Weekly Macro Indicators, Thru March 18

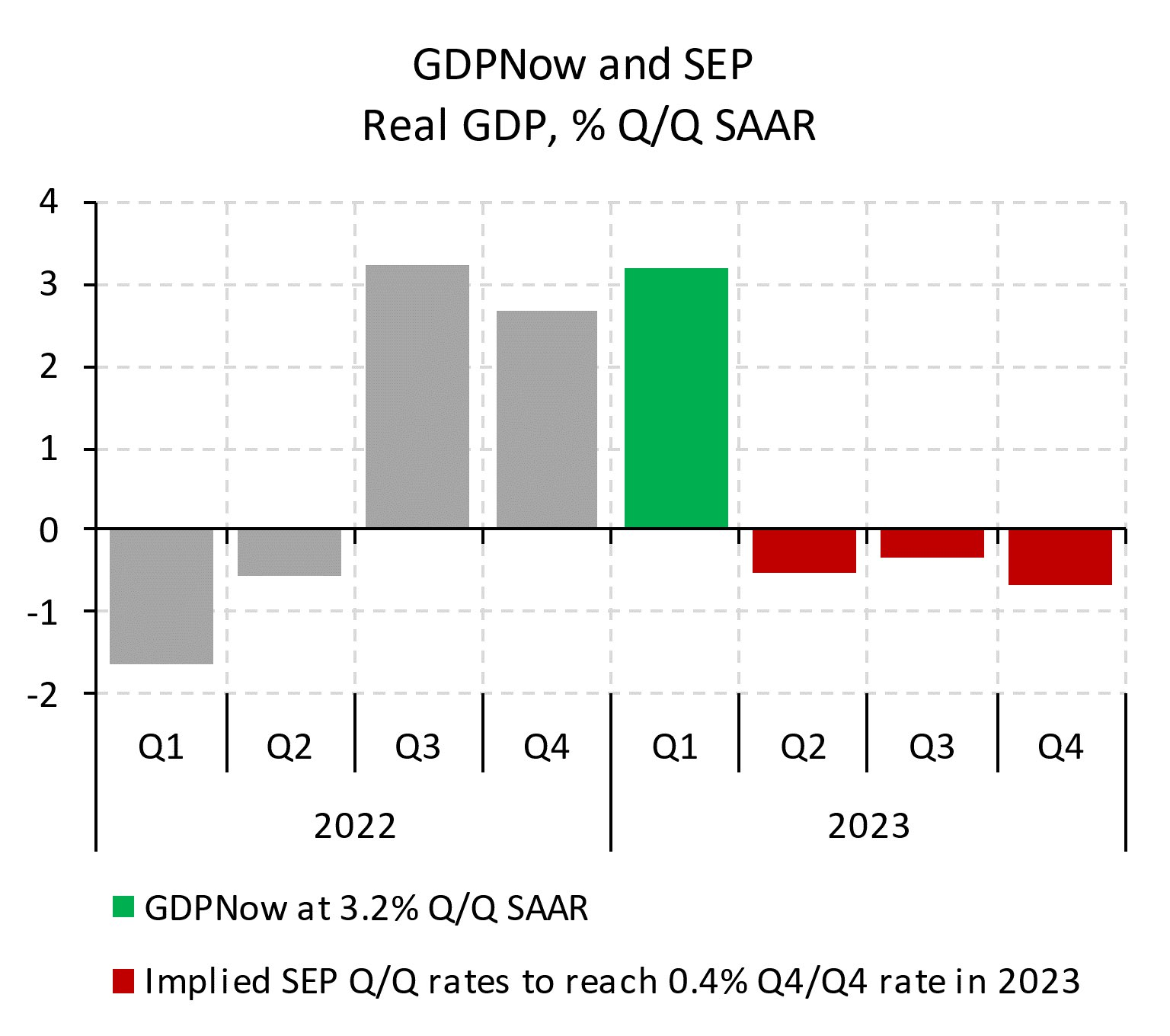

Here’re some indicators at the weekly frequency for the real economy. Bloomberg notes that GDPNow (3/16) combined with SEP median of 0.4% growth rate for 2023 implies 3 quarters of negative GDP growth starting in Q2. The latest data below relate to late in Q1.

(Click on image to enlarge)

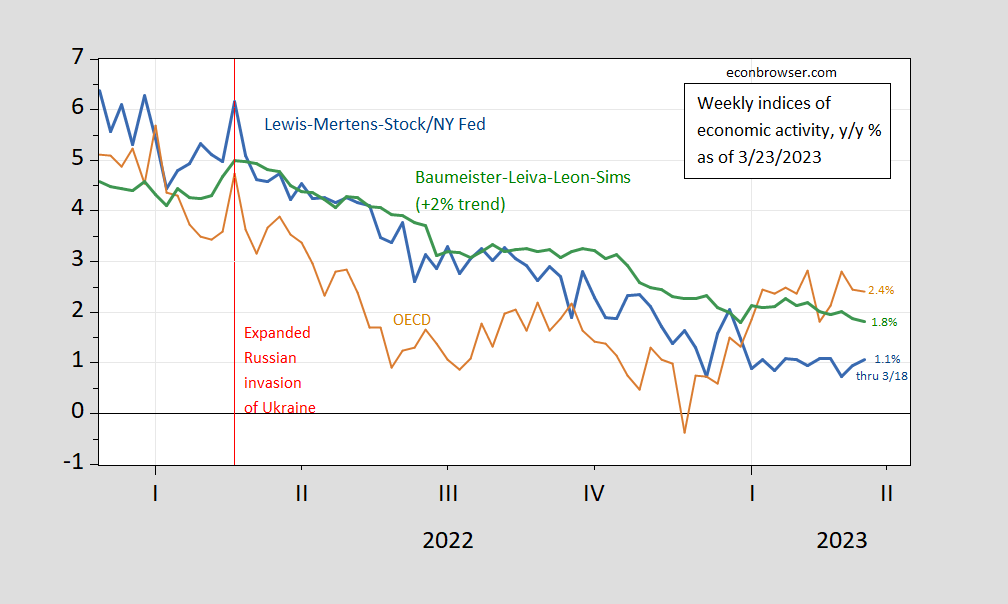

Figure 1: Lewis-Mertens-Stock Weekly Economic Index (blue), OECD Weekly Tracker (tan), Baumeister-Leiva-Leon-Sims Weekly Economic Conditions Index for US plus 2% trend (green). Source: NY Fed via FRED, OECD, WECI, and author’s calculations.

The Weekly Tracker continues to read strong growth, for the week ending 3/18, exceeding the WEI (1.1%) and WECI+2% (1.8%). The WEI reading for the week ending 3/18 of 1.1% is interpretable as a y/y quarter growth of 1.1% if the 1.1% reading were to persist for an entire quarter.The Baumeister et al. reading of -0.02% is interpreted as a -0.02% growth rate in excess of long term trend growth rate. Average growth of US GDP over the 2000-19 period is about 2%, so this implies a 1.8% growth rate for the year ending 3/18. The OECD Weekly Tracker reading of 2.4% is interpretable as a y/y growth rate of 2.4% for year ending 3/18.

Recall the WEI relies on correlations in ten series available at the weekly frequency (e.g., unemployment claims, fuel sales, retail sales), while the WECI relies on a mixed frequency dynamic factor model. The Weekly Tracker — at 2.4% — is a “big data” approach that uses Google Trends and machine learning to track GDP. As such, it does not rely on actual economic indices per se.

Pawel Skrzypczynski does the work on what the GDPNow calculation plus median SEP implies:

Source: Pawel Skrzypczynski.

More By This Author:

Swedish Inflation: Blame It On Biden!What Would Interest Rates Have To Be For Unrealized Losses To Be Zero

Recession Chances: Fed Pause vs. Banking Shock