Central Bankers Are No Longer So Self-Assured

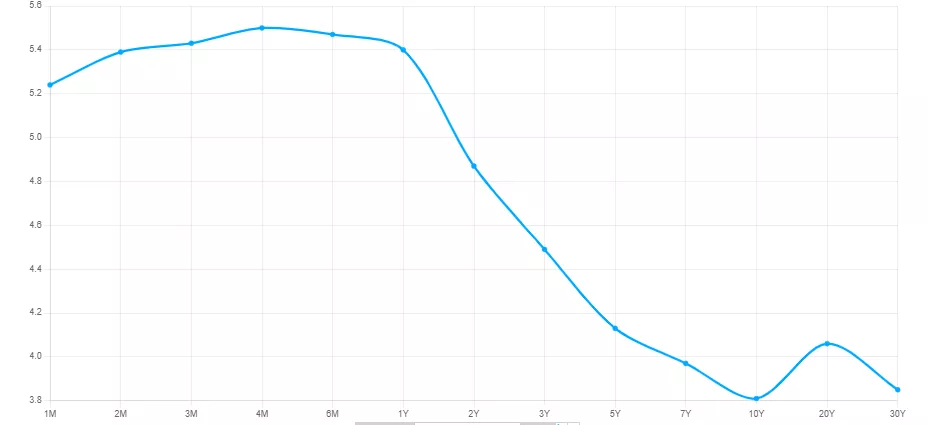

There was a time recently when central bankers were certain that they could tame inflation by a steady march upwards in the bank rate, but no longer is this the case. Witness the discomfort within the international banking community in the past two months, as central banks conduct a stop-go policy on rate hikes. In North America, the Bank of Canada introduced a pause in April from a steady stream of rate hikes only to resume rate hikes in June. The US Federal Reserve paused last month, yet signaled that investors should prepare for a prolonged period of interest rates around these current levels. Fed speakers have even offered up forecasts for the bank rate to reach as high as 6%. Making matters more confusing is the inversion of the government bond. The US two-year yield trades at over 100 basis points above the bell weather 10-yr bond, indicating investors are content with lower returns in the future. Many economists interpret the shape of the yield curve as a leading indicator of a coming recession.

US Treasury Yield Curve, Jun 30/23

Turning elsewhere, European monetary authorities surprised observers with rate hikes by the Bank of England and the European Central Bank, both hinting that further rate hikes are anticipated. All the while, the European economies are slowing, possibly already in recession.

Mohamed El-Erian, notes that:

This combination of events is far from ordinary. In the context of a two-year battle against inflation, it presents a confused and confusing situation that casts an uncomfortably bright spotlight on central banks, both individually and as a collective. Many are now drawing the ire of impatient politicians and ordinary citizens pressured by higher prices and mortgage rates. (Defining moment)

El-Erian calls upon governments to do an independent review of central bank policymaking, especially with respect to their “outmoded policy frameworks and target setting, the lack of cognitive diversity and poor accountability.”

Other well-respected economists have also called into question central banking thinking. Adam Tooze, referencing the slavish adherence to the 2 percent inflation rule, declares that:

“But, like any other quasi-constitutional rule, it should be held up for public scrutiny and judged against the demands of the moment. The 2 percent target was a realistic one in the era of the “great moderation”. The question we ought to be asking is: is it fit for purpose in an age of polycrisis? (Tough Choices)

So far, these cries for a re-examination of 40-yr old policy frameworks have fallen on deaf ears. It is “2 percent inflation or bust”.

More By This Author:

Canada Needs To Promote Business Capital Investment If It Hopes To Tame InflationThe Bank Of Canada Continues To Struggle With Timing Its Policy Changes

Canadian Banks Signal The Coming Economic Downturn

Disclosure: None.