SVB – No One Should Be Surprised

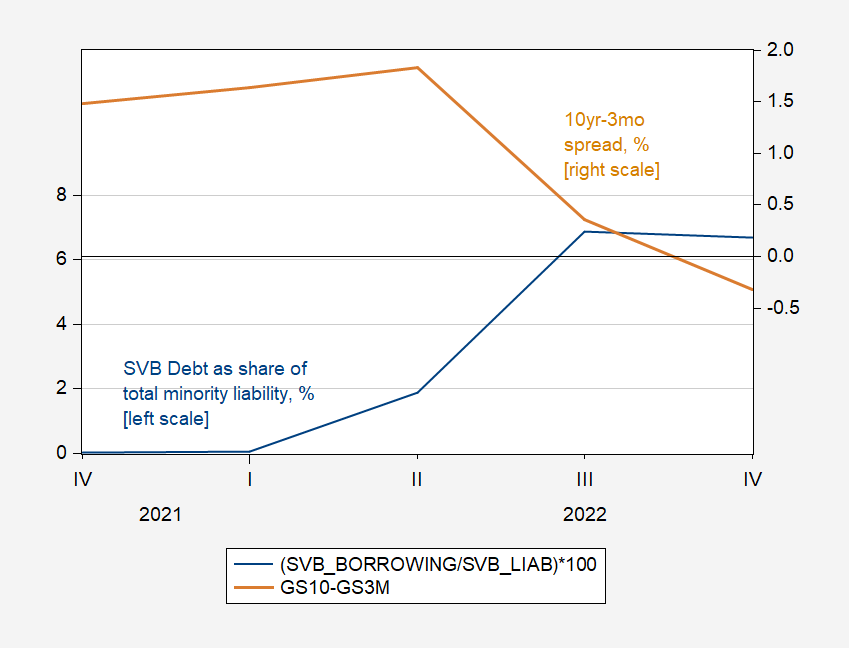

SVB (SIVB) was a collapse waiting to happen. One indicator is the increasing reliance on debt acquired on the capital markets (as opposed to deposits).

From WSJ:

SVB’s year-end balance sheet also showed $91.3 billion of securities that it classified as “held to maturity.” That label allows SVB to exclude paper losses on those holdings from both its earnings and equity.

In a footnote to its latest financial statements, SVB said the fair-market value of those held-to-maturity securities was $76.2 billion, or $15.1 billion below their balance-sheet value. The fair-value gap at year-end was almost as large as SVB’s $16.3 billion of total equity.

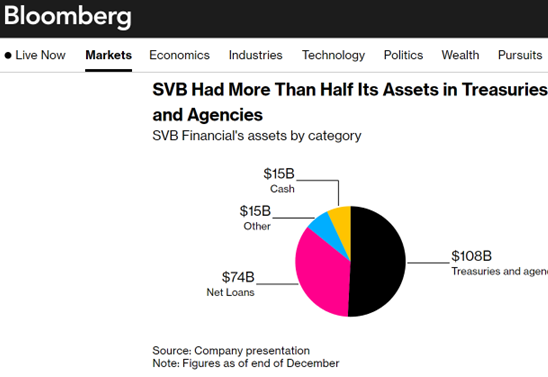

Here’s a picture of assets from Bloomberg:

Source: Bloomberg, 3/10/2023.

It’s kind of funny to think of credit risk associated with Treasurys, but one can make a capital loss (as opposed to loss due to default) if prices change a lot, as they have for Treasurys in the wake of QT and rises in the Fed funds rate.

Hence, SVB experienced a classic bank run in the face of solvency concerns, given that deposits exceeded the insured amount. In the run-up to the crisis, the bank increased its reliance on debt acquired in the capital market (as opposed to deposits which would’ve required higher interest rates). In this sense, incurring more debt should be viewed as a signal, rather than a causal factor.

(Click on image to enlarge)

Figure 1: End of quarter debt as share of total net minority liability, % (blue, left scale), and ten year-three month Treasury spread, % (tan, right scale). Source: YahooFinance, Treasury via FRED, and author’s calculations.

More By This Author:

How Have Market Expectations Of The Fed Funds Changed?

Looking Backward To The “Recession Of 2022H1” And Forward To The Recession Of 2023

Business Cycle Indicators And The Employment Release