Market Briefing For Monday, March 17

Let's begin by contemplating this interesting tidbit from Bank of America:

an 'ode to extreme spending from Covid forward; to isolationism now'.

As I contended for years, excess either way tends to be counter-productive.

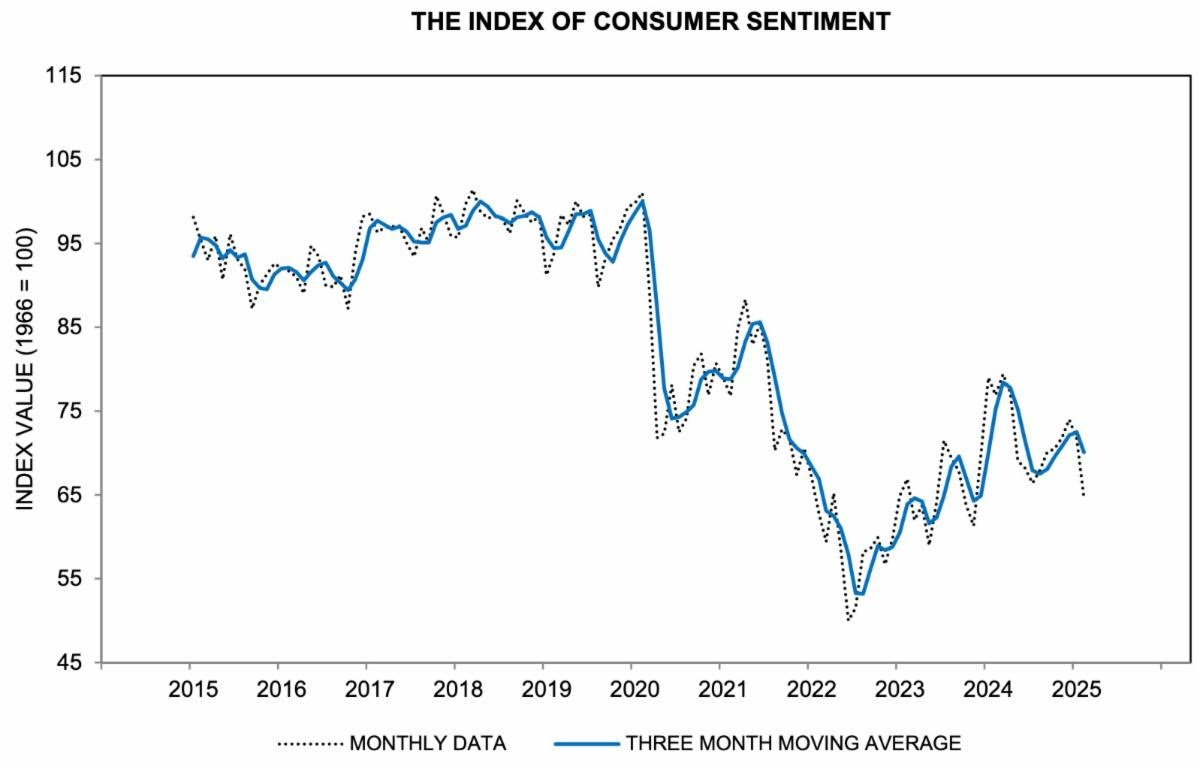

The significant decline in the Univ. of Michigan Consumer Sentiment Index is the best case for a Fed to 'consider' cutting interest rates now... and erasing the S&P's decline possibly entirely; albeit some component fundamentals are very changed given tariff situations or so on. Hence conflating what is already confounding for most investors. I'll be content with Quantum and AI higher. Is President Trump going to ask tech companies to refund chip money given?

Reflections on the macro chaos and unknowns: it is not just the tariffs but the actions his admin is causing to the economy (which may be positive since so many prior Administrations promised cost-controls but never followed-through plus there's no choice given the 'refunding' and demands down the road) that a recession and or stagflation can be triggered, which causes the uncertainty.

Of course the Fed can 'temporarily' nullify that fear with a rate cut Wednesday. Regardless, I occasionally take advantage of opportunities as they appear, to buy dips of either major companies (more rarely, given high prices), or riskier “mismatched” smaller-caps. (BBAI is an example once we get through debt reduction and/or dilution, which should be non-recurring.)

As to the Nation: usually America gets it together eventually and those quality companies will rebound; and specialty AI or Quantum tickers are independent (to a degree) of macro Index moves, unless there's all-encompassing panic.

In this case, doesn't really matter what Trump does short-term. Overarching mantra might be: that if the stock you invest in was sound yesterday, nothing of significance has changed in the business, but the stock value is falling due to market pressure (or financial engineering that looks bad short-term but puts a company on better-footing further-out), your stock is still as viable as it was yesterday, so perhaps invest more (if charts suggest downside exhaustion). Markets are fickle, oscillating all the time; rising over time isn't too relevant to individual stocks; because few have that degree of patience. If you believe in your investment, and bad news is market wide; a hiccup and not about your stock, if you can, you hold through the intervening chaos (or ideally sold some before and jump back in on a scale, without much all-or-nothing drama).

The market has passed-the-baton among sectors; although Friday brought a lot of heavily-shorted stocks into rallying mode; and extended gains for a few already in-play. There are potential inflection points ahead; which can shuffle stocks in both directions (depending on news); but we thought one area would see the upside ahead of next week . . that's particularly Quantum Computing.

Next week and beyond there are a couple 'conferences' that will highlight this sector, and clearly the shorts (who had no business trying to hold them down, knowing - or they should have - that these presentations are forthcoming) are contributing to the upside. That's great for (us) longs; but also questions a degree of sustainability; given obviously some of the upside will be temporary.

Market X-ray: we'll not dwell on the backdrop fundamentals; you all know the litany of challenges, in Washington, in Ukraine/Russia; and with overall Debt.

We also don't know, but are contemplating whether the 'Powell Put' kicks-in, via the upcoming Fed Meeting, concurrent with the Quantum events. Volumes in several Quantum tickers show incredible turnover levels.. and recovering wounded bears are slowing positioning for post-purge revival of significance.

Next week, more so than usual, it's a market of stocks, not a stock market (a reference to sector and company-specific influences). Friday was just terrific.

Clearly the financial media and analysts will be nervously listening to the CEO of Nvidia; who misdirected everyone about the proximity of Quantum arriving in the years ahead. That created the airpockets and serious damage to most of the players in this future field (which makes 'his' chips legacy); hence likely a primary reason he tried to close 'sales orders' before everyone found out he was 'talking his book' rather than seriously examining the Quantum prospects.

After reflecting on all that, and after Microsoft came forth with their own chip to enter the Quantum race, along with the CEO of IBM proclaiming it's in 'this decade' not next, that Quantum becomes realistic; his posture shifted, a lot. In fact dramatically; so he scheduled a 'Quantum Day' during their otherwise more NVDA-focused event; and I believe that's Thursday, although Jensen's Keynote speech is on Tuesday; and we'll see if he welcomes 'the players', or tries to be a 'spoiler' again. Tuesday and Thursday might require sedatives; after the tremendous upside seen this week in one or two of the tickers. Now the leading one (our focus especially over the past week) has filled the 'gap' that broke the sector when Jensen gave his original incorrectly hostile view.

My guess (only that) is he will acknowledge 'some' of the Quantum aspects forthcoming, maybe differentiate between 'Annealing vs. Gate' Quantum, as a way of 'saving-face' regarding what arrives and what's down-the-road, and possibly even highlight a partnership with one.. could it be D-Wave Quantum.

'Of these tickers' .. QBTS (that's D-Wave) exploded higher this week; even to the higher number (10) that I speculated might be seen near-term. The point in that is it filled the breakaway gap, while others are following but not there at this point, but pointed in their respective relative directions to replicate that. In that area I particularly point to Rigetti Computing and lagging Quantum Computing Inc.; it's named for the sector, but probably more controversial.

Again, as to D-Wave’s future prospects: they're tied to new customers, and for the moment key industry events. Qubits 2025 conference, hosted by D-Wave, will showcase technological advancements and commercial use cases.

This event could be a pivotal moment for the company, as it aims to solidify its market leadership in applied quantum computing. Additionally, NVIDIA’s GTC (GPU Technology Conference) is Tuesday's major event that could influence quantum stocks, including D-Wave and Rigetti. As a leading force in AI and high-performance computing, Nvidia’s developments tend to set the tone for the broader tech sector. If quantum computing gains further validation at GTC, it could accelerate investor enthusiasm across the industry. And remember in recent weeks we have IBM, plus Microsoft and Amazon getting into the field.

I think you'll see them all higher to start the new week (barring some further macro fiasco that screws everything up); with QBTS 'not' seeing much profit taking yet; more short-covering; while RGTI and QUBT advance somewhat. I also ponder what announcements 'they' or NVDA might make; increasing the odds of volatility or a total evisceration of short-sellers, depending on news.

Quantum 'is' the hot area of the moment; everything else is just rebounding. I of course would like to be more careful and not greedy; but who knew Jensen would unfairly trash the entire sector (and wrongly so) when he did. So here a slightly similar situation 'could' exist, but different outcome; perhaps because Nvidia is moving in that direction itself, doesn't want to hamper its Blackwell sales or that of Rubin (not a doctor pal, but the name of their next processor), apparently has some rumors of unfolding partnerships with one of the plays.

Bottom-line: crazy times. POTUS trying to smooth matters with Ukraine as he talks with Putin; Courts sending some fired Federal workers back to work; the Senate passing forward the Continuing Resolution to avert shutdown; as well as a Fed Meeting coming, during which they could cut rates if desired. It is no secret that the 'refunding' later this year is immense and lower rates will enable the Treasury to better handle matters; which is probably what much of the 'Budget' cutting is all about. So will Powell help out? Data would permit it.

On top of all this we'll hear more about 'tech funding' possibly related to AI infrastructure as well (although as a 'lower-energy' Quantum optimist, I'm not focused on data-centers, as that's like building beasts to serve the beasts.. it may also be part of why Nvidia was so arrogantly attacking Quantum, given incredible contracts to 'power' those centers.. I think META was 600 million to give an example).

So to be clear; it's not clear if you or I will be inclined to be proactive and sell any spikes higher next week; but might. It depends; and for me (as of now) I don't plan to until hearing a couple speeches or presentations; and will then assess it. There might even be a spot to 'write' Calls or sell part of a winning position, but that's still pending. Having brought Quantum tickers all the way back up normally means the prior high was not 'the' high..

Think about it, we were and are holding all the way since last Fall and always profitable, but presume there are investors that chased the frenzy a couple months back into Nvidia's attack (we argued against chasing). So there are the higher price holders getting bailed-out. That's rare unless a stock's going higher.. those investors may be happy to 'get even and get out' but that's often not how one should play that; because nobody brought 'price' back up for any other investor. Hence they envision significantly higher results, presumably.

Pretty wild week ahead; hopefully evolves higher (Friday was the strongest of the year by the way; so glad we spotted this prospect on Thursday).. but may be roiled by geopolitics, domestic politics, the Fed, Quantum announcements, or who knows the celebration of SpaceX rescuing the marooned astronauts. If Elon and co-President Trump permit; this could be an interesting week ahead.

More By This Author:

Market Briefing For Monday, March 10

Market Briefing For Monday, March 3

Market Briefing For Monday, Feb. 24