Tuesday Talk: Kryptonite And Cannabis

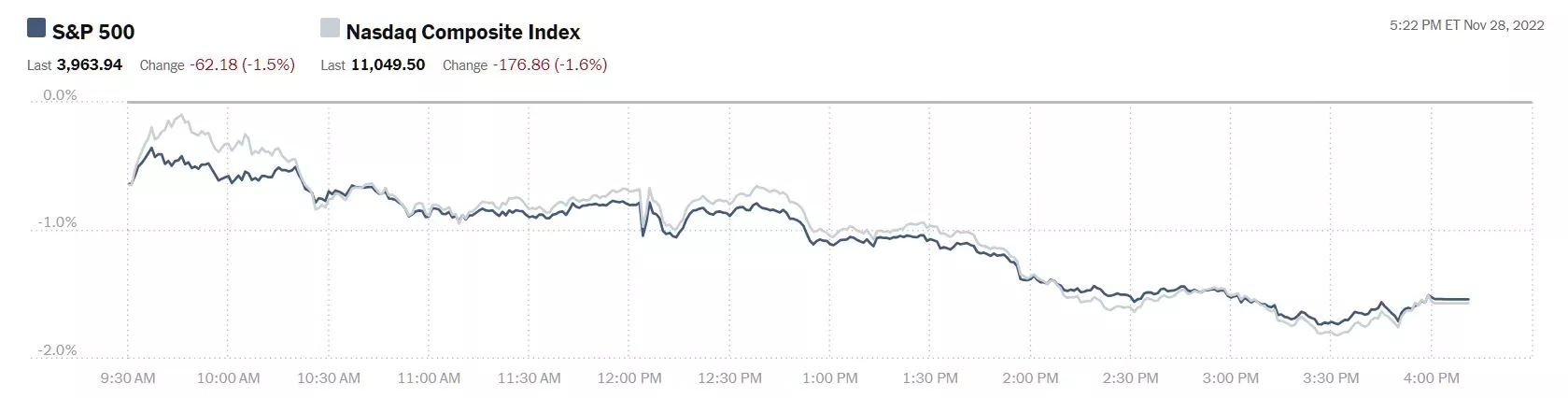

Stocks tobogganed lower on Monday as investors returned from the Thanksgiving holiday to lockdown protests in China and an uncertain holiday season retail outlook.

At the end of trading on Monday, the S&P 500 was down 62 points, closing at 3,964, the Dow Jones Industrial Average closed at 33,849, down 498 points and the Nasdaq Composite was down 177 points, closing at 11,049.

Chart: The New York Times

Tesla (TSLA) which continues to lead the most actives closed at $182.92, up $0.06. In the no. 2 spot was Amazon (AMZN) up $0.54, closing at $93.95, followed by Apple (AAPL), down $3.84, closing at $144.22.

Chart: The New York Times

In early morning trading S&P 500 market futures are up 10 points, Dow market futures are up 33 points and Nasdaq 100 market futures are up 51 points.

TM contributor Michael Kramer writes, Stocks Drop On November 28 As The Market Prepare For Powell.

"I think a reversal in the market was pretty much due. It was evident from the rise in the VVIX and SKEW index last week that something was changing in the market, and given the hawkish Fed minutes and now Jay Powell coming up on Wednesday, traders are starting to think about their tail risk again. Also, a pretty hard reversal today in the dollar index.

Higher implied volatility and a stronger dollar point towards tightening financial conditions, and I hate to say, but as I have been saying, that is what the Fed wants. So it could be that the market is anticipating a hawkish Powell...

Part of the rally in the dollar today had to do with the events in China, its zero COVID policies, and the protest. The dollar did gain notably today against the Chinese yuan. I would think that without a reopening policy in China, the yuan continues to weaken versus the dollar and should help support the DXY to some degree...

What is also notable today is that Dow fell sharply too, and the Dow has been a monster leading the market higher. It broke a pretty significant trend line today and has a big gap to fill down to around 32,500."

See Kramer's article for a look at the charts of IBM, CAT. Take note of his comments on Zoom below:

"Zoom (ZM) made a new closing low, which is very important. As I have observed, when Zoom makes a new low, the broader Nasdaq 100 is not far behind. So we will need to watch this one closely. If it starts to break down materially and drops below $70, it could be a significant warning sign for what’s to come next for the entire market."

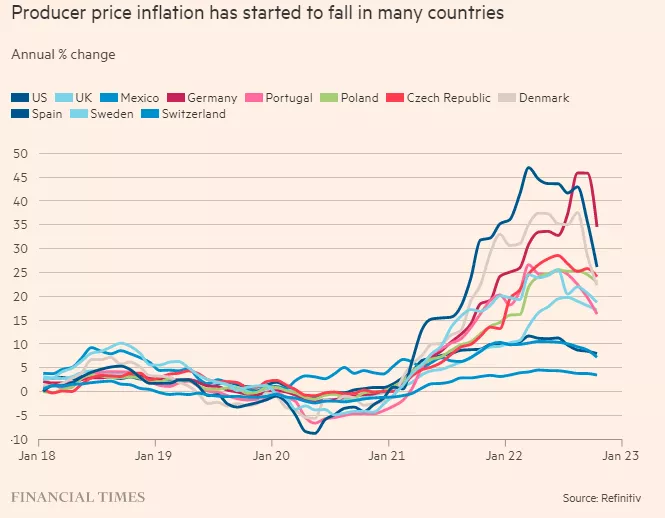

In an exclusive for TalkMarkets contributor Norman Mogil writes that Central Bankers Have Yet To Recognize That Inflation Is Past Its Peak.

"Central bankers often look through the rear-view mirror as they continue to raise rates. Chairman Powell argues that the Fed must continue on its mission to tame inflation by means of tightening credit conditions through higher rates and a reduction of its balance sheet (quantitative tightening). The Bank of Canada Governor Mackem argues that the Bank is not finished in its quest for higher rates since, in his view, core inflation remains elevated. The inflation dragon has not yet been slayed.

However, the evidence is building that inflation has peaked and is heading south. For example, prices at the factory gate in Germany fell by 5% last month compared to the previous month; US and UK producer prices are similarly on the decline. A combination of weakening aggregate demand and lower input prices for both materials and shipping services are bringing costs down everywhere."

"Manufacturing costs are softening, commodity prices are off the highs, and more importantly, inflationary expectations are returning to their historical rates. The case for continued rate increases can no longer be argued on the grounds that more work needs to be done."

In an Editor's Choice column, contributor Charles Hugh Smith says The Uncertainty In China Is Kryptonite To Global Markets.

"One thing we know rather definitively is that markets don't like uncertainty: uncertainty is Kryptonite to markets. Another thing we know is that the events unfolding in China are generating uncertainty on multiple levels. Whatever policy decisions are made, the potential consequences generate waves of profound uncertainty. Should authorities respond to exploding COVID caseloads with heavy-handed lockdowns, that will trigger production and shipping consequences for global trade. If restrictions are relaxed, the healthcare consequences are also uncertain, as China lacks the facilities such as ICU beds in sufficient quantities to deal with a contagious virus spreading in a populace with very little immunity."

"There are no positives for global markets in any of these developments, as each potential outcome has difficult-to-predict and control second order effects. COVID lockdowns have the potential to topple various supply-chain dominoes, and by weakening economic activity, they also have the potential to topple dominoes in the populace's understanding of the social contract between citizens and the state.

Everyone who waits around because they dismissed uncertainties as "nothing" gets their head handed to them on a platter.

Few seem alive to the potentially consequential financial risks arising from uncertainties evolving in China. Those who complacently discount risk may regret it, as one of the few things we know is markets don't like uncertainty for a very good reason: uncertainty generates asymmetric risks that have the potential to deliver life-changing losses to the unwary and over-confident."

Moving over to the "Where To Invest Department", TalkMarkets contributor Sean Hall reports Cannabis Stocks Surge As Congress Eyes Reform.

"Promising developments on Capitol Hill have cannabis stocks surging after a tough year and might be just the encouragement beleaguered investors need to regain confidence in the fledgling cannabis industry. While federal legalization remains elusive, there are signs that some major reforms are on the way – and that could be a big deal for legal cannabis businesses."

"Senate Majority Leader Chuck Schumer (D-NY) announced that bipartisan efforts to enhance the Secure And Fair Enforcement (SAFE) Banking Act are underway and that he expects to soon introduce a bill with the votes to pass it through Congress. The SAFE Banking Act is designed to codify protections for financial institutions that bank and lend to state-legal cannabis businesses, and Schumer said the enhanced version of the bill would also include measures like automatic expungement for people convicted on cannabis charges...

Major cannabis businesses including Canopy Growth (CGC), Tilray (TLRY), and Aurora Cannabis (ACB) saw significant spikes to their stock value immediately following the news that Schumer plans to introduce SAFE Plus and believes Congress has the votes needed to pass it...The gains seemed to be reflected across the whole industry as well. The New Cannabis Ventures Global Cannabis Index saw an immediate increase of more than 5%, a rare positive trend since it began a long, slow decline after peaking in February 2021. Similarly, the American Operators Index, which measures the collective performance of plant-touching cannabis companies, saw an increase of more than 8%."

In the Tech investment sphere the Staff at contributor ValueWalk asks the question, Is Snowflake Poised For A Rebound After Its Recent Tumble?

"Snowflake's (SNOW) stock had been riding high in both 2020 and 2021, perhaps most widely known as one of the most expensive stocks in the software industry over the past two years. While sitting at the top is always a great place to be, it also means there is more room to fall if things start to go awry.

Obviously, things have been out of sorts for the data analytics firm as their stock has fallen more than -57% this year, so far...

Sales have been increasing both annually and quarterly since the IPO in 2020...Specifically, sales have nearly doubled between 2020 and 2021, increasing from $592.0 million to $1.2 billion. Sales have easily followed similar growth on a quarterly basis.

Earnings reflect something similar as well, though the numbers are still in the red. In addition, while earnings have consistently beat the estimate, they have been following a less-than-stable pattern of ups and downs. In Q3 of 2021, for example, actual earnings of $0.04 beat the range high and stayed in the green. Earnings for the following quarter suggested a lot of momentum, coming in at $0.12 and beating the range by nearly a dime.

However, earnings fell again on the top of the new year, 2022. This time, earnings beat the estimate but hit the top of the range at $0.08, only to fall again within the next few months. Fortunately, the $0.01 of actual earnings in Q2 still beat the consensus estimate of -$0.01; but while they managed to stay out of the red at the time, the stock is back down with updated guidance that has earnings back down to -$0.67...

A good percentage of Snowflake's peers are down significantly on the year, so far, but all have notable—and, more importantly, positive—upsides.

This includes not only smaller competitors like Hubspot, Inc. (HUBS) and Cadence Design Systems (CDNS), but also behemoths like Microsoft (MSFT), Alphabet (GOOG) and Amazon.

Hubspot is down about -56% on the year, so far—which is nearly the same as that of Snowflake—while Cadence is down only about -12% on the year. Microsoft is down about twice as much, -27.79%, while Alphabet and Amazon have fallen even further: about -32.5% and -44%, respectively.

There is still excellent room for growth for SNOW...the overall sentiment seems to be that much of the cloud computing and storage industry is in the same boat. And the name of this boat is the SS Moderate Buy."

Caveat Emptor!

That's a wrap for this morning.

Today is "Giving Tuesday". It's all about Radical Generosity.

More By This Author:

TalkMarkets Image Library

Thoughts For Thursday: Gobble And Squawk From The Fed

Tuesday Talk: Tough Talk Till Wednesday