Central Bankers Have Yet To Recognize That Inflation Is Past Its Peak

Central bankers often look through the rear-view mirror as they continue to raise rates. Chairman Powell argues that the Fed must continue on its mission to tame inflation by means of tightening credit conditions through higher rates and a reduction of its balance sheet (quantitative tightening). The Bank of Canada Governor Mackem argues that the Bank is not finished in its quest for higher rates since, in his view, core inflation remains elevated. The inflation dragon has not yet been slayed.

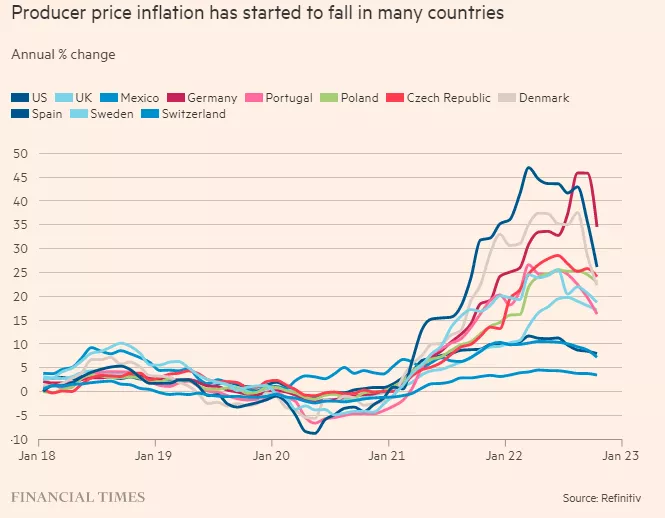

However, the evidence is building that inflation has peaked and is heading south. For example, prices at the factory gate in Germany fell by 5% last month compared to the previous month; US and UK producer prices are similarly on the decline. A combination of weakening aggregate demand and lower input prices for both materials and shipping services are bringing costs down everywhere.

Readers will recall the chaos that reigned in the international shipping industry during the pandemic resulting in freight rates soaring by 500% during 2020-2021. Since its peak in April 2021, container shipping costs have fallen by 70%.

Similarly, the commodity price index is down 15% since its recent peak. Oil reached a peak in June this year at $115/bbl and now trades at less than $80/bbl, a 30% decline. Food prices, according to the FOA, is running at 2% annual, compared to the 40% experience in mid-2021.

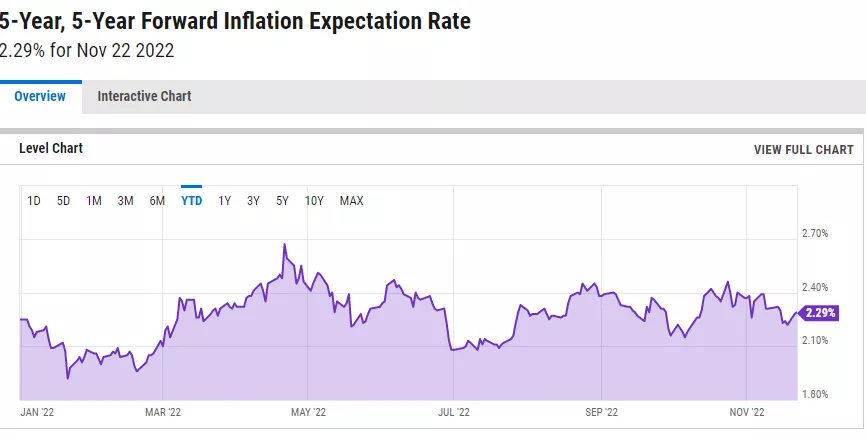

Central bankers constantly remind us that inflation expectations need to be “ well-contained” if we are going to return to a world of low inflation. The bond market serves as an excellent real-world example of how investors cope with expected inflation. Accordingly, expectations can be measured with a 5yr5yr forward inflation rate which estimates the expected average inflation over the five-year period beginning 5 years from today. The rate is currently trading at 2.3%, slightly above the rate experienced over the past decade. Put simply, bond investors expect inflation to be tame over the next decade.

(Click on image to enlarge)

Summing up, the evidence is coming in that inflation rates are declining. Manufacturing costs are softening, commodity prices are off the highs, and more importantly, inflationary expectations are returning to their historical rates. The case for continued rate increases can no longer be argued on the grounds that more work needs to be done.

More By This Author:

The Bank Of Canada Misses The Point When It Speaks Of Tight Labor Markets

The Federal Reserve Is Spreading Pain Around The World

As The Canadian Inflation Rate Starts To Decline, Will The Bank Of Canada Pause?

Disclosure: None.