AYR Wellness Q1 Financials Reflect Company's Strategic Transformation

Q1 2021 Financial Highlights

For the three months ended March 31, 2021. (Unless otherwise noted, all results are presented in U.S. dollars and compared with the previous quarter.)

- Revenue: increased 23% to $58.8M

- Adj. Gross Profit: increased 14% to $31.4M

- Operating Income: declined to $(8.4)M from $6.7M

- Adj. EBITDA: declined 1.1% to $18.4M

- Adj. EBITDA Margin: reduced to 31.5% from 38.9%

Management Commentary

Jon Sandelman, CEO, said:

- “Q1 2021 represents the early innings of our 2021 strategic transformation which can be seen in our April monthly revenues, which have nearly doubled since January. We expect step function growth across Q2, Q3, and especially Q4 2021, with further milestones reached when additional cultivation projects come online and we close our New Jersey acquisition later this summer.

- 2021 will be a year of investment in our brands as we expand in seven states, especially in adult-use markets where merchandising, quality, and selection drive consumer behavior, and these investments are expected to drive additional revenue growth in the second half of 2021 and into 2022 and beyond.”

Outlook:

Based on the results to date, management is expecting 2Q21:

- revenue of approximately $90 million, which reflects growth of over 54% quarter-over-quarter and 218% year-over-year,

- adjusted EBITDA margin on a US GAAP basis to remain in the 30% range reflecting the investment in new markets and growth projects that are expected to generate more meaningful revenue in the second half of 2021 and in 2022.

The Company is reiterating:

- its target for 2022 revenue of at least $725 million and

- its guidance for 2022 Adjusted EBITDA of $300 million, which is comparable to $325 million on an IFRS basis.

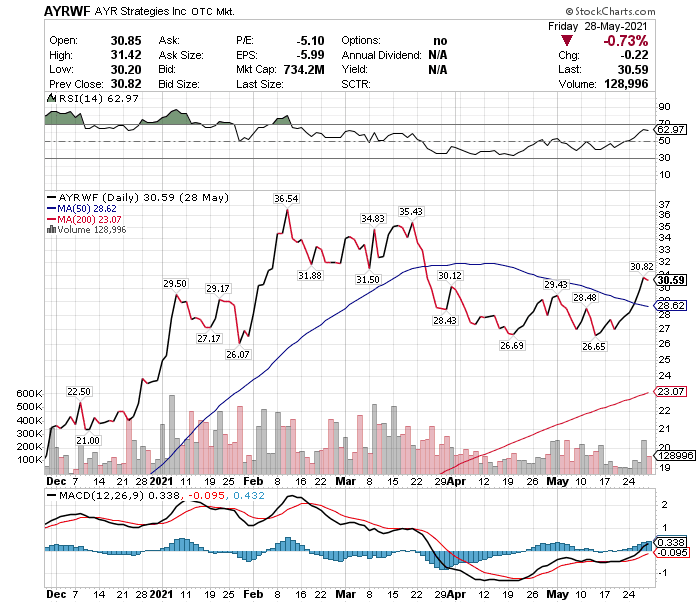

Stock Performance

Ayr Wellness (AYRWF) stock continues to perform well. It is up 28.6% YTD and was up 4.4% in May.

If you found the above analysis of interest check out the other recent quarterly reports from Hexo, Columbia Care, Aurora, Vireo Health, Trulieve, Canopy, TerrAscend, Rubicon, Harvest Health, Valens, Cronos, Curaleaf, Tilray, Green Thumb, and Organigram.

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more