The Trump Tariffs And The Canadian Economy: A Different Perspective

Image Source: Pixabay

Donald Trump’s return to the White House raises concerns that his protectionist stance would likely have a significant impact on Canada-US bilateral trade. More than 75% of Canadian exports go to the U.S. The total bilateral trade market reached $900 billion in 2022. Some 26 US states claim that Canada is their largest export market and represents an important feature of their local economies. On the campaign trail, Trump promised to introduce a 20% tariff on all US imports, as part of a larger initiative to reduce US trade deficits and protect domestic industries.

Lost in much of the political rhetoric is a clear understanding of the nature of the bilateral trade and hence how much of an impact we can expect should the campaign promises turn into adopted policy. Stepping back for a moment, the two countries have a highly developed supply chain in energy, agriculture, and industrial activities which will blunt much of the US’s protectionism. The overall effect will be greatly minimized, once we separate out the major exports and their relation to the US economy.

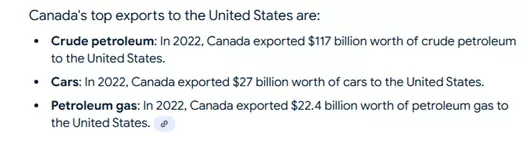

Energy. Canadian oil accounts for 30% of all Canadian exports headed south of the border and is the single largest export category, far and away. The energy products are highly woven into the US energy pipeline system. Canadian crude now represents 23% of US refinery intake. It has become an integral part of the US industrial and domestic energy use. The US cannot replace Canadian energy imports unless it imports from another country. Above all else, Canadian energy producers are not competing with any US domestic production, so the need for tariffs becomes moot.

Automotive Trade. Canada exported $27 billion worth of cars and trucks to the US. Since 1965, Canada and the US have enjoyed the free flow of parts and vehicles made in each country. The North American Free Trade Agreement, USMCA, stipulates that any car or truck is exempt from tariffs if 75% of its components are manufactured in North America. Moreover, parts cross the border more than once in this highly integrated manufacturing business. Almost 20% of the intermediary inputs used in the industry are currently sourced from the US. Thus, a tariff on a final product produced in Canada would, in effect, tax US exports to Canada. Any application of a tariff would be nearly impossible to sort out with this kind of cross-border movement. With parts and assembly in both countries, the issue of tariffs becomes, again, moot. During the US election campaign, Trump threatened to re-open the USMCA, once again. Yet, the re-negotiated deal that we have in place now, is just a minor adjustment from the original NAFTA deal, indicating that there really is not much wiggle room for the Americans to change this sector without doing harm to itself.

Other industries. Aside from energy and automobiles, the other sectors of interest are forestry, machinery, metal ores, and chemicals. These industries have much-reduced exposure to the US market and only will have some localized impacts from a tariff, while the impact on the overall bilateral trade will be minor.

Summing up, Canada is not anywhere as vulnerable to Trump’s proposed tariffs as many would like to believe. Any swift, steep increase in tariffs would hit the supply chains so vital to the US, especially in the energy and automotive products. It would be readily apparent that US businesses and households would suffer from US tariffs.

More By This Author:

Once Again, The Bank Of Canada Is Too Slow To ReactIsrael’s Economy During a Time of War

Once Again, The Americans Plead With China To Curb Its Exports, To No Avail