Yields, Spreads, And Uncertainty/Risk

Term spreads rising slightly, yields (nominal, real) down, and risk measures up.

One nominal rates have dived; real rates as well, suggesting the bulk of the movement is movement in perceived future economic activity.

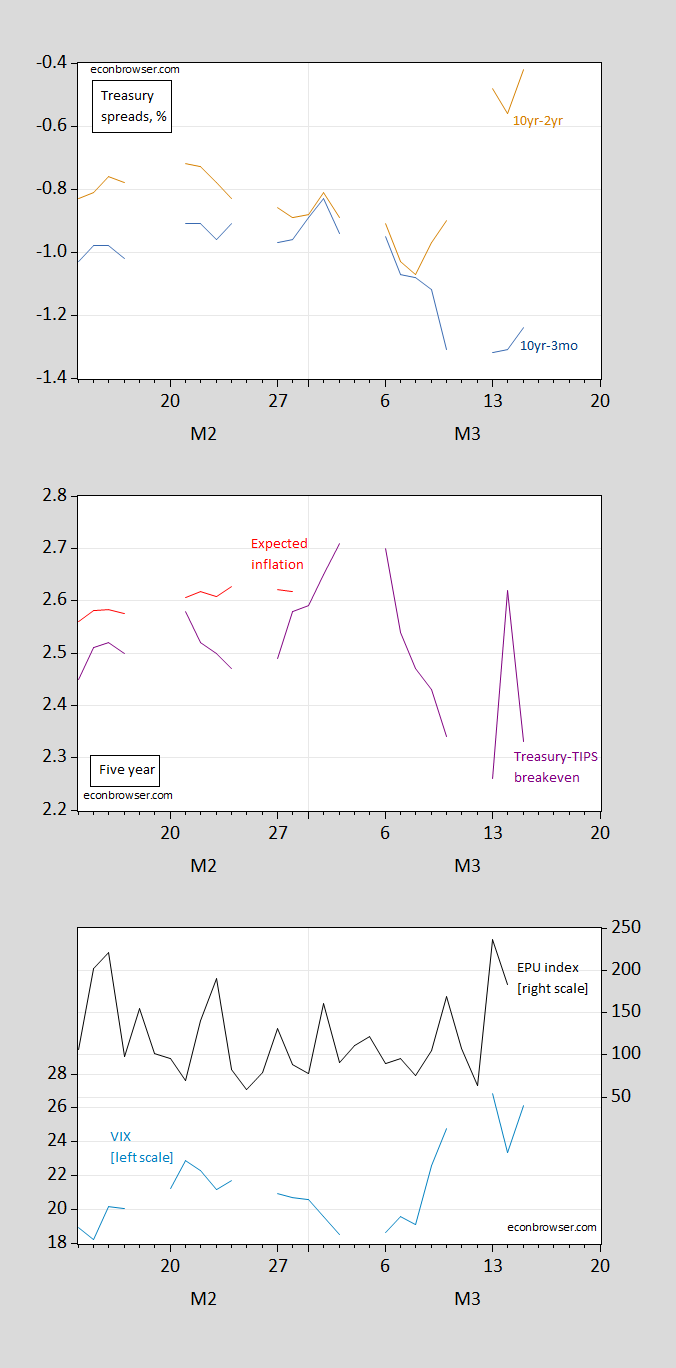

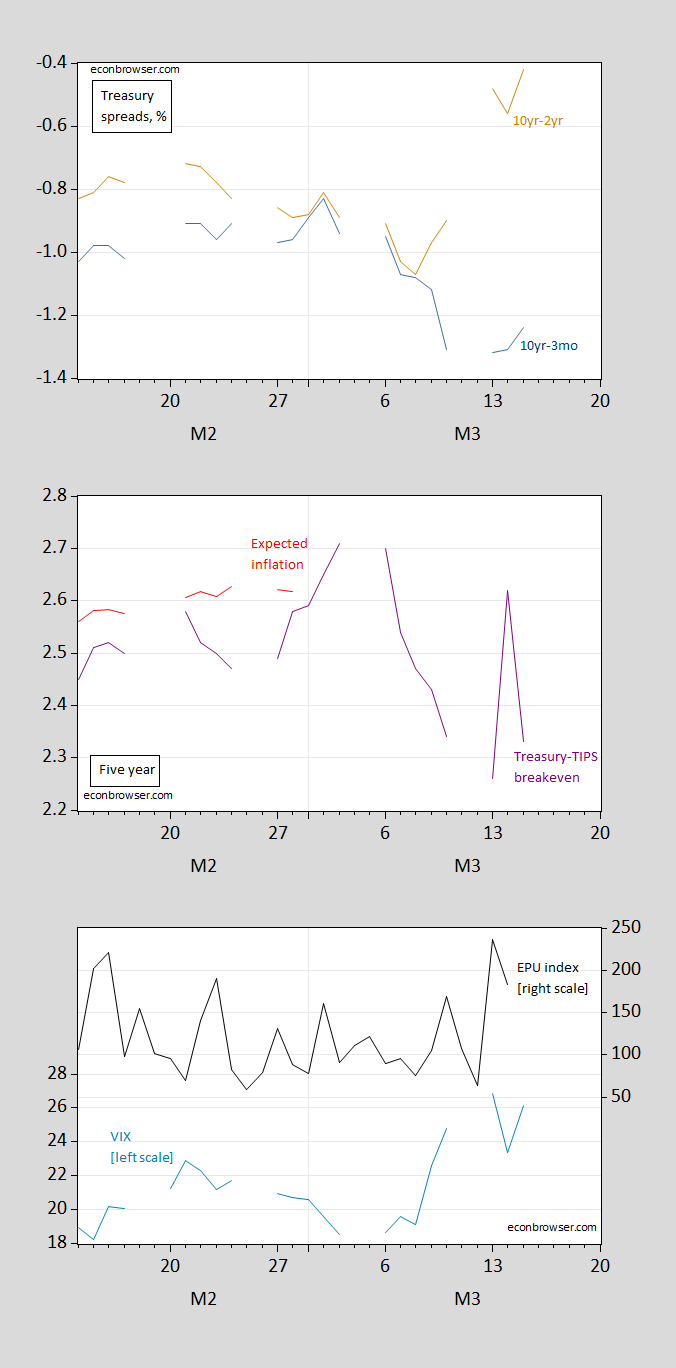

Figure 1: Top panel: 10yr-3mo Treasury spread (blue), 10yr-2yr spread (tan), both in %; Middle panel: 5 year Treasury-TIPS spread (purple), 5 year spread adjusted for liquidity and risk premia (red); Bottom panel: VIX (sky blue, left scale), EPU (black, right scale). Source: Treasury via FRED, KWW following D’amico, Kim and Wei (DKW), CBOE via FRED, policyuncertainty.com.

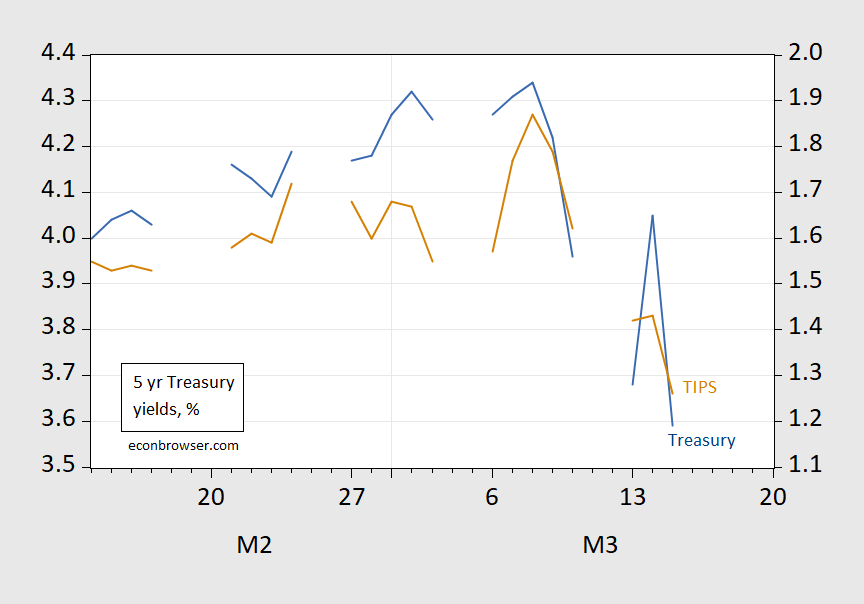

The five year yield dropped 46 bps today, while the two year dropped 27 bps. Real or nominal effects? Here’re the corresponding 5 year nominal and real rates.

Figure 2: Five year Treasury yield (blue), TIPS (tan), both in %. Source: Treasury via FRED.

Over the last week, nominal 5-year rate has fallen 75 bps, while the TIPS yield has fallen 61 bps. This is suggestive of a real decline — which of course could be driven by the outlook for the real economy, or by expectations of Fed policy tightness (see the previous post on the implied path of the Fed funds rate).

More By This Author:

Implied Fed Funds Peak – From September To MayMonth-On-Month Core PPI At 0%

Spreads And Uncertainty/Risk Measures Post-SVB, Post-CPI Release