Challenges Mount For U.S. Manufacturing, Construction And Services

The ISM manufacturing index indicates that the sector is in recession, with few signs of a turn any time soon. Construction is doing better, but higher interest rates will bite. With the impact of student loan repayments presenting major challenges for the sector, services will be the area to watch.

US manufacturing recession deepens

The June US ISM manufacturing index has come in at 46.0, below the 47.1 consensus and weaker than the 46.9 reading from May. This is the worst reading since May 2020 and is the eighth consecutive sub-50 reading (the border between growth and contraction). The key sub-components such as new orders, production, employment and customer inventories are also all in contraction territory. In fact, nothing is growing. The one bit of good news is that this is also the case for prices paid, which dropped to 41.8 – the lowest seen since December. This suggests producer price inflation should soon drop below 1% year-on-year.

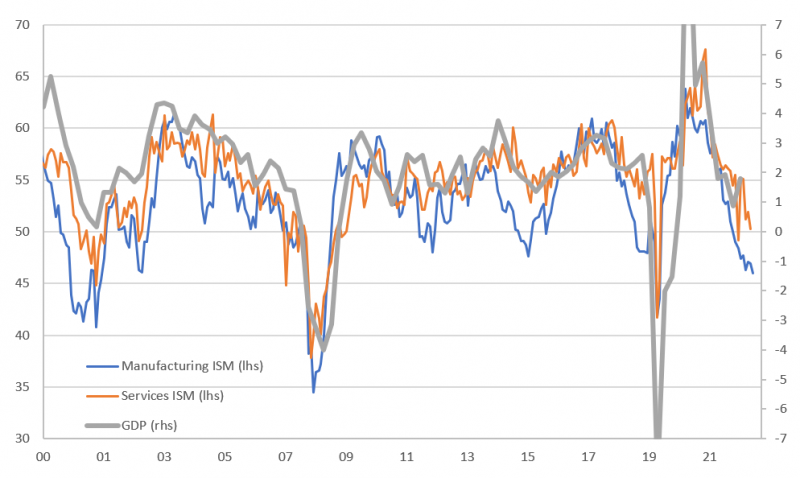

All of the important barometers (orders, production, employment, prices paid) are also below their 6M averages, so there is no sign of a turn coming yet. The weak Chinese PMI –whose trend typically leads the US ISMs by around three months – confirms this. As the chart below shows, the ISM (manufacturing and services) reports have historically been superb lead indicators for GDP growth – and it doesn't look pretty.

ISM indices suggest the economy faces clear challenges

Macrobond, ING

Construction lifted by residential rebound

We also have May construction data, which is a bit of a tricky one to read. Headline construction spending rose 0.9% month-on-month, above the 0.6% consensus, but we have had a whole series of data revisions – most notably with April revised down from +1.2% MoM to just +0.4%.

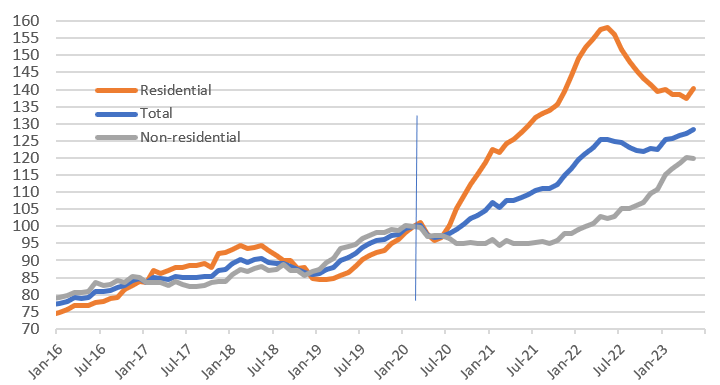

Residential construction remained very strong, rising 2.1% MoM in the May report. This reflects the lack of existing homes available for sale, which is supporting prices and has prompted a sharp pick up in new home sales. Home builder sentiment has recovered, so residential construction should continue to be very firm for the next few months on this story. Non-residential construction fell 0.2% and outside of chip fabrication/tech, activity looks set to remain subdued – particularly with the manufacturing sector clearly struggling, office demand persistently weak and high borrowing costs and weak business sentiment deterring activity elsewhere.

Construction spending by sector Mar 2020 = 100

Macrobond, ING

Services isn't immune from the slowdown story

With the Federal Reserve seemingly intent on raising interest rates further, these two interest rate-sensitive sectors – construction and manufacturing – are likely to find things tougher as we head through the second half of 2023, putting even greater pressure on the services sector to generate the growth needed to sustain employment.

This sector faces its own challenges, however, with the restart of student loan repayments for 43 million Americans from October. At a monthly average cost of $350 per person, this works out at around $180bn in aggregate for a year and is equivalent to around 1% of consumer spending. Consequently, the services sector (leisure and travel in particular) also faces increasing challenges.

More By This Author:

Inflation Slips In Indonesia, But Central Bank Expected To Keep Rates On HoldFX Daily: Quiet Start To An Intense Week

The Commodities Feed: Specs Reduce Oil Net Long

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more