Rate Spread Update

“Davidson” submits:

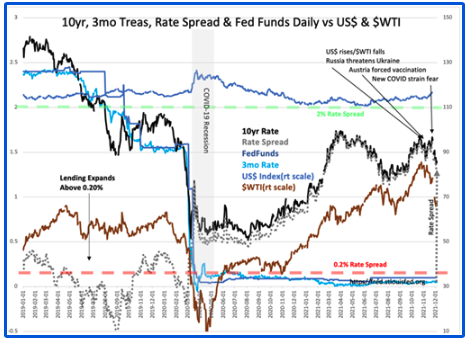

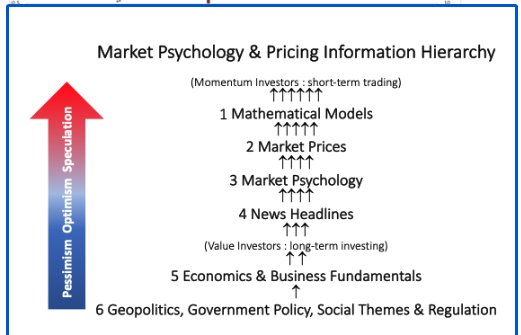

Algorithms dominate short-term trading and use as inputs WTI (oil prices), interest rates, and the exchange rate of the US$ vs global currencies. While long-term shifts reflect economic trends and longer-term investor perception, short-term price shifts have become increasingly dominated by algorithmic trading strategies based on past historical correlations. It is problematic to base short-term trading on past price signals when prices represent different fundamentals than those on which the algorithms have incorporated.

Prices do reflect fundamentals over the long-term simply because economic reality eventually is the basis of market psychology. However, interpreting a sudden short-term shift in pricing as reflecting a shift in the long-term economic trend has economic impact. The other issue arises when one recognizes that the basis for algorithmic trading is Modern Portfolio Theory, 1952, a purely mathematical approach purposely disconnected from fundamentals. It is based on the belief that prices are all-inclusive of every factor public and private, The Efficient Market Hypothesis. Multiple Nobel Prizes were awarded to the originators. While this approach does dominate markets short-term, it is incapable of assessing fundamentals of changes in or differences in self-governance regimes and cultural investing preferences. Specifically, countries differ in protections to private property. Neither Modern Portfolio Theory or the Efficient Market Hypothesis has the capability for recognizing the risk of autocratic governance to investment assets. Routinely, companies operating under Chinese, Russian and other confiscatory regimes are compared on the same financial metrics to Western-based corporations as if there is equivalency. No equivalency exists! Algorithms are programed as if the globe operates under US protections for private property.

Some of the programming rules algorithms have been following:

- Falling 10yr rates signal economic weakness, rising 10yr rates signal economic expansion

- Falling oil prices signal economic weakness, rising oil prices correlated with exiting COVID lockdowns/economic demand and expansion

- Rising technology issue prices are correlated with COVID lockdowns

- Stronger US$ has been correlated to weaker oil prices and weaker economic activity

Lower 10yr rates has been a key driver of belief in economic activity is weakening. Oil has plummeted in part due to this but the US$ strength contributes to weakness in oil prices. This is contrary to the pooling of global capital seeking safe haven in Western countries with better protections to private property as China, Russia, Turkey and now even Austria and Australia turn increasingly autocratic. This capital shift drives 10yr rates lower which improves liquidity for US-based companies even as it lowers the T-Bill/10yr Treasury rate spread. Net/net, liquidity dominates all issues even high inflation. Markets have a history of mispricing events and inflation. History also reveals markets have worked through every issue if enough liquidity is present. When one focuses on fundamentals, the flood of capital, entering the US in particular, seeking safety from rising threats to property rights is apparent.

Last week’s Household Survey report indicated 1,136,000 added to the ranks of those employed. It surprising that every analyst has focused on the 210,000 reported add by the Establishment Survey with little acknowledgment of this report which has been more reliable in my opinion over many years.

Individuals entering the economy require basic services and goods. Multiple indicators support increased demand and economic expansion. This period of volatility while unsettling is a buying opportunity in my estimation.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more