Inflation Surprise Barely Moves Expected Fed Funds Path

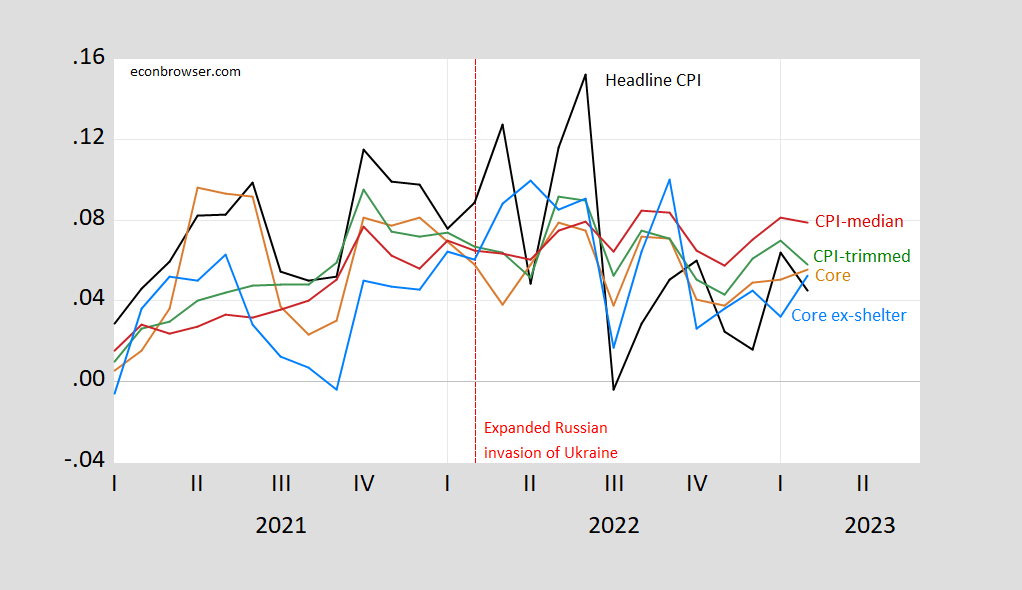

M/M core CPI inflation surprised on the upside (0.5 ppts vs. 0.4 ppts Bloomberg consensus) while m/m headline at consensus. The path of the Fed funds as indicated by futures barely budged.

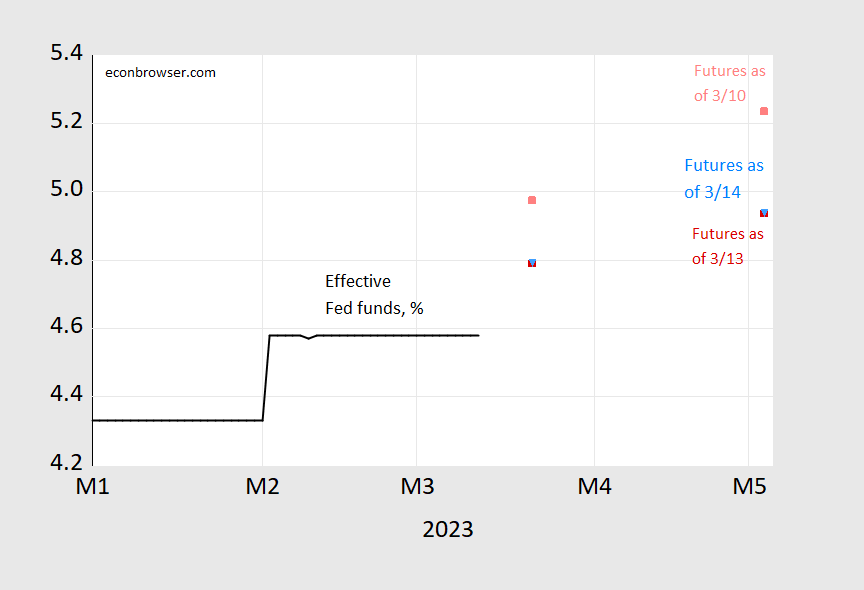

Figure 1: Effective Fed funds (black), CME futures implied as of 3/13 12:20CT (red square), as of 3/10 (pink square), as of 3/14 (inverted sky blue triangle) 1:20CT. Source: CME Fedwatch, accessed 3/13, 3/14.

It’s pretty hard to see the increase, but it’s there; for the May 3rd meeting, the implied rate rose from 4.936% to 4.940%.

Here’s the picture of inflation measures month-on-month, annualized: headline, core, core ex-shelter, trimmed mean, and median.

Figure 2: Month-on-month annualized inflation of headline CPI (black), core (tan), core ex-shelter (sky blue), 16% trimmed CPI inflation (green), median CPI (red), all in decimal form (i.e., 0.05 means 5%).Source: BLS, BEA, Cleveland Fed via FRED, Paweł Skrzypczyński, and author’s calculations.

More By This Author:

The Term Spread and Recession, Across Countries

SVB – No One Should Be Surprised

How Have Market Expectations Of The Fed Funds Changed?