What Would Interest Rates Have To Be For Unrealized Losses To Be Zero

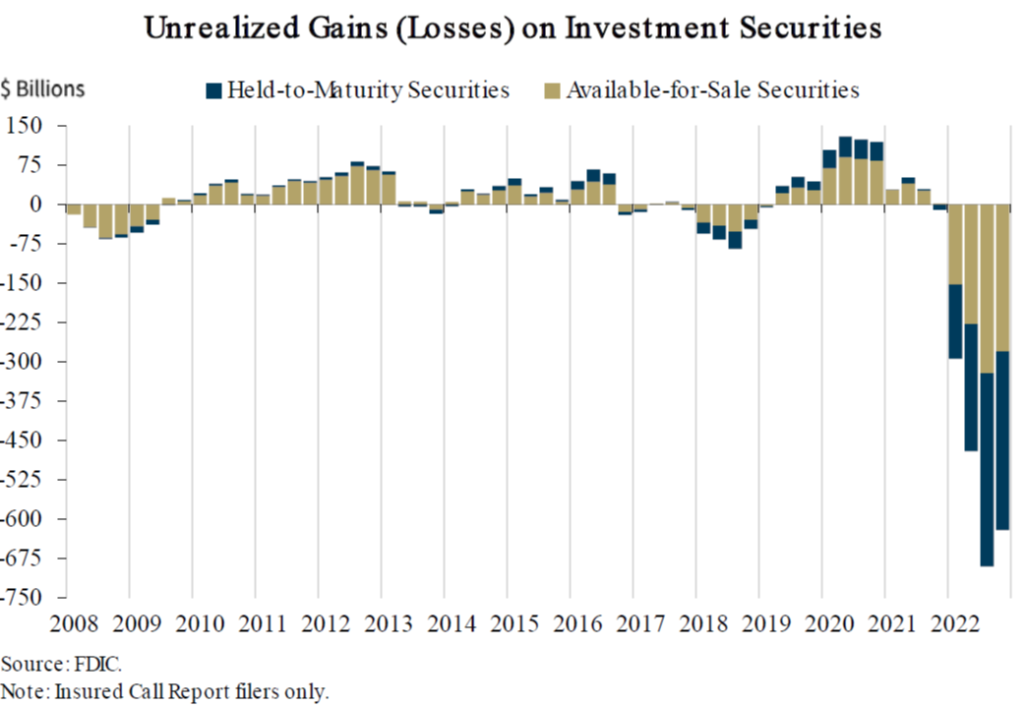

Consider the following graph of unrealized losses on securities held by reporting banks (from Rupkey/Financial Markets This Week):

(Click on image to enlarge)

Source: Rupkey, “Financial Markets This Week,” March 20, 2023.

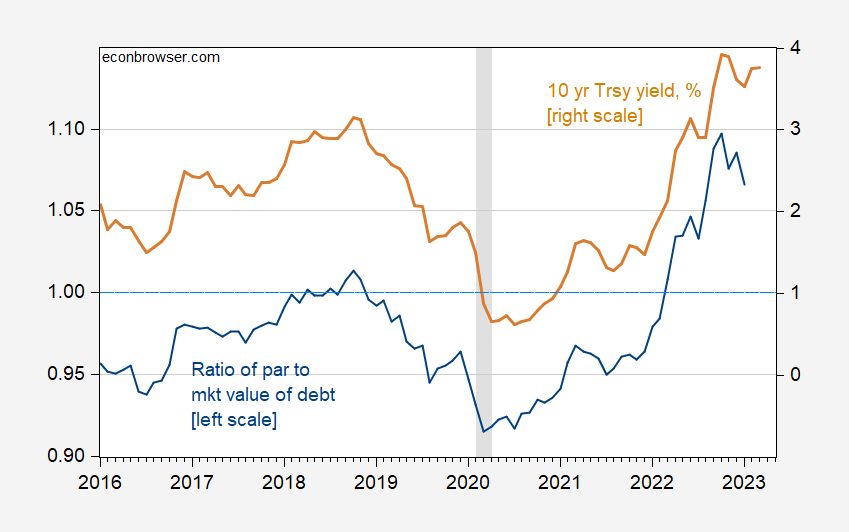

This made me wonder what would make these unrealized losses go to zero? Obviously a reduction in interest rates. I don’t have the data to do the calculation on hand, but I have marketable federal debt at par value and at market value. I can look at the ratio of those two and how that ratio moves with a given interest rate.

Figure 1: Ratio of par value of marketable debt to market value (blue, left scale), and ten year Treasury yield, % (tan, right scale). NBER defined peak-to-trough recession dates shaded gray. Source: Dallas Fed, Treasury, NBER, and author’s calculations.

There’s an obvious correlation. From the regression:

ratio = 0.8817 + 0.0455(gs10)

adj-R2 = 0.83, NObs = 85, DW = 0.20

Using this correlation, it turns out a 10-year yield of 2.6% will do the trick (so far through March, they’re 3.8%, roughly the same as February). Obviously, this is back-of-the-envelope (and the ratio of par to market is not the same as the ratio of purchased price to market price), but you get the idea that if yields fall, some of the unrealized losses will disappear.

How reasonable is this outcome? Not very, but I’ll note that the 10-year rate has fallen by half a percentage point since the beginning of the March…

More By This Author:

Recession Chances: Fed Pause vs. Banking ShockSVB, SIFIs, Dodd-Frank, EGRRCPA, HQLA And The LCR

Weekly Macro Indicators and Nowcasts On The Eve Of SVB