Stocks are bouncing this morning on announcements that the Feds will backstop all of the deposits at the now bankrupt SVB Financial Group (SIVB) aka Silicon Valley Bank.

![]()

I think this is a massive mistake. The banking system is in serious trouble and it is not clear that the $25 billion bailout the Feds crafted will be enough to deal with fallout.

One other bank, Signature (SBNY), has already been closed, while most of the regional banks in California have seen their stocks halted.

What’s causing all of this?

Two things:

1) For the first time in 15 years, depositors can earn 4% or 5% in yield.

2) Banks are up to the eyeballs in garbage loans made during the pandemic.

Regarding #1, most banks are now paying out something like 0.05% or lower on deposits. Meanwhile, money market accounts and short-term T-bills are paying 4% of 5%.

As a result of this depositors are pulling money out of banks. And because the banks have to maintain leverage ratios based on capital requirements, the banks are being forced to sell assets (deleverage).

We are not talking about a small amount of money either. There is $5.5 trillion in deposits in small/ regional banks in the U.S.

This brings us to #2.

SIVB went bananas with its lending following the pandemic courtesy of all the bail-out/ stimulus money. SIVB was the bank for (h/t DiscloseTV):

1) Some 1,500 climate and energy-tech companies.

2) More than 60% of all community-based solar financing.

3) Countless “woke” programs that financed politically-tied entities/ startups.

Look, a bank can lend money to whoever it likes… but when you throw lending standards out the window and start loaning money based solely on political ideology (as opposed to whether or not the person/ business could ever pay you back) it’s a recipe for disaster.

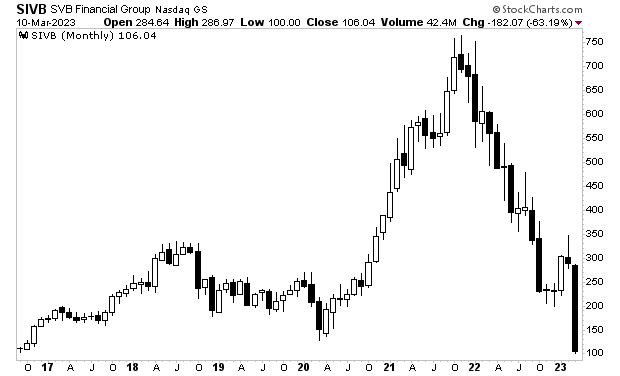

By doing this, SIVB went from the 42nd largest bank to the 15th largest bank in the U.S. in the span of three years. The chart below is not of a tech start-up or micro-cap… it’s that of a bank. Yes, it went from $150 per share to $750 per share in less than two years.

Which brings us to today.

SIVB is not the only bank with these problems, just as Bear Stearns wasn’t the only bank with exposure to subprime mortgage loans in 2008. There is no easy way out of this mess.

Remember, there are over $5.5 trillion in deposits sitting in regional banks in the U.S. The Fed thinks that a $25 billion bailout fund will be enough to prop up the banks as a major percentage of this leaves to seek higher yields.

Good luck with that!

More By This Author:

Three Charts Every Trader Needs to See Today

Is The Great Debt Crisis Of Our Lifetimes Finally Going To Arrive?

The Next Major Downdraft Is Approaching