An Introduction

Gold and silver equities tend to rise 2 to 3 times faster than gold and silver because their costs are relatively fixed and, with the increasing prices of physical gold and silver, the value of each troy ounce (see definition of "troy" ounce here) mined flows straight to the bottom line causing their stocks to go ballistic.

Let me explain further. Average all-in sustaining costs for major producers currently range from $1,080 to $1,220 per troy ounce (source) and with spot prices for gold, for example, currently more or less triple that, producer margins are exploding as illustrated in the following chart compliments of the World Gold Council and U.S. Global investors.

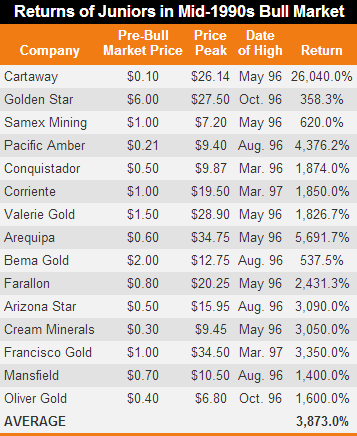

With profits increasing dramatically, the major producers are flush with cash which, if history is any indicator, they will likely eventually invest in the smaller cap producers, those mining companies in development and the many juniors explorers, causing many of the latter company stock prices to go parabolic (the tables below are compliments of Jeff Clark) with many of them becoming 10-baggers (i.e. 1,000% gains, or more) back in 1979/80...

and again in the mid 1990s.

Conclusion

We are on the verge of a tremendous boom in gold and silver equities. As physical gold and silver continues to increase more and more investors/speculators will flood into gold/silver futures which will catapult physical gold and silver prices higher and that will motivate investors to chase gold/silver further increasing the margins of the gold/silver producers and the likelihood of many of them buying out the "mining' companies - the developers and juniors - in the market, or at least expressing interest in doing so which will cause these "mining' companies to rocket higher!