Uncertainty Dominates The Decision Making At The Bank Of Canada

Image Source: Pexels

When in doubt, often, the best strategy is to standstill and do nothing. That seems to be the approach taken by the Bank of Canada today when it announced no change to its overnight lending rate of 2.75%. Faced with an unprecedented shift in US trade policy, featuring on-again- off again tariffs, the Bank had no viable option other than to hold its breath and maintain its current policy stance. As it clearly stated in its press release that:

“Pervasive uncertainty makes it unusually challenging to project GDP growth and inflation in Canada and globally.” Yet, the Bank must deliberate under some assumptions that will shape future economic performance.

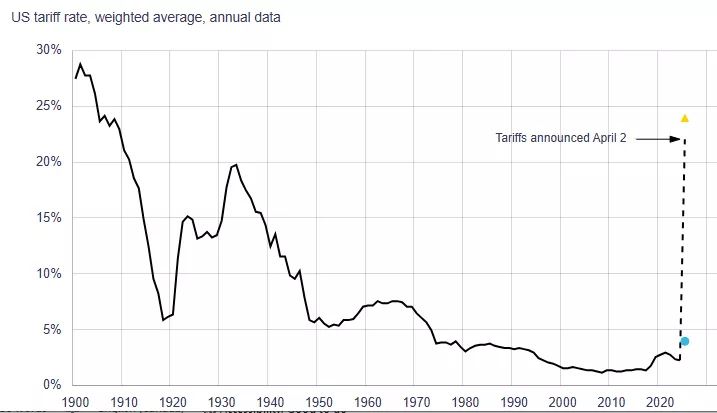

US Tariffs Highest in a Century

Thus, in its April Monetary Report the Bank considers two possible outcomes flowing from US trade developments. One possible outcome takes place within a regime of high tariffs, but much more limited in scale and scope than currently in place. Canadian economic growth weakens, temporarily, as business and consumers adjust to a higher price level. Also, inflation remains around the 2% target, allowing the Bank to maintain a steady hand on interest rates.The second possibility is the feared sustained trade war, resulting in a sharp recession and accelerating inflation above 3% next year.What makes matters harder for the Bank is that other scenarios, falling between these two footstools, are legitimately plausible. As the Bank acknowledges, “there is also an unusual degree of uncertainty about the economic outcomes within any scenario, since the magnitude and speed of the shift in US trade policy are unprecedented”.

Already, Canada is experiencing a slowdown. Consumer and business confidence declined in first quarter of the year. Specific sectors, such as auto manufacturing, now features layoffs and more are expected. Employment fell in March and wage demands are moderating, both reflecting the impact of uncertainty throughout the country. Not unexpectedly, we are witnessing weakness in the U.S., amidst confusion on why exactly is Trump putting up a high tariff wall. Canada cannot disentangle itself overnight from existing bilateral trade patterns and will be harmed by a weaken U.S. economy.

What does a central bank do in such an uncertain environment? The balancing act is: to support growth, jobs, and business investment while ensuring that inflation does not get out of hand.But that is the task before a central bank. The Bank of Canada appears to come down in favour of supporting growth more than taming inflation. This is consistent with the prospects of U.S. trade policy creating a serious worldwide recession that threatens itself and every one of its trading partners.

More By This Author:

Trump’s Assault On The Canada-US Bilateral Trade Continues In Full SwingWhat Lies Behind The Israeli Economic Recovery, Post October 7

The U.S. Economy Weakens