Tuesday Talk: Cool Your Heels

After an up close last week, the stock market took a moment to cool its heels, ending the day lower and reminding investors that volatility has not gone on vacation.

On Monday the S&P 500 closed at 3,999, down 73 points, the Dow closed at 33,947, down 483 points and the Nasdaq Composite closed at 11,240, down 222 points. Most actives led by Tesla (TSLA) were all in the red.

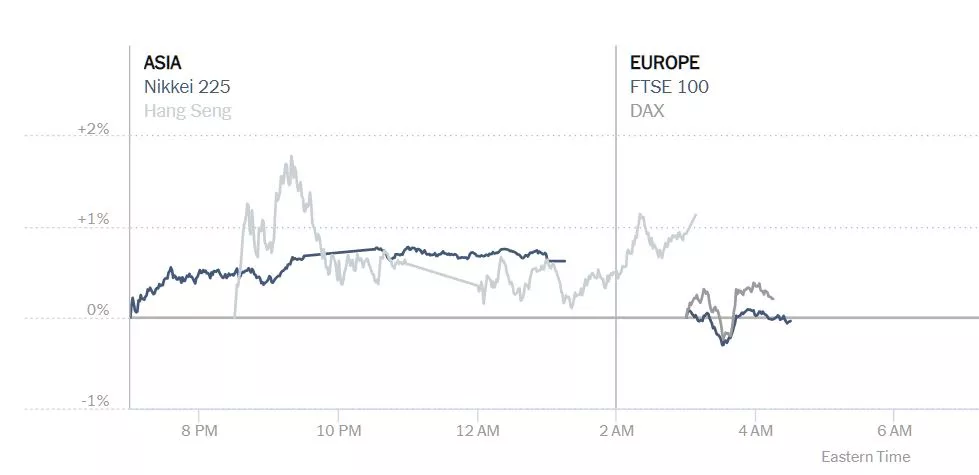

Chart: The New York Times

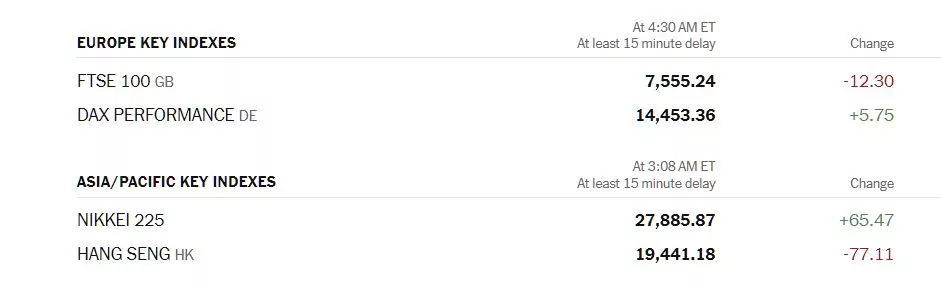

Asian markets were mixed at the end of trading; European markets have opened mixed, as well.

Charts: The New York Times

In early morning futures trading, S&P 500 market futures are down 2 points, Dow market futures are down 25 points and Nasdaq 100 futures are up 2 points.

TalkMarkets contributor Declan Fallon remarking on yesterday's market actions writes, A Weak Start To The Week, But This Is Not Important.

"We don't want to dwell too much on today's action, although at the same time, we don't want the selling to get away from us. Sellers were able to push markets lower on light volume.

The Nasdaq drifted back to support but was able to hold the prior support level (at least, support before the 'black' candlestick appeared). There was a 'sell' trigger in On-Balance-Volume but there is a large degree of whipsaw in this indicator since the swing low in November. There is a modest uptick in relative outperformance against the S&P which may help the index build out from its November bottom, but this nascent trend needs to continue."

"The Dow Industrials Average returned below its breakout level (defined by the August High) but only has a weak 'sell' sell signal in the MACD to consider. Today's selling ranked as dsitribution but if the index can shape a 'handle' it will offer a solid bullish setup for 2023."

Though Fallon reports a smidgen of concern for the Russell 2000 (IWM) in his article, he is pretty much green as a Christmas tree.

Contributor James Stanley weighs in with a S&P 500 Technical Analysis: Trendline Resistance, 4k Support Test.

"The S&P 500 set its current yearly low on October 13th. This was just after a CPI print was released above expectations and initially, this created a swell of weakness as the S&P 500 tipped down to the 3500 level...

But, a bounce developed as US equities came online for the day and price hasn’t been below 3590 since. Similar to the bounce that was seen in June, intermediate-term trends have been bullish in the midst of a longer-term bearish backdrop. Cumulatively, 2022 price action has been one big falling wedge in the S&P 500.

On the above chart, you’ll probably notice that there’s two falling wedges. The first is marked with the same support trendline but matched with a dashed resistance trendline, taken from August and September swing highs. That resistance held the highs through October and early-November, finally giving way on another CPI print that was released on November 10th. That breakout led to a higher-high which was then matched with a higher-low, and that was followed by bullish continuation into last week’s high.

The intermediate-term trend here remains bullish as we’ve had a progression of higher-highs and lows. And there’s longer-term bullish reversal potential, as illustrated by the falling wedge formation...The big question is whether bulls can evoke a deeper reversal of the bearish move that was so prominent in the first nine months of this year."

See the full article for additional charts and technical analysis of the S&P 500.

Bob Lang offers some tips on How To Trade Wild Market Movements.

"How are you supposed to trade wild market movements, which seem to be happening frequently? Just last week, we had a day (Monday) when no news came out but stocks were bludgeoned. Perhaps traders were bracing for potentially negative remarks from Fed Chair Jerome Powell and the November jobs report. In any case, there was no bid and we saw a retreat back towards 4K. This was a shock to the recently minted bulls, who continue to look for more upside."

"Then we move to Friday. The jobs report for November was strong on all fronts: job creation, wage growth and tightness in the labor market. These are all characteristics the Fed would like to see slow down, hence the markets immediately dropped some 1.5%. But as we are in a seasonally strong period for stocks, investors and traders are looking for the silver lining, so markets rallied nicely off this report. Good news eventually delivered good results...

How to trade wild market movements

Pay attention to volatility...look at the market conditions. It seems most people are out talking about recession in 2023, yet the market continues to rally. It’s up nicely in November. Is the market ignoring the signs? Possibly, but when money is flowing into stocks strongly as it is now, you don’t fight the momentum."

Okay, but be careful, market elves can be wily characters.

Elsewhere in the "Recession Looming" department, TM contributor Tyler Durden reports PepsiCo To Lay Off Hundreds After Price-Hikes As Consumer 'Strength' Questioned.

"Up until now, the majority of layoffs have been focused in technology firms and banks, as talking heads proclaim 'the consumer is still strong'.

However, tonight's news that no lesser staple than PepsiCo (PEP) is to announce a major belt-tightening suggests the pain is spreading much more broadly across the US economy."

"This decision comes just a few weeks after the company announced it had raised prices on its snacks and drinks by 17% on average from last year.

“The consumer has very much stuck with our products,” said Hugh Johnston, PepsiCo’s finance chief, in an interview.

“In a world where there are many struggles and stresses, we are kind of an affordable luxury.”

...

“There may be a point when the revenue growth slows down,” Mr. Johnston said. He added: “We just have to be prepared for it.”

Do the layoffs mean that the consumer is cutting back further? Or have margins been crushed even more by inflation?"

In the "Where to Invest Department" contributor Bill Smead is all in on Oil by way of a somewhat obtuse analogy in his article Dallas Buyers Club.

"In one of his best movies, Matthew McConaughey plays a blue-collar guy who is quite the ladies’ man. His wide array of sexual partners quickly moved from being a badge of pride to a ticket to the scariest sexually transmitted disease of all, HIV/AIDS. A frantic quest took him to Mexico to find a medicine that was proving beneficial in slowing the progression of the disease.

Once he brought the medicine back to the U.S., he found out that you couldn’t sell the medicine to a large community of gay men with HIV/AIDS, because it had never been approved by the FDA. In response, a club was formed with membership dues to receive the medicine via membership in the Dallas Buyers Club.

In 2022, oil prices shot all the way up to $120 per barrel as war raged in Ukraine and massive underinvestment in energy sources around the world came home to roost. Oil prices were a part of the economic disease called inflation. Even though the effect on the U.S. economy of higher oil prices has become muted in the last 20 years, it became politically expedient for President Biden to sell 200 million barrels of oil out of the Federal Government’s Strategic Petroleum Reserve...

Numerous major oil companies took one look at refining oil without pulling it out of their reserves and formed their own Dallas Buyers Club.

As we look out into 2023, there are many things we don’t know and a few things we think we know. We know that U.S. oil production averages around 16 million barrels per day. We know that oil and gas companies have been dissuaded from increasing oil and gas drilling as fossil fuels are treated like a pollution disease. We know that President Biden’s reserve release represented about 6.5% of U.S. oil production for about 200 days in 2022. Lastly, we know that the Strategic Petroleum Reserve must be refilled in the event that the U.S. is lured into a war somewhere around the world...

History would argue that we have years of higher oil and gas prices ahead of us, especially if the Communist Chinese release their population from its COVID-19 imprisonment and start competing on the world economic stage. Therefore, we are making every effort to over-weight our oil and gas stocks despite their stock market success in 2021 and 2022."

See the full article for additional particulars and comments.

As always, Caveat Emptor.

Till Thursday, have a good one.

More By This Author:

TalkMarkets Image Library

Thoughts For Thursday: Lift Me Higher

Tuesday Talk: Kryptonite and Cannabis