Aurora In Freefall As A Result Of Ugly Q3 Financials

Aurora Cannabis Inc. (ACB), a constituent in the munKNEE Canadian LP Pot Stock Index, announced its Q3 financial results after the markets closed on Thursday for the period ended March 31, 2021. The highlights are as follows:

Q3 Financial Highlights

(All results are presented in Canadian dollars - go here to convert into USD - and compared to the previous quarter.)

- Total Net Revenue: decreased 18% to $55.2M

- Adj. Gross Margin: increased to 44% from 42% due to:

- a significant shift in revenue mix towards our medical markets which command much higher average net selling prices, partially offset by

- the purposeful reduction in production levels at Sky resulting in charges related to under-utilization of capacity.

- Consumer Cannabis Net Revenue: decreased 37% to $18.0M due primarily to:

- Covid-19 related challenges across Canada in both provincial distributors and consumer access to in-store retail shopping

- Adj. Gross Margin: decreased to 21% from 27% primarily driven by:

- a $1.8 million increase in cost of sales due to under-utilized capacity as a result of the scaling back production at Aurora Sky (expected to partially reverse in future quarters), and

- a decrease in the average net selling price per gram of consumer cannabis as a result of price compression.

- Adj. Gross Margin: decreased to 21% from 27% primarily driven by:

- Covid-19 related challenges across Canada in both provincial distributors and consumer access to in-store retail shopping

- Medical Cannabis Net Revenue: decreased 6% to $36.4M

-

- Adj. Gross Margin: increased to 59% from 56% despite:

- the increase in the cost of sales from the under-utilized capacity at Aurora Sky and

- the continued ramp-up of the Aurora Nordic facility in Europe.

- Adj. Gross Margin: increased to 59% from 56% despite:

-

- Adj. Gross Margin: increased to 44% from 42% due to:

- SG&A/R&D: increased 1.6% to $45.1M

- Adj. EBITDA: declined 43% to $(24.0)M

- Cash-on-Hand: increased 21% to $525M

- announced that it will file to raise another $300 million in U.S. dollars through an equity offering

- Cash Expenditures: reduced by 2%

- Cash used in operations and for capital expenditures are crucial metrics in Aurora's drive toward generating sustainable positive free cash flow

- Cash Used in Operations: increased 12.3%

- Capital Expenditures: increased 38.5%

- Working Capital: decreased 17.8%

- Debt/Interest Payments: decreased 9.3%

- Cash used in operations and for capital expenditures are crucial metrics in Aurora's drive toward generating sustainable positive free cash flow

Q3 Operational Highlights

- Kilograms Sold: decreased by 11%

- Average Net Selling Price/g of Dried Cannabis: declined 13% to $3.59/g

Looking Forward

- Business Transformation/Operational Efficiency Plan

- plans to achieve $60 million to $80 million in annualized cost efficiencies over the next 12-18 months in:

- costs of goods sold ($40M to $60M) and

- SG&A expenses ($20M) primarily related to production costs, facility, and logistic expenses, organizational efficiencies, insurance, and capital markets-related expenses.

- It is intended, and anticipated, that the Company's ongoing business transformation will move the operating cash flow metric in a positive direction over the coming quarters.

- plans to achieve $60 million to $80 million in annualized cost efficiencies over the next 12-18 months in:

- New Stock Exchange Listing

- plans to transfer its listing from the NYSE to the NASDAQ effective May 24th, 2021, and will continue to trade under the symbol ACB. It will continue to trade on the TSX under the same ACB symbol.

Management Commentary

Miguel Martin, Chief Executive Officer, said:

- "...We delivered the strongest performance in domestic medical and the best results in international medical cannabis of any Canadian LP during the period.

- ...Being #1 by revenue in Canada's medical market, the largest federally regulated medical market globally, should translate into global adult-use success in the future as medical regimes evolve to adult-use markets...

- Being the #2 largest Canadian LP by global cannabis sales this quarter, and a leader across multiple markets and segments gives Aurora the brand recognition and clout to pursue numerous incremental opportunities around the world.

- Our cost structure transformation continues and we have identified further cost savings of $60 million to $80 million annually that are expected to be achieved within eighteen months and are incremental to the ~$300 million in annual savings already achieved. We anticipate that this initiative will not only allow us to meet our financial objectives while the Canadian adult-use market normalizes over the next several quarters but will not have any effect on future revenue growth.

- We have recently added Alex Miller and Lori Schick to the team; two highly respected leaders in the areas of operations and human resources, respectively, to accelerate the execution of our corporate objectives. They each bring 20 plus years of transformative regulated industry experience and are already fully engaged.

- Lastly, our balance sheet remains strong with approximately $525 million in cash. This will allow us to support organic growth as well as opportunistic M&A, particularly in the U.S."

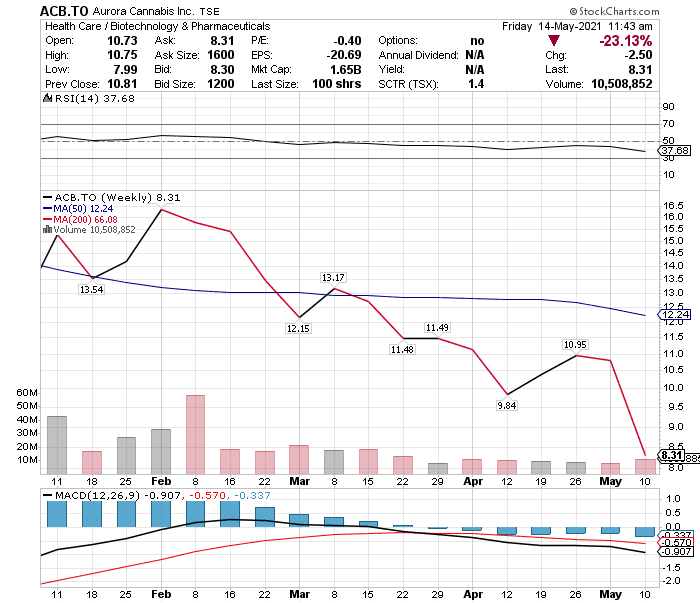

Stock Performance

While Aurora's share price had advanced by +2% YTD as of last Friday it has declined -23% since then as can be seen in the chart below. ( As Aurora's Q3 results were announced in Canadian dollars, as noted, the chart below is from the TSX which is in Canadian dollars). It appears that the ugly Q3 financial results and the revelation that there is going to be even more share dilution coming is not sitting well with shareholders.

If you found the above analysis of interest check out the other recent quarterly reports from Hexo, Columbia Care, Ayr Wellness, Trulieve, Canopy, TerrAscend, Rubicon, Harvest Health, Valens, Cronos, Curaleaf, Tilray, Green Thumb, and Organigram.

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more

Relatively new businesses will have ups and downs, but it seems that it is still producing a net profit.

So tears about reduced profits are not met with much sympathy here.