The Next Major Downdraft Is Approaching

The stock market is primed for another major leg down.

Why?

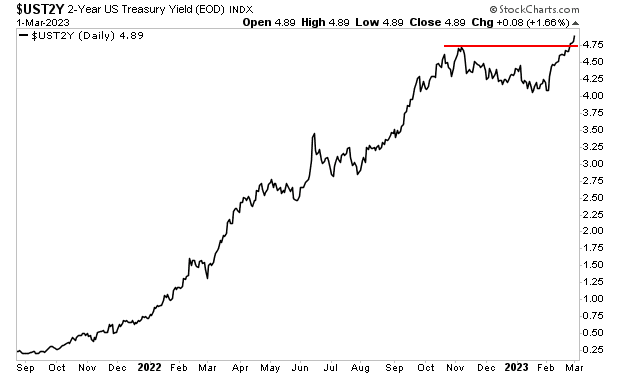

Treasury yields are spiking again.

The yield on the 2-Year U.S. Treasury has exploded higher… blasting through its previous high of 4.72%. It is now closing in on 5%.

Bear in mind, it was just 1.25% this time last year.

Why does this matter?

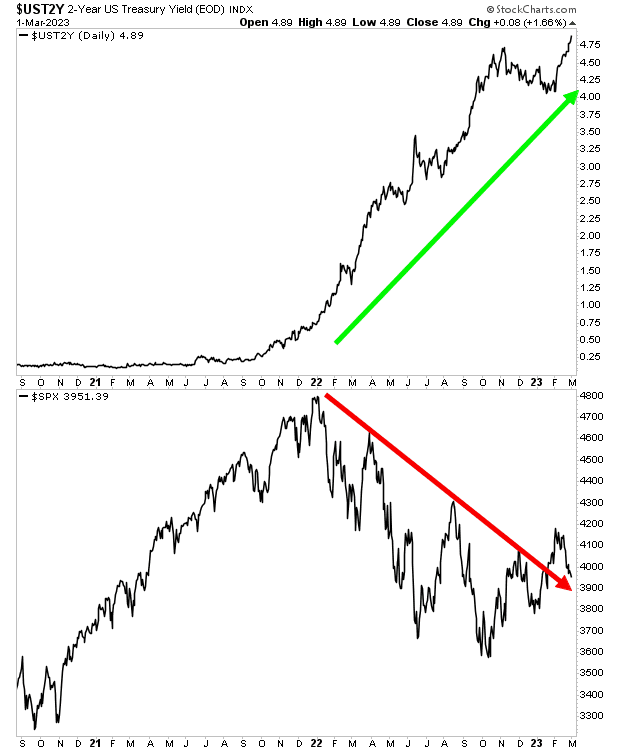

The ENTIRE collapse in stocks thus far in this bear market has been due to Treasury yields spiking. Investors used to collect 0.25% “risk free” from these bonds. They can now get almost 5%.

As a result of this, no one is willing to pay 20-22 times forward earnings for growth from stocks. Instead, they’re paying just 16-18 times forward earnings. And by the look of things it will soon be lower than that. Treasury yields keep rising… so stocks will keep falling.

More By This Author:

The Bubble is Back… And It’s Bursting Will Only Be That Much WorseInvestors Are About To Pay The Price For The Fed’s Failures…

Here’s Your Roadmap For the Market’s Next Money Making Move