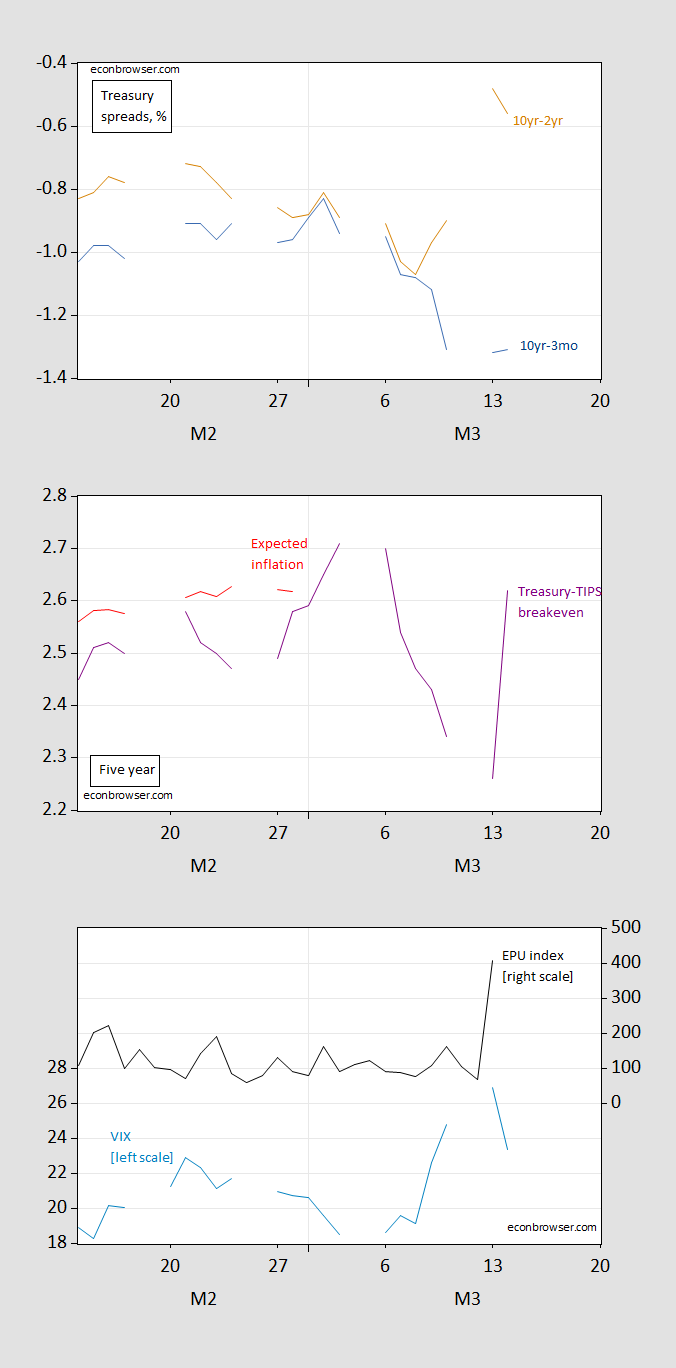

Spreads And Uncertainty/Risk Measures Post-SVB, Post-CPI Release

Five year Treasury-TIPS breakeven rises. EPU up on 13th, VIX down (but still elevated) today. 10yr-3mo spread remains very negative.

Figure 1: Top panel: 10yr-3mo Treasury spread (blue), 10yr-2yr spread (tan), both in %; Middle panel: 5 year Treasury-TIPS spread (purple), 5 year spread adjusted for liquidity and risk premia (red); Bottom panel: VIX (sky blue, left scale), EPU (black, right scale). Source: Treasury via FRED, KWW following D’amico, Kim and Wei (DKW), CBOE via FRED, policyuncertainty.com.

More By This Author:

Inflation Surprise Barely Moves Expected Fed Funds PathThe Term Spread and Recession, Across Countries

SVB – No One Should Be Surprised

Comments

Please wait...

Comment posted successfully

No Thumbs up yet!