Tuesday Talk: Swingtime In December

"Swing high, swing low, Swing to and fro...And if you think you can't swing high, swing low", so goes the 1937 Ink Spots hit of the same name, and certainly an apt way, to describe current market action.

Image: Internet Archive

Talk about a Monday bounce, we sure experienced one yesterday. The S&P 500 closed at 4,592, up 53 points or 1.2%, the Dow closed at 35,227, up 647 points or 1.9%, and the Nasdaq Composite closed at 15,225, up 140 points or 0.93%.

Looking at Monday's top gainers it is clear that at least from the market's point of view, Omicron jitters have subsided for now; all the outperformers were travel and entertainment related issues as you can see from the chart below:

Chart: The New York Times

Currently futures are bright green, S&P futures are trading up 59 points, Dow futures are up 352 points and Nasdaq 100 futures are trading up 277 points.

In a TalkMarkets exclusive contributor Vivian Lewis poses a question that would seem to be the last thing anyone wants to hear right now, Recession In 2022?

"The Dow Jones was up nicely but Nasdaq was barely ahead. Mohammed El Erian, the Harvard economist, warns that the real risk is not inflation but a recession in 2022. Russia is surrounding Ukraine with 70,000 soldiers so there is a real war risk with the USA and the West. Despite this, the Dow is up sharply. China has cut its reserve requirement for lending by 50% giving a $188 bn boost to its market. The reason appears to be Evergrande (EGRNF) being unable to raise more money."

There, that's said now.

See the rest of Lewis' article for a look at what's going on with some stocks in the Drug, Energy, Finance and Telecom sectors that you might not ordinarily follow.

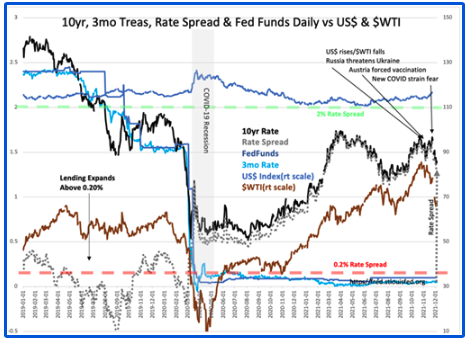

In an article that is part educational and part current events contributor Davidson argues that the use of simple algorithms in short-term trading tends to cloud over the long term trend for the US economy, which he sees as robust. Here is some of what the author has to say in Rate Spread Update:

"...short-term price shifts have become increasingly dominated by algorithmic trading strategies based on past historical correlations. It is problematic to base short-term trading on past price signals when prices represent different fundamentals than those on which the algorithms have incorporated. Prices do reflect fundamentals over the long-term simply because economic reality eventually is the basis of market psychology...interpreting a sudden short-term shift in pricing as reflecting a shift in the long-term economic trend has economic impact."

"Routinely, companies operating under Chinese, Russian and other confiscatory regimes are compared on the same financial metrics to Western-based corporations as if there is equivalency. No equivalency exists! Algorithms are programed as if the globe operates under US protections for private property.

Some of the programming rules algorithms have been following:

- Falling 10yr rates signal economic weakness, rising 10yr rates signal economic expansion

- Falling oil prices signal economic weakness, rising oil prices correlated with exiting COVID lockdowns/economic demand and expansion

- Rising technology issue prices are correlated with COVID lockdowns

- Stronger US$ has been correlated to weaker oil prices and weaker economic activity"

"Lower 10yr rates has been a key driver of belief in economic activity is weakening...This is contrary to the pooling of global capital seeking safe haven in Western countries with better protections to private property as China, Russia, Turkey and now even Austria and Australia turn increasingly autocratic."

"This capital shift drives 10yr (SPTL) rates lower which improves liquidity for US-based companies even as it lowers the T-Bill/10yr Treasury rate spread. Net/net, liquidity dominates all issues even high inflation. Markets have a history of mispricing events and inflation. History also reveals markets have worked through every issue if enough liquidity is present...the flood of capital, entering the US in particular, seeking safety from rising threats to property rights is apparent."

"Last week’s Household Survey report indicated 1,136,000 added to the ranks of those employed...Individuals entering the economy require basic services and goods. Multiple indicators support increased demand and economic expansion. This period of volatility while unsettling is a buying opportunity in my estimation."

Taking a further look at employment figures is just what TalkMarkets contributor Jill Mislinski does in Full-Time And Part-Time Employment: A Deeper Look.

"Let's take a closer look at the latest employment report numbers on Full and Part-Time Employment...The focus is on total hours worked regardless of whether the hours are from a single or multiple jobs. The Labor Department has been collecting this since 1968, a time when only 13.5% of US employees were part-timers. That number peaked at 20.1% in January 2010. The latest data point, over ten years later, is lower at 16.7% last month...(Charting the data) we see a conspicuous crossover during the Great Recession. Since early 2016, the two cohorts have slowly drifted apart, with full-time employment gaining. Interestingly, this trend has continued, even during the COVID-19 global pandemic and recession. As of November 2021, Full-time employment made up 83.3% of all employment.

Mislinski includes several cuts of the same data over different time periods but the chart below shows the trend from 1986 to November 2021.

"Even though some employees shifted to Part-time from Full-time as a result of the pandemic, it was only about 3% of those working Part-time. Full-time employment peaked in April 2020 due to the COVID-19 pandemic, possibly as a result of a shift in the type of full-time work available. The trend after the Great Recession (Dec '07-Jun '09) has continued despite the pandemic and the two types of work seem to be growing farther apart."

"The Bureau of Labor Statistics' monthly employment report is a hodgepodge of data. The full-time/part-time ratio is but a tiny piece of the whole, and the magic 35-hour threshold is arguably arbitrary. But this is, nevertheless, a metric that bears close watching as we try to understand where the economy is headed. The question is whether the ratio shift is to some extent a structural change initially triggered by the Great Recession but now influenced by a combination of factors, not least of which are workplace demographics and ongoing increases in technology-driven productivity with less dependence on human workforce participation."

This is an interesting (and easy to comprehend) article and bears reading in full.

Bitcoin (BITCOMP) and other cryptocurrencies have also, been in "swing high, swing low" orbit as of late. In 2021 crypto has also been touted as a successor to sovereign currencies. To close out today's column we look at both sides of that coin, so to speak.

TM contributor Frank Holmes says that Bitcoin Could Fix Turkey’s Currency Crisis. Really?

"It’s December 2021, and the Turkish lira is near an all-time low against the U.S. dollar as President Recep Erdogan continues to implement what the Wall Street Journal calls “unconventional economic policies.” Turkish households saw the value of the national currency plunge nearly 30% last month alone, making everything from food to fuel significantly more expensive for already-struggling families...Like many others, I believe Bitcoin could fix Turkey’s lira problem."

"Bitcoin has been a fabulous store of value compared to traditional currencies such as the Turkish lira and even the dollar, whose purchasing power has steadily deteriorated since the Federal Reserve’s founding in 1913. In the past 40 years alone, the greenback has lost two-thirds of its value as Fed governors have pursued increasingly more unorthodox monetary schemes."

"Despite a crypto ban, many Turks have reportedly turned to Bitcoin, not to mention gold, as the lira continues to sink due to Erdogan’s insistence on lowering interest rates to combat out-of-control inflation. Yes, central banks ordinarily hike rates to control higher prices, not lower them, but Erdogan allegedly does not want to risk economic momentum for economic stability."

"The country’s finance minister, Lutfi Elvan, resigned in protest last week, and Erdogan immediately replaced him with a loyalist. This tells me the president won’t be abandoning his easy money scheme anytime soon, which is bad for consumer prices but good for Bitcoin’s use case."

Really? Read the full article for further details including references from Friedrich Hayek's seminal work, Denationalization of Money.

On the other hand contributors on the Staff at Bespoke Investment Group lead with this headline: El Salvador Hurt By Bitcoin.

"On June 5, 2021 El Salvador passed a bill that made Bitcoin legal tender in the nation effective September 17, 2021. Since passing the bill, the country hosted a Bitcoin Week, which generated excitement from the crypto community in which the President and political/industry leaders spoke about the logistics and benefits of legalizing Bitcoin as a currency."

"Since the country officially announced that Bitcoin would become legal tender, its bonds have declined in value. As one example, the price of the country’s 7.65% bonds maturing in June 2035 has plummeted by 37.5%. Investors are wary of the idea of tying a country’s assets and currency to an extremely volatile asset, and that has caused the yield on the bond shown below to rise nearly 90% from under 8% to over 14% now."

"The country’s currency has also lost substantial value in relation to the dollar. In order to swap the country’s currency (Salvadoran Colon) for one US Dollar, individuals now need more than double the number of they did versus before Bitcoin officially became a legal currency in the nation."

Caveat Emptor, all around!

That's a wrap for today.

Here's a YouTube link to the Ink Spots singing "Swing High, Swing Low".

Have a good week. I'll see you on Thursday.

Good stuff.

Thanks, Mike