Trump’s Assault On The Canada-US Bilateral Trade Continues In Full Swing

Image Source: Unsplash

While the world has been spared horrendous US tariffs, specifically designed and calculated for individual countries, Canada still remains burdened with a number of specific tariffs that now promise to push the economy into recession. The US slapped a 25% tariff on Canadian steel, aluminum and products; a 34% tariff on Canadian lumber; a punishing 25% tariff on the non-US content of Canadian/Mexican vehicles; and promised to levy additional tariffs on copper and pharma products made in Canada. What baffles Canadians is the US has made no specific claims of any trade unfairness, rather a loosely concocted claim about the Canadian border is too porous, allowing huge inflows of fentanyl and illegal migrants into the US. Tariffs are to punish Canada .

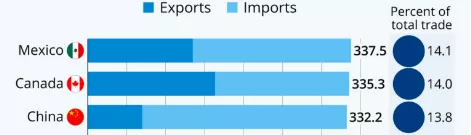

Canada shares top billing with Mexico and China as the U.S. most important trading partners. As an open economy, Canada has no choice but to bear the brunt of the US tariff onslaught with a commensurable set of counter tariffs. Canada says it has started imposing a 25% tariff on certain vehicle imports from the US, retaliating against a similar measure from its neighbour.

Trade Flows in US$

The 90-day pause does nothing to remove uncertainty and the world trading community continues to, once again, wonder what follows the pause. While in this state of limbo, the Canadian economy is already showing signs of weakness. Specifically,

- Up to 12,000 workers in the Canadian automotive parts industry are off the job; more are expected to be laid off as plants in the U.S. begin to shut down; the fear a cascading effect of plant after plant shutting down;

- The labour market lost 33,000 jobs in March and the unemployment rate hit 6.7%;

- The annualized rate of inflation jumped to 2.6% in February, up from 1.9% in January, highest in eight months; the Canadian tariffs on imports from the U.S. are expected to hit the consumer later this month;

- Canadians have witnessed a drop in their equity portfolios and savings of 12% since the April 2 announcement of universal tariffs has hit equity markets worldwide;

- Canada 10 yr long bond has moved up from 2.8% to 3.3 % over the last month, as interest rates moved up in anticipation of the inflationary pressures about to be unleased by US tariffs:

- Prime Minister Carney is already talking about the need to set additional budgetary provisions to take care of those thrown out of work by this trade war.

Next week the Bank of Canada is scheduled to meet at its monthly policy review. While the betting is for no change in the current policy rate of 2.75%, observers are expecting the rate to drop in June and later in the fall as the full brunt of the tariffs result in a drop in national income and a further rise in unemployment.

More By This Author:

What Lies Behind The Israeli Economic Recovery, Post October 7The U.S. Economy Weakens

The Bank Of Canada Can Only Choose One Issue To Manage: Inflation Or Recession