Canadian Exchange Rate, Interest Rates And U.S. Tariffs All Wrapped In One

Image source: Pixabay

Today’s announcement that the Bank of Canada (BoC) lowered its overnight rate to 3% from 3.25% signals that officials are concerned with a lingering weakness at home, requiring further monetary stimulus. Starting in April last year, the BoC has cut its rate six times from 5% to today’s rate of 3%. The Bank clearly is concerned with a sluggish economy and has chosen to offer more stimulus. However, these rate cuts have barely resulted in an improved economic performance. Business investment remains weak and is the single biggest disappointment given the interest rate drop of 200bps . Domestic inflation is well contained as the cost of shelter eases and surveys point to a lowering of inflationary expectations. The BoC has the inflation issue, for the time being, under control and can safely allow lower rates to revive business investment.

In its press statement today, the BoC suggested that:

“The cumulative reduction in the policy rate since last June is substantial. Lower interest rates are boosting household spending and, in the outlook published today, the economy is expected to strengthen gradually and inflation to stay close to target. However, if broad-based and significant tariffs were imposed, the resilience of Canada’s economy would be tested.”

So, we come to the elephant in the room----- US tariffs. The BoC wisely notes that “the scope and duration of a possible trade conflict are impossible to predict”. Instead, it just provides a baseline scenario, more like a primer on how a tariff war impacts an economy. ( For those interested in a full discussion should turn to impact scenarios offered in the Bank’s Monetary Report, January, 2025).

However, the Canadian economy has already reacted to the threaten tariffs for several months.

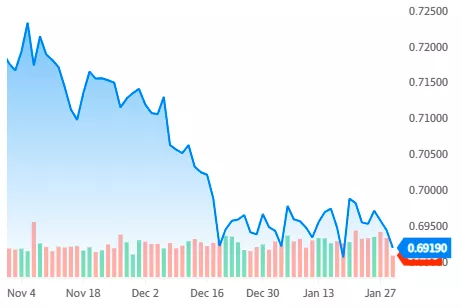

To begin with, the Canadian dollar has depreciated 6% since the US election. Traders anticipate a fall off in Canadian exports, followed by a declining income in Canada. Canadian retaliatory tariffs will increase import costs and hence reduce incomes further. On the whole, Canada’s trade balance worsens and the currency will then drop further. Traders in the field are looking at the Canadian dollar hitting a low of US $ 0.63 cents, testing historic lows.

Dramatic Fall in the Cdn Dollar

The exchange rate is also coming under pressure from the divergence in US and Canadian monetary policies.

The Federal Reserve seems in no hurry to lower its funds rate, rather it is sending out warnings that inflationary expectations are not yet in its comfort zone. The Fed is greatly concerned with excessive government deficits, the need for higher bond yields to soak up ever greater issuances, and the undeniable inflationary impact of a wide range of US tariffs. Traders now do not expect any meaningful rate cuts in 2025.

Meanwhile, Canadian bond traders are experiencing a much lower rate environment than their American counterparts. Such that, the US 2-yr note is now 140 bps higher. Money flowing out of Canada to take advantage of this added return also puts downward pressure on the exchange rate. It is estimated that roughly 100bps differential between Canadian and US interest rates translates into 1% depreciation in the Canadian dollar.

At his press conference today, Governor Tiff Macklem, made it abundantly clear that:

“A long-lasting and broad-based trade conflict would badly hurt economic activity in Canada....The magnitude and timing of the impacts on output and inflation will depend importantly on how businesses and households in the United States and Canada adjust to higher import prices.”

More to the point, the Governor acknowledges that the BoC cannot do a lot to counter the harm to the economy from a trade war.There will be downward pressures on incomes from reduced exports and at the same time upward inflationary pressure from higher import prices from a weaken Cdn dollar.

The BoChas only a single policy tool---- the bank rate. It can use the bank rate to stimulate growth or to control inflation. It can’t do both at the same time.

More By This Author:

World Trade is Doing Just Fine Without The U.S.

Trump Has Painted Himself Into A Corner When It Comes To Tariffs On Canadian Oil Imports

Bonds Never Attract Interest Until It Is Too Late To Take Notice