Tuesday, Aug. 2

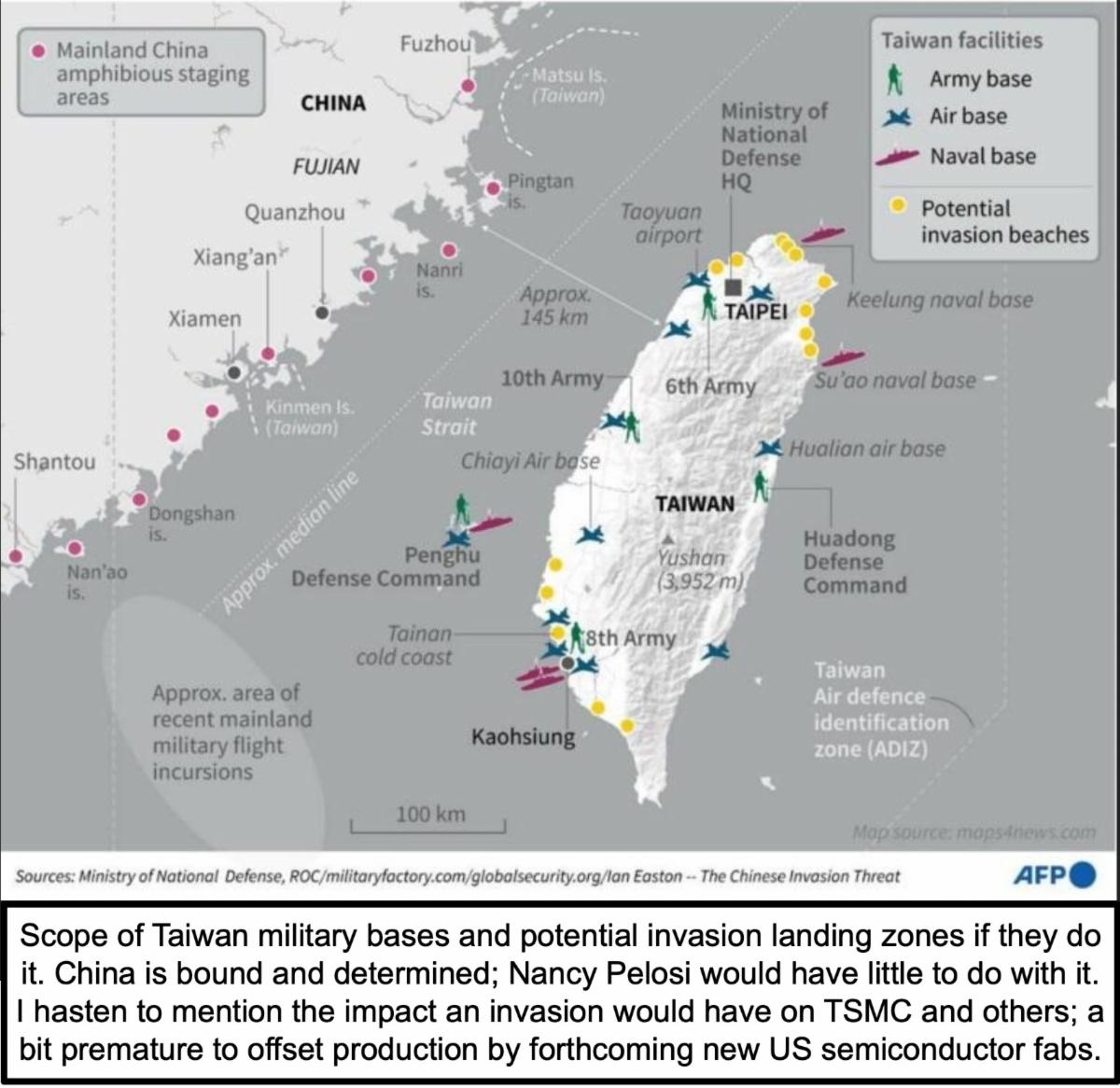

Militaristic expansion must be comprehended or at least considered in an investment assessment, as we look at existential threats to stock markets (or humanity) coming from China. Beijing 'might' use Speaker Pelosi's arrival in Taipei as an 'excuse' to initiate some sort of action.

If that happens, it's not because of anything in US thinking, but because CCP logic in China has no pretext to attack, as actually Taiwan could claim they're the legitimate 'government' of China, pushed-out over 70 years ago. So just a bit like Putin did with Ukraine, there's propaganda efforts to 'blame the victim'.

I suspect the Taiwan tension, as China institutes 'naval blockades' of sorts, in the Taiwan Straits (something not done before, but what they would attempt in prelude to invasion) ...that alone has stock markets on the defensive. Add a drop in Oil we'd looked for (although only temporary), and factor-in the heavy concern about Semiconductors in-event of actual conflict, plus a high S&P.

I already speculated China might respond to Pelosi by 'shelling the islands' off of the Mainland (like they did in the 1950's tension), but really nobody knows. I can imagine that President Biden's call with President Xi focused on all this, and the White House has been known to be lukewarm about the trip, which is a reason we thought Speaker Pelosi needed to visit, as it's America's policy in the future that's at-stake. Of course so is the speaker's security, but that's the role of the U.S. Navy (USS Reagan in the neighborhood) if it comes to it.

Passage of the 'Infrastructure Bill' . . has serious meaning for auto industry EV makers. One item that's obvious is the elimination of the 200,000 vehicle 'cap' for which buyers can get a 'tax credit' of up to $7500 in a purchase year. Eliminating the 'cap' helps Ford, Tesla and GM of course, all above the 200k level already. And it does drop to 4000. for some buyers, it also becomes tied to income levels and even vanishes for buyers making over 40k a year.

That's discriminatory on the surface and might get challenged, but that's not the point I wanted to make. The point is the tax credit applies to vehicles up to but not beyond $80,000, with maximum credits determined by something we have not heard about in years: related to American sourced and assembled % of components. To wit: Chinese EV's won't fare as well, as U.S. made with US batteries too, will both get favorite treatment under the new regulations.

So if that passes, there's reason for foreign and domestic battery companies to make their 'packs' in the USA, and the cars too, and priced below 80,000, with the best benefits for vehicles priced under 50k and made in the USA. For our purposes that sounds promising for Canoo (GOEV) and even indirectly for Israeli based REE Automotive (REE), because they will have facilities near Austin Texas.

Then there could be Romeo Power (a nearly de-listed 'bet') (RMO) and still is, but it's more unique now, since it's either being bought by Nikola with a 1 for 9 stock exchange basis expected to close in October. As I commented in the video's, I actually don't like the deal (viewing RMO as worth more), but unless there's a sudden bidding offer (hence it goes in-play), it does help Nikola (NKLA) secure their domestic battery-pack/module supplier (Romeo) and we find ourselves newly covering Nikola, which (fortunately) I didn't like after their own SPAC-IPO and have never looked at with any interest. They are about to dilute their holders it appears, in tomorrow's Annual Meeting, and that's to implement this deal. So I will be covering Nikola, although a reference cost basis has to be around 6+ as will be adjusted 'if' the deal closes (presuming it does) accordingly.

Back to the 'EV tax credit' I started talking about, it really is shuffled a lot from prior credits, also applies to pickup-trucks and vans especially, aka.. Canoo? Overall it's structured to favor American not import brands, unless they're just assembled 'in' the USA. Of all these (price, materials, labor and sourcing), for all practical purposes it seems inclined to favor something like Canoo or GM, since a Ford or most others do not yet really offer EV's that sticker under 50k. None had much action today, although Ford gained about 6%, so it was best in this session. I suspect Canoo needs their own deal to press much higher, at the same time I get more reports of Dallas Walmart deliveries 'in Canoos'.

In-sum:

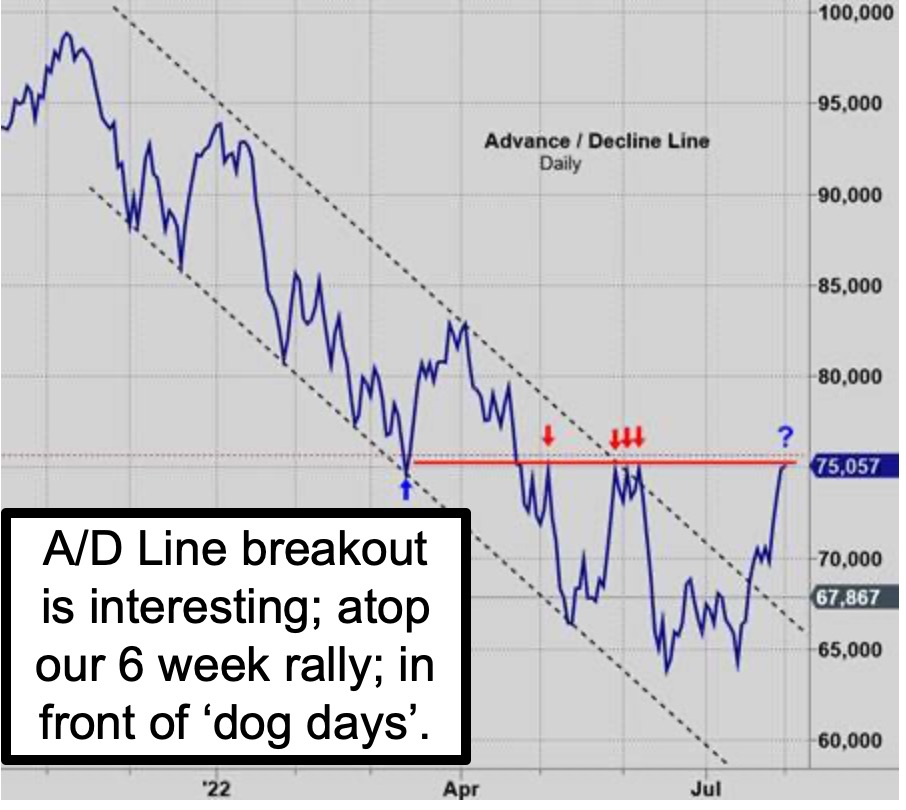

the S&P is choppy at high levels and generally due to retreat, while of course sensitive to Oil movements more than anything. All technical levels are about where we needed to have achieved, but constructive in some ways.

Again, resiliency of the market and U.S. consumers is one thing, passivity in the face of Chinese expansionism is another.

So, we are in a tough environment, the market rebounded from our June lows as desired, and we suspect the deliberate (to use Apple's words) slow hiring and so on in the Jobs arena, along with lower marketing expenses broadly.. it all is warnings that sound like growth at a slower pace, more than declining. If that's the case we can muddle through this tough season and look for 'better'.

More By This Author:

Market Briefing For Monday, Aug. 1

Market Briefing For Thursday, July 28

Market Briefing For Wednesday, July 27

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more

This excerpt was a small portion of my daily work. If you wish me to continue sharing a bit here daily; I'd appreciate your joining for the full Daily Briefing service at www.ingerletter.com