Bonds Never Attract Interest Until It Is Too Late To Take Notice

Image Source: Pixabay

Bond investors love to remain in the background, but when the bond yields are on an upward march they are suddenly put under the microscope. We need an explanation for the global rise in yields since mid-September. The bond sell-off is nevertheless both intriguing and important as the US moves into a new Administration. The recent surge in yields is one of the most important developments facing government finances in all industrialized countries, especially in the US.

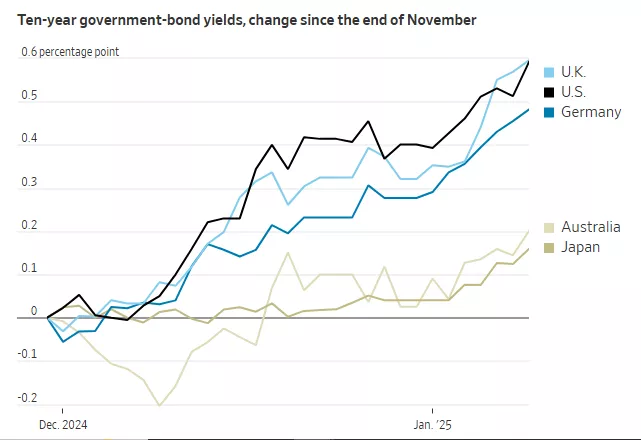

Graphically, the surge in long term interests is unmistakable since the American election. Something is happening in the minds of investors that has spread throughout the investment community.

While the central banks control the very short-term interest rates the more important rates reside in the longer-term segment of the yield curve, conventionally measured as the 10-year Treasury market or in the UK, as gilts. Yields on government debt are largely determined by investors’ expectations for inflation and growth over the long haul. Corporate and real estate borrowings derive their cost of money from what is offered in long-dated government debt market.

The shape of yield curve can complicate the efforts of a central bank to, say, stimulate borrowing and economic growth. A rising yield curve just signals that borrowing money for long-term commercial uses just becomes more expensive. Wall Street investors have taken note of the tightening borrowing conditions hitting its customers. For example, mortgage rates in the US just hit 7% last week, many consider to be an important level of deterrence facing the home buyer.

The US has the highest interest rates in the developed world. Nevertheless, the UK, Germany, Japan and others are experiencing higher rates in lock step, even though those countries have poorer economic performance. Some argue that the US economy is robust enough to withstand higher interest rates and the recent surge should be judged in that light. But it is doubtful that Europe can tolerate higher long-term rates as readily.

However, many bond investors take a much less sanguine view of the surge in US rates. It is no secret that the US federal deficit ratio is at very high levels (6.5% of GDP). The Trump administration promises of tax cuts and increased selective spending reinforces the view that additional will only make matters worse. Simply, the more debt issued, the likelihood that rates will be higher in order to satisfy investors that they are amply rewarded for locking funds up for a decade. As it stands, interest costs on the US federal government will reach 13% spending this year.

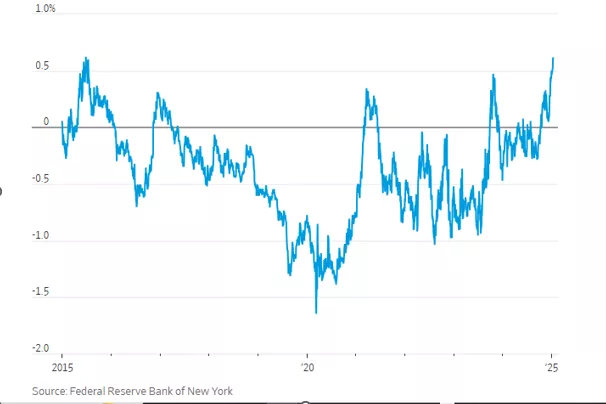

Another rather elusive measure used in the bond market is the “term premium”. That is, the premium required to account for all other risks associated with holding a bond for the long term. Currently, the term premium implied in the yield is at its highest in a decade.

Term Premium on 10- year bond

It is not possible at this stage of the interest rate cycle to determine whether the rise in long term rates will negatively impact on the stock market. We know, though, it is playing an important role in the rise of the US dollar, as the interest rate differential between the US and its trading partners has resulted in the US dollar index rising. Nonetheless, rising interest rates and a rising dollar are not what stock market investors want to hear.

More By This Author:

China’s Weapons In The Coming China-U.S. Trade War

Pity The Canadian Dollar As It Gets Hit From All Sides

A Finance Minster’s Resignation And A Fiscal Update Put Canadian Politics Into A Turmoil