Market Briefing For Monday, March 10

A 'Detox Period' from Government spending is what Secretary Bessent spoke to. That actually helped the market's tone, as did Chairman Powell's talk at a New York Conference. And after requisite margin-call liquidation pressures on a lot of stocks, prices stabilized and we got a bit of an afternoon recovery.

Skepticism is reasonable about 'prices' in the wake of 're-shoring'; and what's likely to make the difference here will be 'if' Canada & Mexico are 'allowed' to revert to compliance with USMCA, and leave it at that. Global diversification, from China particularly, is actually underway, and I still suspect that the focus on the Panama Canal relates to firmly reestablishing 'our' sphere of influence, which might mean hedging possibilities of surrendering Taiwan (longer run).

The 'automation' story is what the key to re-shoring is going to be; if there's a real belief that would lower prices. On the surface re-shoring would not, with of course higher labor costs. But with AI and automatics, perhaps ... if companies do not exploit their newfound domestic growth by maintaining higher prices.

Technology is at the heart of this; and Semiconductors will come back where they are 'American made'. In this regard if you listened to Jensen (Nvidia) as he talked about the need for 100x more computing power ... he inadvertently took that discussion to Quantum Computing, which D-Wave says is here; Rigetti says is years off (still in R&D, per the CEO; yet RGTI shares rallied).

As we 'detox' and sober from the circus of the past two weeks, keep in mind two Quantum conferences are coming this month: D-Wave 'and' Nvidia Day. By the way, Commerce Secy. Howard Lutnick is a fine guy; but totally off when he said 'Apple would be making iPhones in the U.S., not China', with their huge commitment to new American factories. That's not correct; as the new factories will be making 'Servers'; which Apple already does in Austin. It is correct that Apple is moving 'some' iPhone production out of China; but to India, and some to Vietnam. No iPhones are planned for U.S. production yet.

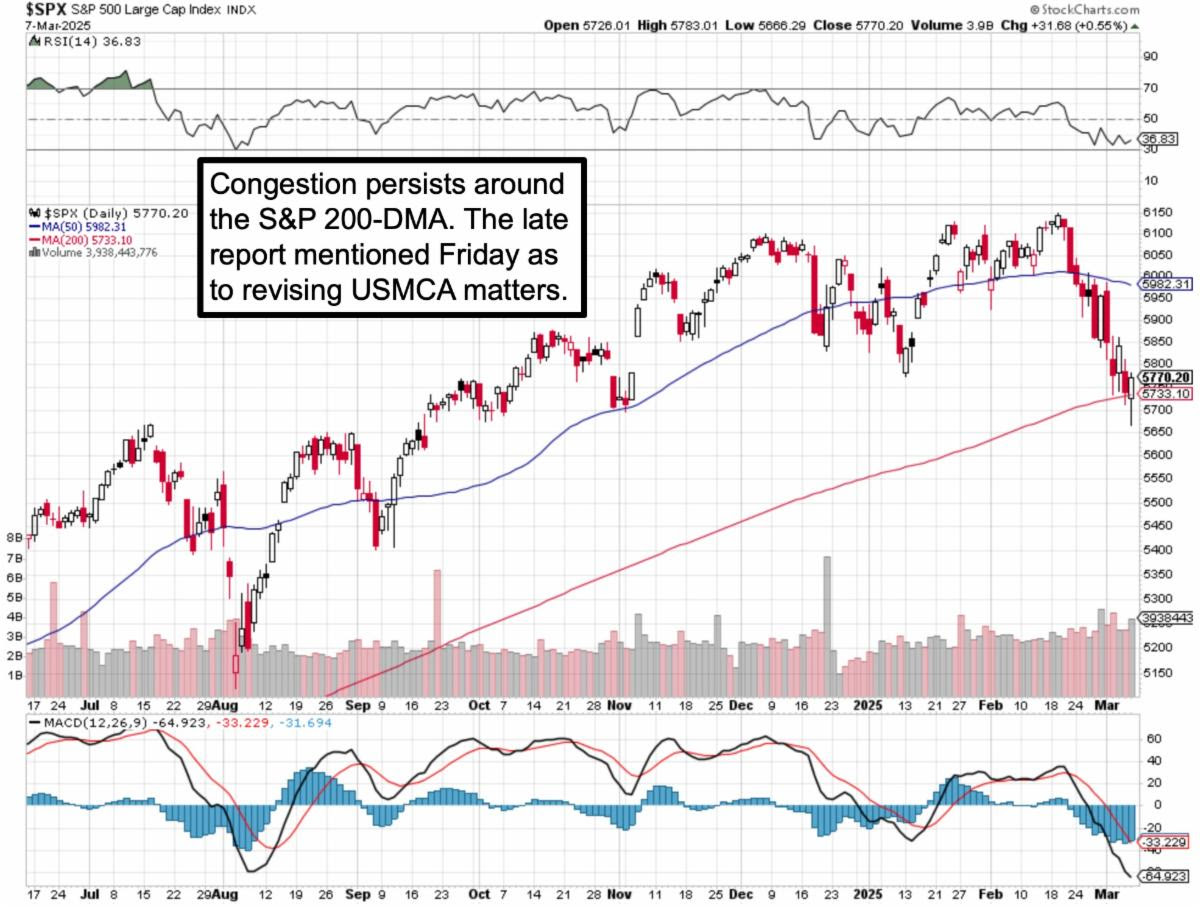

Situational awareness: clearly lots of issues juggling, without confidence as to how they will settle out. However for the moment, other than an early dip to see if intraweek traders have enough going, we ought to see some rally try; especially if the late report about Canada - U.S. renegotiating is verified; and/or even better should Mexico join- n to work for a trilateral 'area of agreement'.

Also; part of the entire Market being in flux is partially because it appears that the 'powers that be', are actively trying to devalue the US dollar. China does this frequently; because it improves prices for exports and tougher on imports. When they do that, they also harm industry in Canada & Mexico; not just U.S.

For now, I'll just share a few posts I added to 'X' chatter Friday; which more or less positions the market for where it is.

Weaker jobs report raises further concerns about an economic softening; sends rates lower. Nonfarm payrolls increased by 151,000 jobs in February, less than the consensus forecast for 170,000 from economists polled by Dow Jones. The unemployment rate ticked higher to 4.1%.

Bottom-line: maybe we have seen just enough carnage for now, and we get a rebound. If we get peace (the Saudi Conference may hint at progress next week); or even some tariff relief, perhaps markets can muddle thru without the need for an even more significant S&P decline; or at least not as yet. I think next week will be key. The circus continues; but there may be an intermission.

More By This Author:

Market Briefing For Monday, March 3

Market Briefing For Monday, Feb. 24

Market Briefing For Tuesday, Feb. 18