RISR: A Unique Bond ETF With Interest Rate Protection

Image Source: Pixabay

I recently added the FolioBeyond Alternative Income and Interest Rate Hedge ETF (RISR) to the Fixed Income Investments category of the Dividend Hunter portfolio. I think the ETF’s name says it all, notes Tim Plaehn, editor of The Dividend Hunter.

A traditional bond fund owns a portfolio that matches the fund’s stated investment characteristics. These can include types of bonds, such as Treasuries or corporate bonds, and a targeted maturity range. Most bond funds (BulletShares are an exception) constantly buy and sell bonds to maintain the targeted maturity range. The funds do not hold bonds until maturity.

The returns of bond ETFs are more driven by changes in interest rates than by dividend yields. When interest rates go down, bond prices increase, and a bond ETF will post positive total returns. When interest rates go up, bond prices and bond ETF share prices fall — and they can drop dramatically.

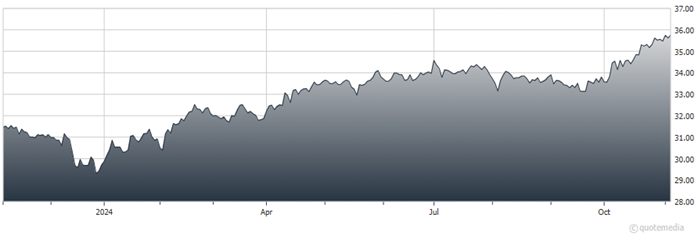

FolioBeyond Alternative Income and Interest Rate Hedge ETF (RISR) Chart

A duration metric tells us how much a bond fund’s share price will change with changing interest rates. It gives the percentage change in a fund’s value for a one-percentage point change in rates. So, a bond ETF with a duration of 10 years will lose 10% of its value with a one-percentage point increase in interest rates.

The RISR portfolio consists of agency mortgage-backed, interest-only (MBS IOs) securities, and Treasuries. MBS IO securities make up 98% of the portfolio and are what distinguish RISR from traditional bond ETFs.

MBS IOs have a negative duration. That means if interest rates go up, the value of these securities will increase. They are a strong hedge against rising rates in fixed-income investments. MBS IO securities have a positive carry of 6% to 9% per year, providing cash for the RISR dividends.

Bottom line? RISR is a likely hedge against higher interest rates. I can envision several scenarios in which rates at the long end of the yield curve move higher, possibly much higher. The most likely scenario is that investors could decide to stop funding the US government debt load unless they’re paid more.

My recommended action would be to consider buying the RISR ETF.

About the Author

Tim Plaehn is the lead research analyst for income and dividend investing at Investors Alley, a subsidiary of Magnifi Communities. He is the editor of The Dividend Hunter, Weekly Income Accelerator, and Monthly Dividend Multiplier. Mr. Plaehn was formerly in the US Air Force serving as an F-16 fighter pilot and instructor. Several times a year he offers live training courses on income investing, covered call trading, and portfolio management.

More By This Author:

SPY: What Now After The Big Post-Election Rally?Cisco: A (Relatively) Cheap Way To Profit From AI, Chip Sector Growth

Market Remains Resilient, Despite Domestic And International Risks

MoneyShow Editor’s Note: Tim Plaehn is speaking at the 2025 MoneyShow Las Vegas, which runs Feb. 17-19. more