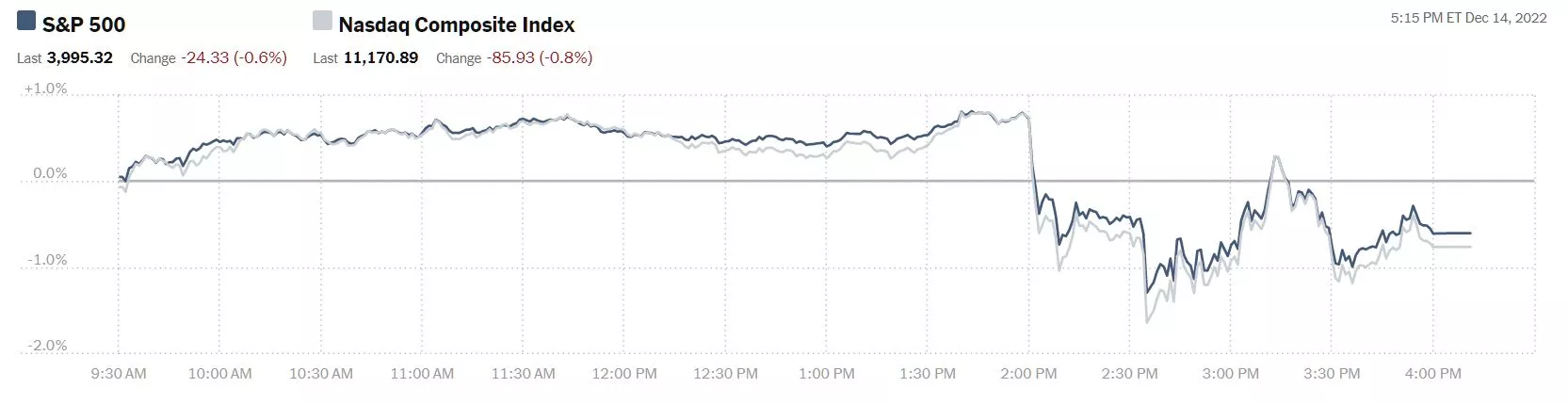

Slower but higher was the message from The Fed yesterday as it raised interest rates by 50 bps, as anticipated. The market moved slightly lower on the news, today may bring more.

The S&P 500 closed at 3,995, down 24 points, the Dow closed at 33,966, down 142 points and the Nasdaq Composite closed at 11,171, down 86 points.

Chart: The New York Times

Top gainer for Wednesday was Moderna (MRNA), up 5.8% on news of a breakthrough vaccine for melanoma.

Chart: The New York Times

In early morning futures action S&P 500 market futures are down 43 points, Dow market futures are down 269 points and Nasdaq 100 market futures are down 154 points.

The Staff at contributor Bespoke Investment Group observes that Another Fed Day Ends In The Red.

" With the S&P 500 finishing the day down 0.61%, today marked the third decline on a Fed day in a row. That is the longest streak of consecutive declines on Fed days since the three meetings ending July of last year. Looking at the price action of the S&P over the past three meetings, today basically stuck to the script. Whereas the index traded higher throughout most of the session leading up to the release of the policy decision, it plummeted when the statement hit the tape. That drop brought the index into the red on the day in a similar way to the September meeting. Declines kept on coming until shortly after Powell took the podium. From there, the S&P 500 rebounded, even pivoting back into the green briefly around the time of the conclusion of the press conference. While it did not go on to end the day at the lows of the day like the past couple of meetings, Powell’s presser that pumped stocks back into the green was not long-lasting as the S&P dipped back into the red in the final hour of trading."

TalkMarkets contributor Mish Shedlock says The Fed Projects Interest Rates Higher For Longer At Least Through 2023.

"Please consider the FOMC Press Release from December 14.

Recent indicators point to modest growth in spending and production. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures.

Russia’s war against Ukraine is causing tremendous human and economic hardship. The war and related events are contributing to upward pressure on inflation and are weighing on global economic activity. The Committee is highly attentive to inflation risks.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 4-1/4 to 4-1/2 percent. The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time. In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in the Plans for Reducing the Size of the Federal Reserve’s Balance Sheet that were issued in May. The Committee is strongly committed to returning inflation to its 2 percent objective.

Hawkish Dot Plot

The FOMC statement was expected.

The Dot Plot of interest rate projections from the FOMC Projections Materials (below) was unexpected in light of a seemingly weak CPI report for November.

2023 Projections, Change From September 2022

- Real GDP 2023: 0.5%, down from 1.2%

- Unemployment Rate: 4.6%, up from 4.4%

- PCE Inflation: 3.1%, up from 2.8%

- PCE Core Inflation: 3.5%, up from 3.1%

The Fed is predicting higher inflation, higher unemployment, lower GDP, and more rate hikes than the September 2022 meeting.

No Recession?

The Fed never predicts recession. It skirts the issue through this statement:

"Projections of change in real gross domestic product (GDP) and projections for both measures of inflation are percent changes from the fourth quarter of the previous year to the fourth quarter of the year indicated."

By comparing the fourth quarter to the fourth quarter of the previous year, the Fed can ignore mild recessions in the first three quarters of the year.

Range Key Points

- The projected GDP range for 2023 is -0.5 to 1.0 percent, down from -0.3 to 1.9 percent.

- The projected interest rate range for 2023 is 4.9 to 5.6%, up from 3.9 to 4.9 percent in September.

Across the board this is a decidedly weaker economic forecast and a much more hawkish interest rate forecast."

See Mish's full article for more detailed Fed projections.

How much better was the November CPI? Contributor Jill Mislinski breaks it down in her article, November Inflation: The Components.

"We can make some inferences (from the table below) about how inflation is impacting our personal expenses depending on our relative exposure to the individual components. Some of us have higher transportation costs, others medical costs, etc.

A conspicuous feature in the year-over-year table is the volatility in energy, significantly a result of gasoline prices, which is also reflected in Transportation.

Here is the same table with month-over-month numbers (not seasonally adjusted).

We are now seeing the highest Headline inflation rates since the second of the two recessions in the early 1980s. Headline inflation was at today's rates or higher between 1978-1982.

For a longer-term perspective, here is a column-style breakdown of the inflation categories showing the change since 2000."

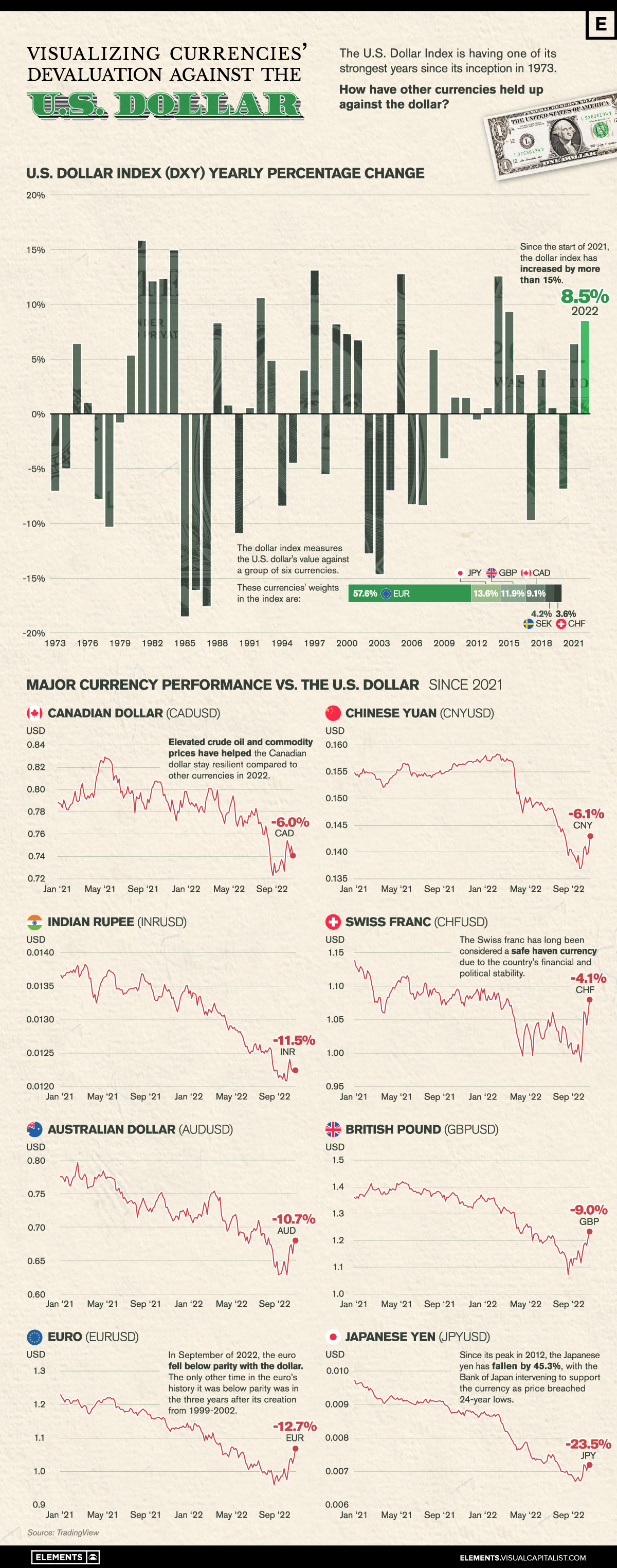

Contributor Niccolo Conte with the help of graphics shows us what Visualizing Currencies’ Decline Against The U.S. Dollar looks like.

"In a highly volatile and difficult year for many currencies and equities, the U.S. dollar has been a safe haven for investors.

The greenback has provided exceptional stability, with almost every currency around the world declining against the U.S. dollar in 2022.

This graphic visualizes almost 50 years of the Dollar Index’s returns along with the decline of major currencies against the U.S. dollar in the past two years."

"One of the currencies hit hardest is the euro, which briefly fell below parity (meaning the euro was worth less than one U.S. dollar) in September and October of 2022, before recovering with a 5.3% rally in November. However, the Japanese yen was the major currency hit hardest, having fallen more than 25% since the start of 2021. At the yen’s lowest point this year in October, the currency breached 24-year lows, resulting in the Bank of Japan intervening with $42.8 billion to support the country’s falling currency.

The Swiss franc and Canadian dollar have been the most resilient major currencies against the U.S. dollar since 2021, largely due to the financial and political stability of those nations. Along with this, Canada has benefitted from surging crude oil prices in 2022, exporting the majority of its crude oil across its southern border to America."

"In September of 2022, the Dollar Index was up 20% on the year reaching a high of 114.8 but has since retreated and given back more than half its gains for this year so far.

Investors around the world will be watching closely to see if the U.S. dollar’s rise will continue, or if this end-of-year reversal will carry through and provide major currencies some relief going into 2023."

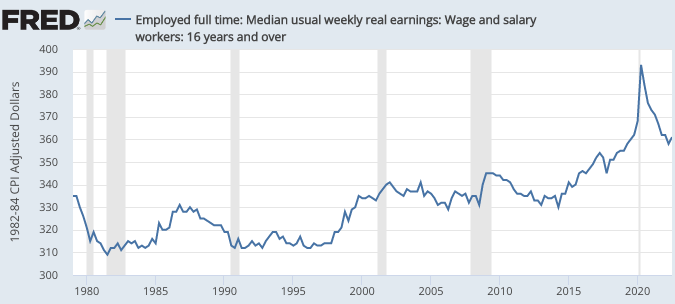

Obviously was of the major impacts of inflation on families is spending power, which prompts TalkMarkets contributor and economist Scott Sumner to ask, Can You Raise A Family On One Income?

"Yes.

Let’s start with some data:

A few comments:

1. This deflates median wages by the CPI. Most economists believe the PCE is more accurate, and it would show much more rapid real wage gains.

2. This excludes fringe benefits, which have improved much faster than money wages.

3. On average, families are smaller, hence there are fewer children to raise.

4. If I had used average wages, the increase would have been even greater, as top-end incomes have risen faster than median wages.

To summarize, this is a conservative estimate of the gains in real wages. So why the perception that it now takes two incomes for the lifestyle that one income once supported? I see many factors:

1. In a few places such as Silicon Valley that claim is clearly true, at least for workers with median incomes. Influential pundits often live in places where house prices have risen much faster than average.

2. We now have higher expectations. Suppose you are a median worker that wished to reproduce a 1960s lifestyle. How do you do this? You’d move into a 1200-square-foot ranch house with one bath in a working-class immigrant neighborhood. To get a car as unreliable as a 1960s car, you must buy a cheap 15-year-old car. To get a TV as bad as a 1960s TV, you find one that someone left out at the curb. You give up your cell phone. No vacations by jet, it’s a drive down to Disneyland. You get the idea...

Pundits seem surprised that people now believe it takes two incomes to support a family, whereas one income would have been adequate in the 1960s. In retrospect, however, this was inevitable once America’s married women decided to enter the labor force in large numbers. It would have occurred even if real wages had increased 10 times faster...

If you don’t believe me, you might want to study more extreme cases, such as China and South Korea, where real wages did increase at least 10 times faster. If you speak with people from those countries, you’ll often hear claims that the birth rate has fallen to very low levels because it is too costly to raise children today. In one sense, that’s obviously nonsense. Back in the early 1960s, South Korea was as poor as sub-Saharan Africa, and (like Niger today) Korean women had roughly 6 children on average. Today, South Koreans are vastly richer, even adjusting for the rising cost of living, and they have 0.8 children."

As if we were not already backed up in the food for thought department.

That's a wrap for today.

As the war in Ukraine grinds on please remember to lend support where you can.

Artwork by Rosanna Schmitt

More By This Author:

TalkMarkets Image Library

Thoughts For Thursday: Slower But Higher

Tuesday Talk: Cool Your Heels