Tuesday Talk: A Glorious First Half And A Glorious Fourth

As we begin the second half of the year the stock market is up, which is not a given (historical statistics aside that show this should be an up year) based on all that has transpired, thus far. So that is something to celebrate, as well as 247 years of American independence, which is no small feat, and something that deserves reverence as well as celebration.

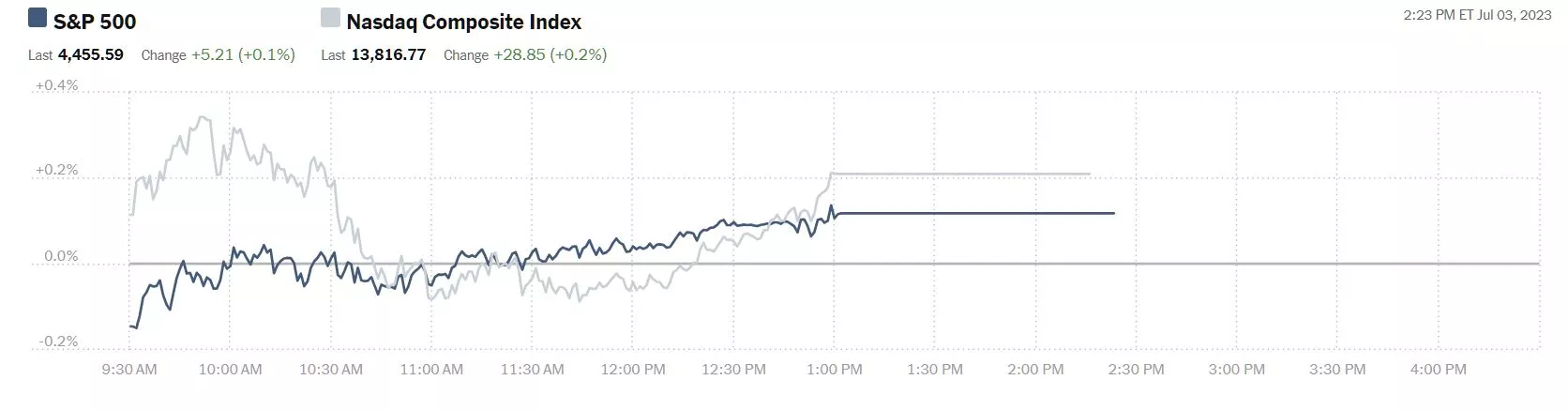

In yesterday's abbreviated pre-holiday trading session the S&P 500 closed up 5 points, at 4,456, the Dow closed at 34,418, up 11 points and the Nasdaq Composite closed at 13,817, up 29 points.

Chart: The New York Times

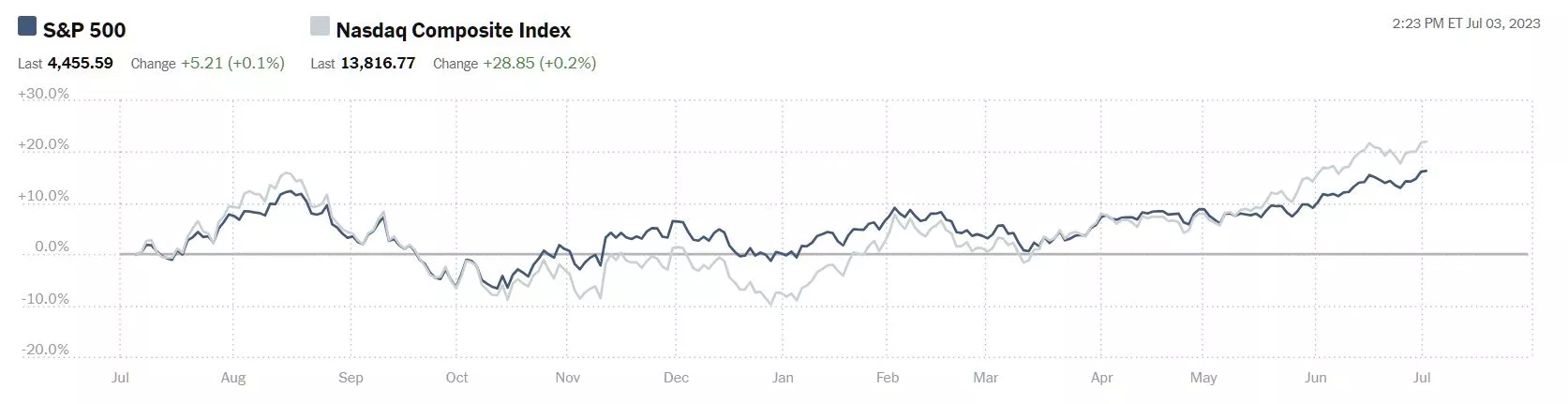

A look at the yearly chart, shows there is reason to celebrate. ![]()

Chart: The New York Times

Most actives on Monday were this year's favorites to date, led by Tesla (TSLA), up 6.9%, followed by Carnival Cruise Lines (CCL), up 0.7%, and Advanced Micro Devices (AMD), up 1.7%.

Chart: The New York Times

Today, the stock market is closed for the Fourth of July holiday.

TalkMarkets contributor Declan Fallon says, Markets Push Gains With The Russell 2000 Slowly Working Through Its Base.

"It has been a positive last couple of weeks for markets. The S&P (SPX) and Nasdaq have had it relatively easy with 20-day MAs providing able support. Friday's gains managed a fresh 'buy' signal for the S&P, returning all of its technicals to a net positive state. Next up is resistance at 4,550."

"The Russell 2000 (IWM) managed a solid recovery after its attempted test of breakout support at $178.Like the Nasdaq, it hasn't yet triggered a new 'buy' signal, but its larger challenge is resistance of $198 on the weekly time frame."

"With the shortened week in play, I won't be expecting too much change into Friday, but the outlook for the rest of the summer should be positive."

See Fallon's full article for the Nasdaq Composite chart.

Contributor Norman Mogil in an "In The Spotlight" column writes Central Bankers Are No Longer So Self-Assured about taming inflation.

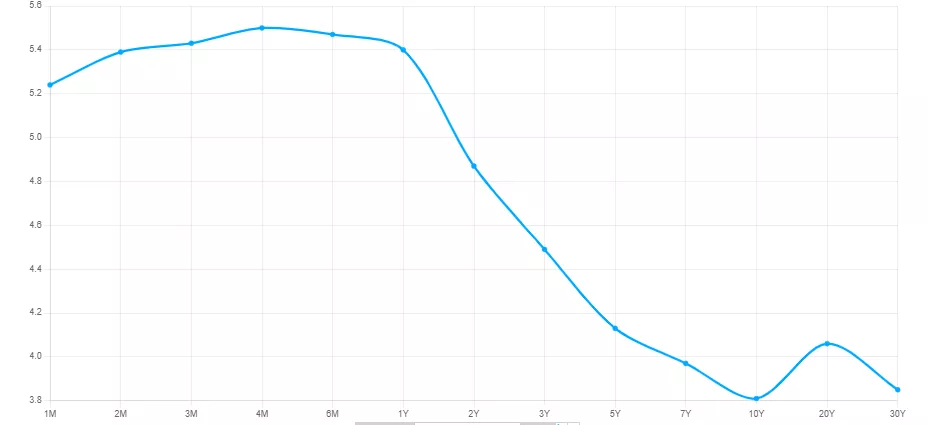

"There was a time recently when central bankers were certain that they could tame inflation by a steady march upwards in the bank rate, but no longer is this the case. Witness the discomfort within the international banking community in the past two months, as central banks conduct a stop-go policy on rate hikes. In North America, the Bank of Canada introduced a pause in April from a steady stream of rate hikes only to resume rate hikes in June. The US Federal Reserve paused last month, yet signaled that investors should prepare for a prolonged period of interest rates around these current levels. (Editor's note: Yesterday, the Reserve Bank of Australia, also "skipped" a hike opportunity.) Fed speakers have even offered up forecasts for the bank rate to reach as high as 6%. Making matters more confusing is the inversion of the government bond. The US two-year yield trades at over 100 basis points above the bell weather 10-yr bond, indicating investors are content with lower returns in the future. Many economists interpret the shape of the yield curve as a leading indicator of a coming recession."

"(And) European economies are slowing, possibly already in recession.

Mohamed El-Erian, notes that:

This combination of events is far from ordinary. In the context of a two-year battle against inflation, it presents a confused and confusing situation that casts an uncomfortably bright spotlight on central banks, both individually and as a collective. Many are now drawing the ire of impatient politicians and ordinary citizens pressured by higher prices and mortgage rates. (Defining moment)

El-Erian calls upon governments to do an independent review of central bank policymaking, especially with respect to their “outmoded policy frameworks and target setting, the lack of cognitive diversity and poor accountability.”

Other well-respected economists have also called into question central banking thinking. Adam Tooze, referencing the slavish adherence to the 2 percent inflation rule, declares that:

“But, like any other quasi-constitutional rule, it should be held up for public scrutiny and judged against the demands of the moment. The 2 percent target was a realistic one in the era of the “great moderation”. The question we ought to be asking is: is it fit for purpose in an age of polycrisis? (Tough Choices)"

The Staff at contributor ING Economics, present some contrarian data in Challenges Mount For U.S. Manufacturing, Construction And Services. It's not a long article and worth the read, but here are some of the highlights.

"The ISM manufacturing index indicates that the sector is in recession, with few signs of a turn any time soon. Construction is doing better, but higher interest rates will bite. With the impact of student loan repayments presenting major challenges for the sector, services will be the area to watch."

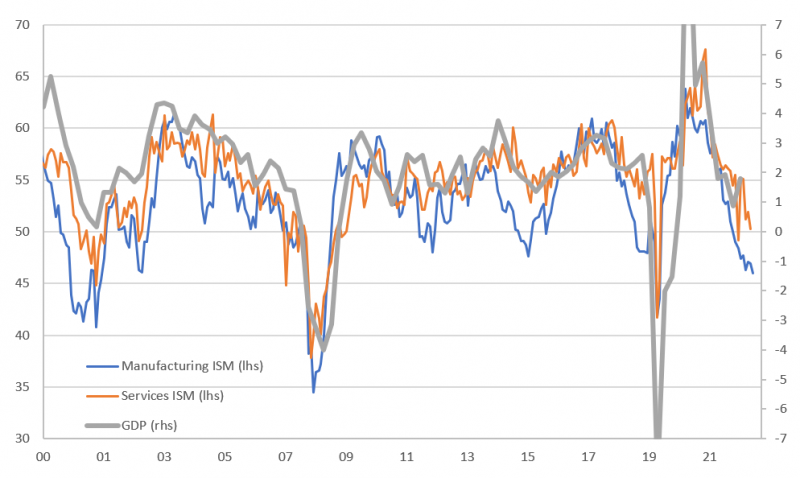

"All of the important barometers (orders, production, employment, prices paid) are also below their 6M averages, so there is no sign of a turn coming yet. The weak Chinese PMI –whose trend typically leads the US ISMs by around three months – confirms this. As the chart below shows, the ISM (manufacturing and services) reports have historically been superb lead indicators for GDP growth – and it doesn't look pretty."

Macrobond, ING

"Residential construction remained very strong, rising 2.1% MoM in the May report. This reflects the lack of existing homes available for sale, which is supporting prices and has prompted a sharp pick up in new home sales. Home builder sentiment has recovered, so residential construction should continue to be very firm for the next few months on this story. Non-residential construction fell 0.2% and outside of chip fabrication/tech, activity looks set to remain subdued – particularly with the manufacturing sector clearly struggling, office demand persistently weak and high borrowing costs and weak business sentiment deterring activity elsewhere."

"This (Service) sector faces its own challenges, however, with the restart of student loan repayments for 43 million Americans from October. At a monthly average cost of $350 per person, this works out at around $180bn in aggregate for a year and is equivalent to around 1% of consumer spending. Consequently, the services sector (leisure and travel in particular) also faces increasing challenges."

Shifting gears a bit, in an "Editor's Choice" column TM Contributor James Picerno gives us his Major Asset Classes Performance Review - June 2023.

"Global markets rebounded in June after widespread losses in May, based on a set of proxy ETFs. The downside outlier to last month’s rally for the major asset classes: US bonds, which continued to lose ground.

US stocks topped the winner’s list in June. Vanguard Total Stock Market Index Fund (VTI) rose 6.7%, marking a fourth consecutive monthly advance. Although VTI remains well below it’s record close, set in January 2022, the fund ended last week at a 14-month high.

Note that US shares (VTI) are also the top performer so far in 2023, posting a strong 16.1% return. On the flip side, a broad brush definition of commodities (GSG) is suffering the biggest loss in 2023 for the major asset classes, slumping more than 8%.

The only losers in June: US investment-grade bonds (BND) and inflation-indexed Treasuries (TIP). Both ETFs slipped fractionally, each marking a second month of modest loss.

See Picerno's full article for additional performance stats.

Contributor Sweta Killa provides some holiday cheer in our "Where To Invest Department" with Five ETFs To Make The Most Of July Fourth Celebrations.

"This Fourth of July will be a celebration of not only freedom but also economic growth. Along with the spirit of Americans, this Independence Day should lift revenues and profits in various corners. Industries like travel & leisure, lodging, hotel, restaurants and retail will benefit the most. Investors seeking to enjoy the fanfare could tap these industries through the following ETFs.

ALPS Global Travel Beneficiaries ETF (JRNY - Free Report)

ALPS Global Travel Beneficiaries ETF provides diversified exposure to the global travel industry by tracking the S-Network Global Travel Index. The fund invests in 75 companies engaged in booking and rental agencies, airlines and airport services, hotels, casinos and cruise lines, along with travel-related companies...

ALPS Global Travel Beneficiaries ETF has accumulated $6.4 million in its asset base and charges 65 bps in annual fees. JRNY trades in an average daily volume of 1,000 shares.

U.S. Global Jets ETF (JETS - Free Report)

U.S. Global Jets ETF provides exposure to the global airline industry, including airline operators and manufacturers from all over the world, by tracking the U.S. Global Jets Index. The product holds 51 securities and charges 60 bps in annual fees.

U.S. Global Jets ETF has gathered $2 billion in its asset base while seeing a heavy trading volume of nearly 3 million shares a day. JETS has a Zacks ETF Rank #3 (Hold) with a High-risk outlook.

Kelly Hotel & Lodging Sector ETF (HOTL - Free Report)

Kelly Hotel & Lodging Sector ETF tracks the Strategic Hotel & Lodging Sector Index, which measures the performance of companies that specialize in providing hotel, motel, lodging, residential and timeshare properties management services, operational services, including lodging platform services...It holds 37 stocks in its basket, with a concentration on the top four firms.

Kelly Hotel & Lodging Sector ETF has accumulated $0.7 million in its asset base while charging 78 bps in annual fees. It trades in an average daily volume of about 100 shares.

AdvisorShares Restaurant ETF (EATZ - Free Report)

Restaurants will benefit as more consumers eat out. AdvisorShares Restaurant ETF is actively managed and the only fund investing exclusively in the restaurant and foodservice industry... AdvisorShares Restaurant ETF holds 25 securities in its basket with a higher concentration on the top firm.

AdvisorShares Restaurant ETF gathered $2.5 million in its asset base. EATZ charges 99 bps as annual fees and trades in an average daily volume of 900 shares.

SPDR S&P Retail ETF (XRT - Free Report)

SPDR S&P Retail ETF tracks the S&P Retail Select Industry Index, which provides exposure across large, mid and small-cap stocks. It holds well-diversified 87 stocks in its basket, with none making up for more than 2.1% share. SPDR S&P Retail ETF is well spread across various industries with a double-digit allocation each in automotive retail, specialty stores, apparel retail, and broadline retail.

SPDR S&P Retail ETF is the largest and most popular in the retail space, with AUM of $476.3 million and an average trading volume of 5.6 million shares. It charges 35 bps in annual fees and has a Zacks ETF Rank #1 (Strong Buy) with a Medium risk outlook."

See the complete article for additional information.

Caveat Emptor.

Have a glorious Fourth!

More By This Author:

Thoughts For Thursday: Cautious Optimism Takes Hold, Seemingly

Thoughts For Thursday: Profit For The Taking

Comments

No Thumbs up yet!

No Thumbs up yet!