The U.S. Economy Weakens

Image Source: Pexels

The US Economy Weakens as the So-called “Day of Liberation” Approaches

President Trump is fond of slogans in characterizing his policy measures, none greater than when it comes to his tariff policy. So, it comes as no surprise that April 2 is dubbed “Liberation Day” whereby his Administration will impose reciprocal dollar-for-dollar tariffs on nations that levy duties on US goods. Trump makes it sound as is the world conspires against the U.S. by leveling steep tariffs on US exports. Far from the truth, the trade-weighted averaged tariff rate across all products worldwide is about 4% and has been for several decades. Put simply, the world, including the U.S. has greatly benefited from decades of trade negotiations that have resulted in such low tariffs. Nonetheless, the Trump Administration feels aggrieved to the point of initiating a trade war that we all fear could get so out of hand as it did in the 1930s that resulted in the Great Depression.

Putting up trade barriers at a time when the US economy is entering a cyclical drop in economic performance has become the number one topic of discussion throughout the investment community. The evidence of a deepening economic malaise comes from key corners of the US economy.

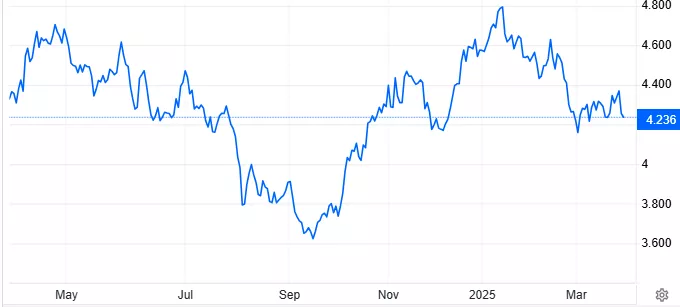

The S&P is headed for its largest quarterly loss in three years, as investors anticipate the possible combination of inflation and slow or negative economic growth:

Source: WSJ

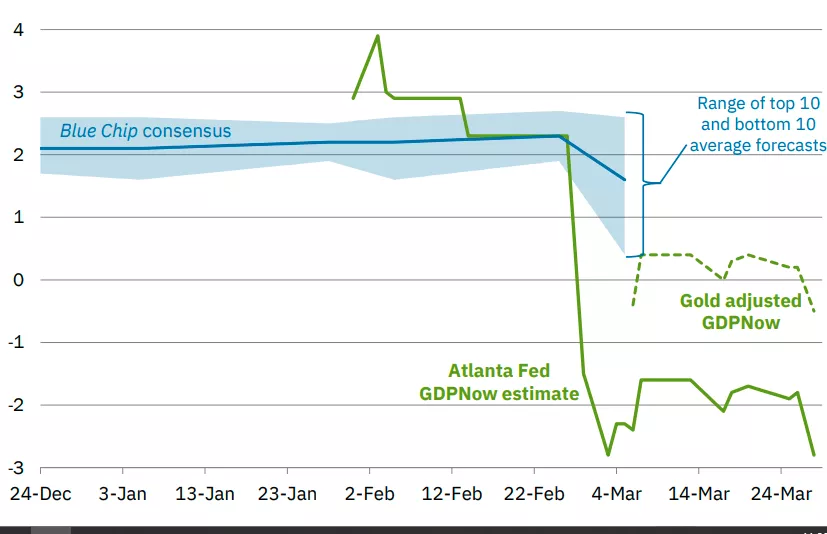

Real GDP growth estimates for 2025: Q1 have plunged. A decline in housing starts, manufacturing, car sales, and retail trade have soured the outlook. Consumer sentimenthit a 12-year low as the fear of tariffs rip through the economy.

Source: WSJ

Ten-year US Treasury yield has climbed as much as 115 bp from its September 2024 low, wiping out all of gains in the previous 6 months. The recent drop in the long end yields is reflective of widespread concerns that a recession is not too far off.

The Fed will be dealing with the worst of both worlds. Tariff-induced inflation and tariff-induced decline in national output. This puts that institution clearly on the sidelines, since it has only one instrument----interest rates---- to deal with two different economic challenges. There is a realization now that Trump will not relent on the use of tariffs, perhapsuntil such times as the economy weakens much further, at which time a shift in policy may not be able to ward offstagnation.

More By This Author:

The Bank Of Canada Can Only Choose One Issue To Manage: Inflation Or RecessionAmericans Are Waking Up To The Consequences Of U.S. Tariffs Aimed At Canada

One By One Trump Walks Back Tariffs Aimed At Canada