Cisco: A (Relatively) Cheap Way To Profit From AI, Chip Sector Growth

Photo by Steve Johnson on Unsplash

I recently explained why Coherent Corp. (COHR) is one of my favorite semiconductor stocks thanks to its exposure to optical transceivers. But today, I want to talk about Cisco Systems Inc. (CSCO), notes George Gilder, editor of Gilder’s Technology Report.

Coherent’s highest-margin products, high-speed optical transceivers (400 Gbps/ 800 Gbps, and soon 1.6 Tbps), are used to move data across hyperscale data centers. That’s a rapidly growing market, thanks to the data demands of AI.

According to the Information Network, the market for 800 Gbps transceivers, which was $2 billion in 2023, will hit $3 billion this year, $4 billion next year, and $5.2 billion in 2026. The market for all high-end transceivers — 800G, 1.6T, and 3.2T (expected in 2026), is expected to grow at a CAGR of more than 25% through 2028.

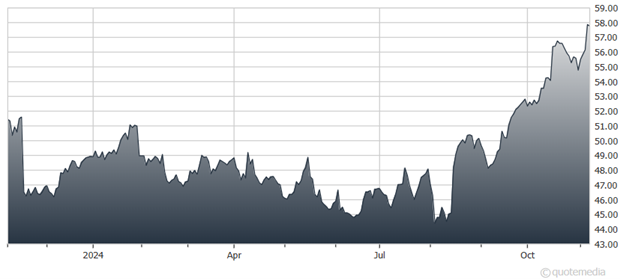

Cisco Systems Inc. (CSCO) Chart

But as well as Coherent Corp. is doing in optical transceivers, it is not the market leader. That honor is shared by Cisco (30%), Arista Networks Inc. (ANET), at 25%, and Broadcom Inc. (AVGO) at 20%. Broadcom is expensive, while Arista makes Broadcom look like a bargain.

For Cisco, however, familiarity, not to mention boredom and flattish revenues, have long bred the market's contempt. That venerable company now holds a price/sales ratio less than one fourth of Broadcom’s and closer to one fifth of Arista’s.

But the market has just begun to notice that Cisco Systems is another AI play, giving the stock some momentum. Operating margins are healthy, though well short of Arista’s. Data movement is the core of AI.

My recommended action would be to consider buying shares of Cisco Systems.

About the Author

George Gilder is a high-tech venture capitalist and the author of more than 20 books. He has spoken at the MoneyShow since 1981. Mr. Gilder accurately tipped off President Reagan to the rise of the microchip. He also predicted the iPhone 13 years before its release and forecast the rise of Netflix—more than a decade before it existed.

Forbes calls Mr. Gilder a technology "prophet." He now leads his research team to publish several products with Eagle Financial Publications, including Gilder's Technology Report, Gilder's Technology Report PRO, Moonshots, and Private Reserve.

More By This Author:

Market Remains Resilient, Despite Domestic And International RisksHere's The Skinny On The October Jobs Report

Stocks: What's Next After Last Week's "Strategic Withdrawal?"

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more