A Finance Minster’s Resignation And A Fiscal Update Put Canadian Politics Into A Turmoil

Photo by Michelle Spollen on Unsplash

It is not often that Canadians witness high drama just prior to the release of an update on the Federal government Fall Economic Statement (FES). Yet that is what precisely happened on Monday when Finance Minster Freeland submitted her resignation just hours prior to the release of the FES. Calls went out for the resignation of Prime Minister Justin Trudeau from all political quarters including his own party caucus. For those familiar with Canadian politics, this comes as no surprise since the PM and his Liberal Party about 20 points behind the Conservative party in every national poll. Ottawa and the nation have been riveted on the issue of whether he will resign and call an election before this government’s term expires in October, 2025.

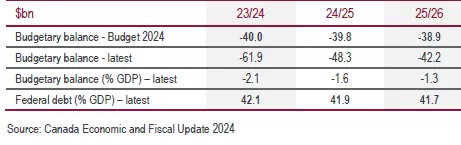

Politics aside, the FESrevealed that the government has blown passed its forecasted budget deficit ofC$40 billion by an additional C$21 billion. Naturally, a government this unpopular could expect nothing less than a full court press by the opposition and the media, labelling the government as being “out of control”.Before we make any pronouncements of that score, lets look at where and how the budget went awry.

The political storm struck with the release of the single most blatant item, the 2023/24 projected deficit. It rose to C$61.9bn rather than the C $40.0bn expected at budget time last year. Almost all of this additional change was due to higher, one-time, contingent labilities. Included are the government provisions for future payments related to Indigenous lands claims and losses related to compensation to those who lost income due to the pandemic. While payments will only be made as and when a claim in settled, the money set aside adds to the deficit projection. Absent these claims the revised 2023/24 deficit would have been $40.8bn - not greatly different from the previous $40.0bn projection.

The increase in the 2024/25 deficit ---- (C$ 48.3bn vs. C$39bn) is attributed toseveral different sources. Initially, Finance officials expected economic growth to be around 2%, but now foresee a much weaker economic performance, lowering tax receipts and increases in unemployment insurance payouts. Additional spending result from higher border security costs in response to US pressure on that front. The government just passed new measures to give temporary GST (sales tax) relief over the Xmas retail season.

Lost amidst the political crisis is the fact that the overall budgetary conditions are far from out of control. The deficit as a percentage of GDP is 2.1% and expected to drop to 1.6% in the coming budgetary year. This figure continues to be the lowest amongst the G-7 nations. By comparison, the US Federal deficit is 6% of GDP. Similarly, the Federal debt remains at 42% of GDP, again a very low number compared to our trade competitors. Lastly, the interest costs on Federal borrowings are an average of3.3%.

Meanwhile, the FES remains at the centre of a political crisis that continues to grab headlines and will continue to be misused to score political points.

More By This Author:

Interest Rates Tumble As Growth Prospects Sour

Trump’s Bark Is Worse Than His Bite When It Comes To Canada-U.S. Trade

The Trump Tariffs And The Canadian Economy: A Different Perspective