Thoughts For Thursday: Gobble And Squawk From The Fed

Squawk and gobble from the Fed in the form of the release of the November FOMC minutes provided the right amount of doublespeak to carry the market higher on Wednesday.

Below is some of the celebrated Fedspeak from yesterday's November FOMC Meeting Minutes release:

“There was wide agreement that heightened uncertainty regarding the outlooks for both inflation and real activity underscored the importance of taking into account the cumulative tightening of monetary policy, the lags with which monetary policy affected economic activity and inflation, and economic and financial developments,”

“A substantial majority of participants judged that a slowing in the pace of increase would likely soon be appropriate,...The uncertain lags and magnitudes associated with the effects of monetary policy actions on economic activity and inflation were among the reasons cited regarding why such an assessment was important.”

Not lyrical you say, it was music to traders ears. Yesterday the S&P 500 closed at 4,027, up 24 points, the Dow closed at 34,194, up 96 points and the Nasdaq Composite closed at 11,285, up 111 points.

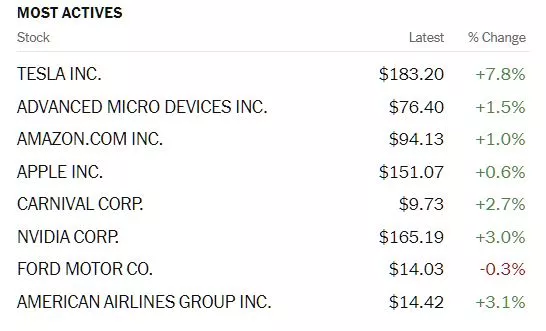

Most actives were all green, except for Ford (F) which closed down 4 cents, but added back 2 cents after the close.

Chart: The New York Times

TalkMarkets contributor Seb notes US Equities Boosted By Potential Slowdown Of Interest Rate Hikes.

"US equity indexes gained with the E-mini S&P 500 to 0.3%, Nasdaq rose by about 0.5% and the Dow Jones is up by about 0.2% in the European trading session due to the FOMC minutes which showed officials pointing to a potentially slower pace of interest rate hikes.

- Policymakers are still concerned about the economy’s health which hinted at a higher terminal rate.

- Economic data such as business activity and manufacturing contracts hinted at a slowdown of hikes and increased odds for a 50 bps hike.

The daily interval rose for the third consecutive in a row, targeting the swing highs for more inventory which may be able to drive the market to even higher prices, depending on the auction and absorption operations.

The volatility index is little changed for the session which hints at a rotational behavior as the market rose above the day’s swing highs, depending on the mentioned absorption behavior the market may be able to operate to higher prices."

Contributor Fiona Cincotta takes a look at some of the positive fall-out for the Euro from yesterday's FOMC meeting minutes release, today's ECB notes and what's in store for oil amidst the latest developments around a possible price cap for Russian oil in, Two Trades To Watch: EUR/USD, Oil - Thursday, Nov. 24.

"The EUR/USD (FXE) is pushing higher, extending gains from yesterday. The less hawkish Fed minutes and weaker-than-forecast US business activity data are dragging on the USD...

Meanwhile, the upbeat market mood and not as bad as feared eurozone PMI data is helping the EUR gain ground. The Eurozone composite PMI unexpectedly rose to 47.8, up from 47.3. This could indicate that a recession in the eurozone could be shallower than initially feared.

Today attention shifts to German IFO business sentiment, which is expected to rise to 85, up from 84.5.

The minutes of the latest ECB meeting are also due to be released and could provide further insight as to whether the ECB is considering a downshift in the pace of rate hikes to 50 basis points in December...After rising to a high of 1.0448 in early trade, the EUR/USD is heading, easing back, testing the 200 sma at 1.04. The RSI supports further upside while it remains out of the overbought territory."

"Oil (OIL) prices are treading water after falling sharply in the previous session. Oil recorded its biggest daily decline in two months as the G7 group weighed up, capping Russian oil prices at $65-$75 per barrel...Oil trades below its falling trend line dating back to the start of November. The RSI is in bearish territory, and the 50 sma on the 4-hour chart has crossed below the 50 sma in a death cross signal. Sellers will look to break below 75.27, the weekly low, to create a lower low and head towards 74.10, the 2022 low. Beyond here 70.00, the psychological level comes into play."

On "Recession Watch" duty contributor Jill Mislinski reports that the Michigan Consumer Sentiment Falls 5% In November.

"The November Final Report came in at 56.8, down 3.1 (5.2%) from the October Final. Investing.com had forecast 55.0. Since its beginning in 1978, consumer sentiment is 34 percent below the average reading (arithmetic mean) and 33 percent below the geometric mean.

Surveys of Consumers chief economist, Richard Curtin, makes the following comments:

Consumer sentiment fell 5% below October, offsetting about one-third of the gains posted since the historic low in June. Along with the ongoing impact of inflation, consumer attitudes have also been weighed down by rising borrowing costs, declining asset values, and weakening labor market expectations. Buying conditions for durables, which had markedly improved last month, decreased most sharply in November, falling back 19% to its September level on the basis of high interest rates and continued high prices. Long-term business conditions declined a more modest 6%, while short-term business conditions and personal finances were essentially unchanged.

Inflation expectations were also little changed from October. The median expected year-ahead inflation rate was 4.9%, down slightly from 5.0% last month. Long run inflation expectations, currently at 3.0%, have remained in the narrow (albeit elevated) 2.9-3.1% range for 15 of the last 16 months. Uncertainty over these expectations remained at an elevated level, indicating that the general stability of these expectations may not necessarily endure. [More...]

See the chart below for a long-term perspective on this widely watched indicator. Recessions and real GDP are included to help us evaluate the correlation between the Michigan Consumer Sentiment Index and the broader economy."

Go to the full article for additional charts detailing current consumer sentiment trends.

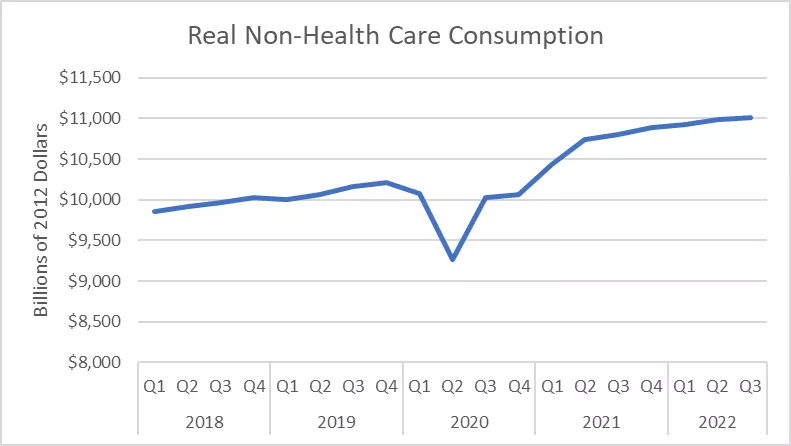

Contributor Dean Baker writes, On Thanksgiving 2022, Non-Health Consumption Is Far Higher Than Before Pandemic.

"The media’s coverage of the economy in the last year and a half has inflation playing a starring, and almost exclusive, role. Items like the 50-year low in unemployment reached earlier this year have barely been mentioned...Wages for workers at the bottom have largely kept pace with inflation, with workers in low-paying industries, like hotels and restaurants, actually seeing pay gains that outpace inflation. We have also seen twenty million families refinance their mortgages, saving thousands of dollars a year in interest payments...For these reasons (and others), the idea that large segments of the country are experiencing extraordinary hardship does not make sense. This comes with the usual qualification that around 20 percent of the country (roughly 70 million people) are always struggling to get by, even in good times...

One way to get a sense of how people are doing is to look at how much they are consuming. We have quarterly data from the Commerce Department that allows us to measure real consumption...

The figure below shows aggregate consumption, with one important modification. It pulls out consumption of health care services. We have actually seen the share of spending on health care fall sharply since the pandemic. With people spending less on healthcare, it means that they have more to spend on other items.

As can be seen, spending on non-health care items has grown rapidly over the last three years. Real non-health consumption is up 7.8 percent since the fourth quarter of 2019, which translates into an annual growth rate of just under 2.8 percent.

For the curious, the biggest increase has been in consumption of durable goods, which were 25.6 percent higher in the third quarter of 2022 than in the fourth quarter of 2019."

In the "Where To Invest" Department, contributor Sweta Killa reports ETFs In Focus Post Better Q3 Retail Earnings.

"The overall Q3 earnings picture for the retail sector has improved somewhat from the prior quarter. Total earnings from 93.8% of the sector’s total market capitalization reported so far are down 4.9% on 8.8% higher revenues, with 70.4% beating EPS estimates and 55.6% beating revenue estimates. This is better than an earnings decline of 4.9% and revenue growth of 47.9% in the second quarter.

The EPS and revenue beat percentages represent an improvement from the same group of companies in the preceding period but has been on the lower side of the 5-year range.

Most of the retailers beat estimates on both earnings and revenues and maintained their full-year outlook. As such, SPDR S&P Retail ETF (XRT), Amplify Online Retail ETF (IBUY) and ProShares Online Retail ETF (ONLN) have lost 0.1%, 7%, and 2.5%, respectively, over the past week, while VanEck Vectors Retail ETF (RTH) is up 1.8%."

See the full article for details of some of these earnings releases.

That's a wrap for this Thanksgiving Holiday.

Enjoy the food, family time and football.

More By This Author:

TalkMarkets Image Library

Tuesday Talk: Tough Talk Till Wednesday

Thoughts For Thursday: Correction Day!