The Term Spread And Recession, Across Countries

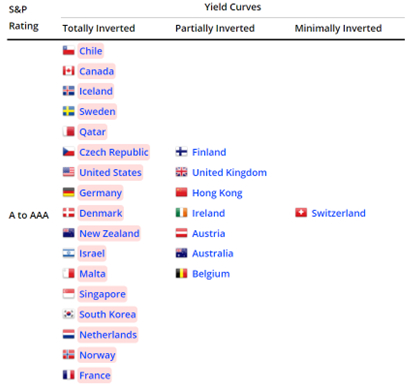

World of Government Bonds has this interesting page that notes all the inverted yield curves as of today. Shown below are those for S&P ratings of A to AAA as of today.

Source: World of Government Bonds, accessed 3/14/2023.

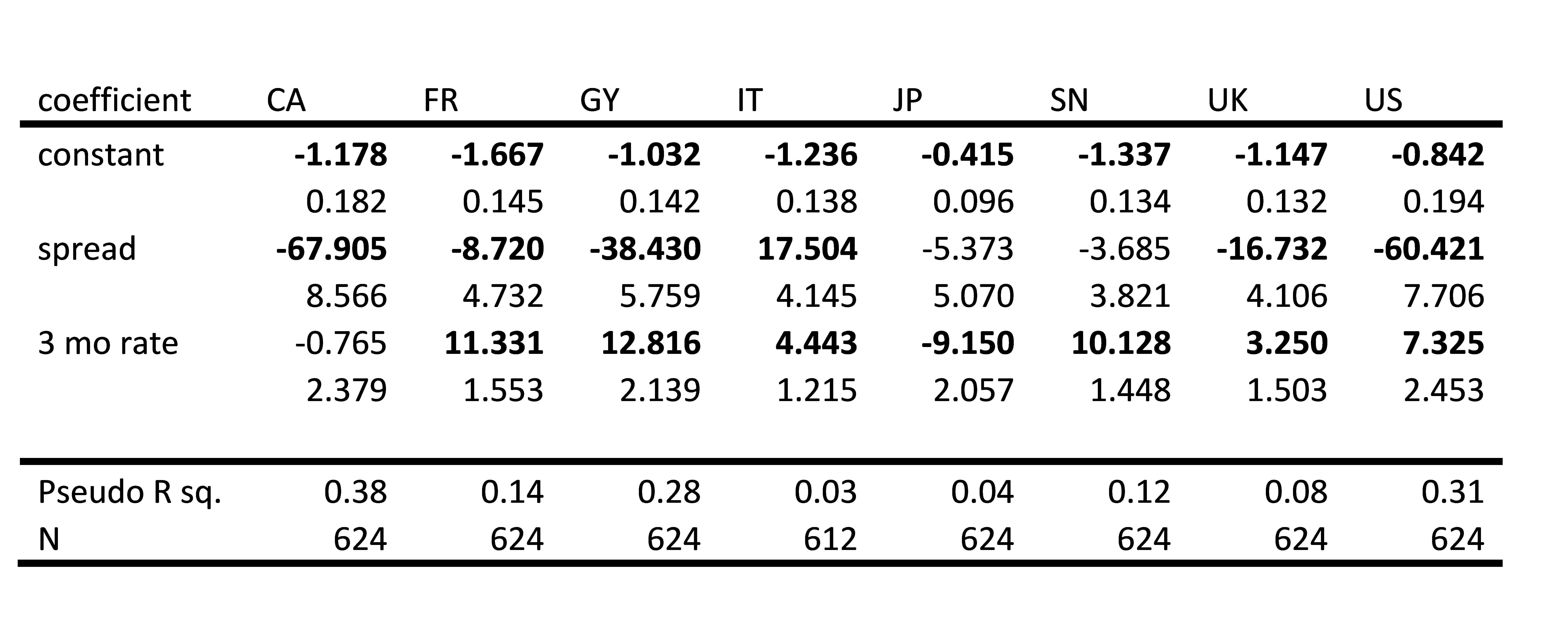

What does this mean? In Chinn and Kucko (2014), we examined the relationship between the ten-year-three-month term spread and recessions, as defined by ECRI (by NBER for the US). Using interest rate data up to 2021M12, here are the results for predicting recessions one year ahead. We noted that not all countries exhibited a reliable relationship between the 10yr-3mo spread and recession a year subsequent. Here are some preliminary results from work conducted with Laurent Ferrara, updating the data to 2021M12 (for interest rates), assuming no recessions have started in these countries as of December 2022.

Table 1: Probit regression results of recession dates one year ahead on term spread and 3 month interest rate (in decimal form). Bold denotes significance at 5% level. Source: Author’s calculations based on OECD interest rate data, ECRI recession dates (except for US, which uses NBER dates).

While there are a good number of significant entries for the term spread across countries, the sign is wrong for Italy. Even when the coefficient is significant, the pseudo-R2 is low (UK, and to a lesser extent, France). That means that the term spread really only seems useful for Canada, Germany, and the US.

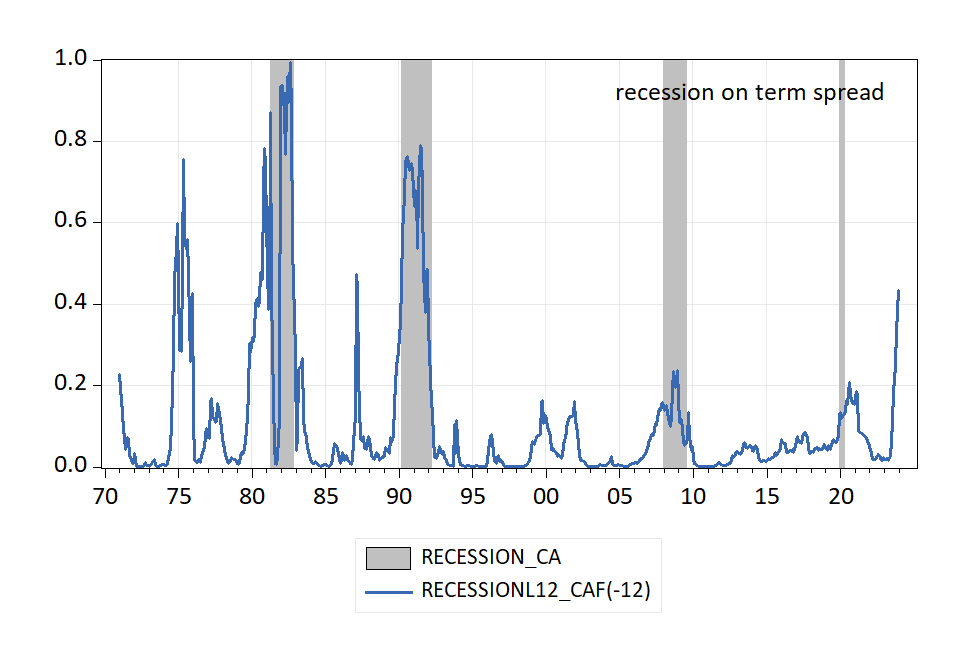

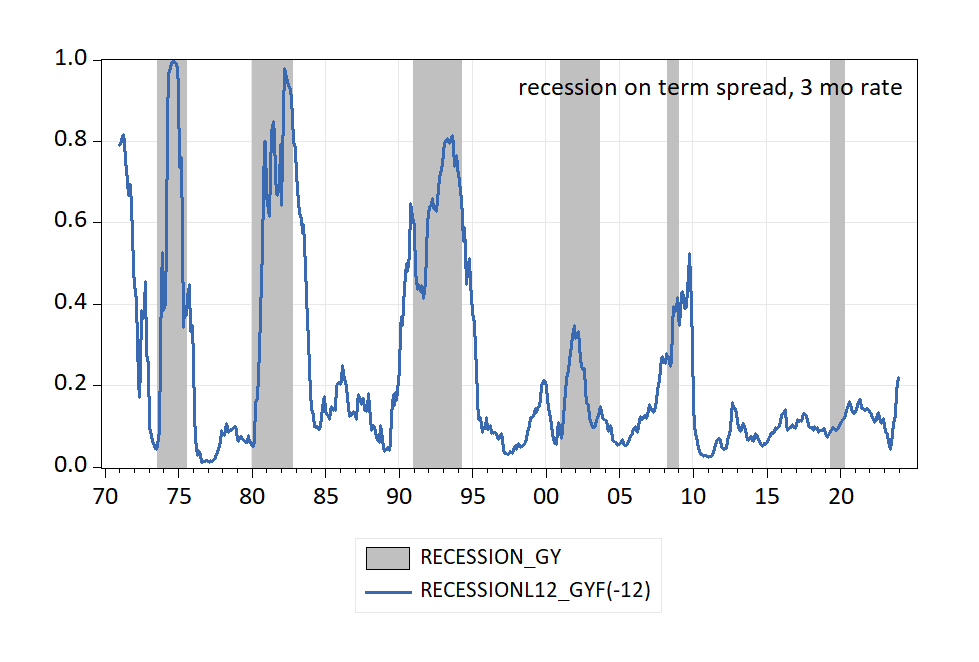

Here’re the simple predictions for Canada (not including the 3-month interest rate) and for Germany. Note however the last observation is the predicted probability for December 2023; probabilities for March 2023 (now) are quite low in both cases. (However, false negatives are quite common unless quite common for Canada unless a low threshold is used.)

Figure 1: Probability of recession in given month from probit recession on Canadian 10yr-3mo term spread. Canada ECRI peak-to-trough recessions dates shaded gray. Source: OECD via FRED, ECRI and author’s calculations.

Figure 2: Probability of recession in given month from probit recession on German 10yr-3mo term spread. Germany ECRI peak-to-trough recessions dates shaded gray. Source: OECD via FRED, ECRI and author’s calculations.

This is true for the US as well, where the estimated probability of recession exceeds 50% only in December of 2023/January 2024. On the other hand, the 10yr-3mo spread put the highest likelihood for the 2020M02-04 recession at 2020M08.

More By This Author:

SVB – No One Should Be Surprised

How Have Market Expectations Of The Fed Funds Changed?

Looking Backward To The “Recession Of 2022H1” And Forward To The Recession Of 2023