Recession Chances: Fed Pause Vs. Banking Shock

Goldman Sachs raised the probability of recession from 25% to 35% in light of the SVB-related turmoil (although their guess is still lower than the consensus). This prompted me to wonder what was the net effect of the turmoil and Fed response (less tightening) on economic activity.

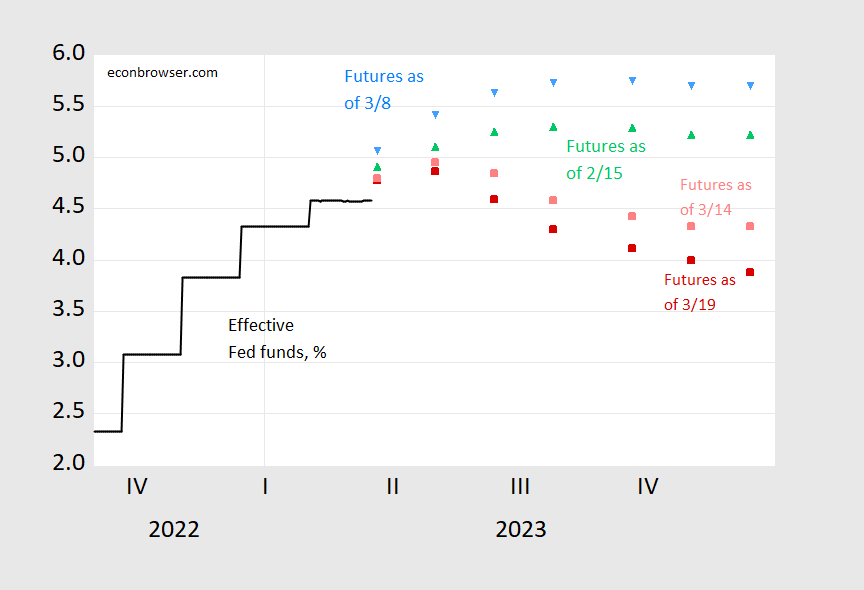

First, the path of Fed funds — as perceived by the market — Sunday vs. a couple of weeks ago.

(Click on image to enlarge)

Figure 1: Effective Fed funds (black), implied Fed funds as of March 19 4:30CT (red square), March 14, 1:30 CT (pink square), March 8 (sky blue inverted triangle), and February 15 (green triangle). Source: Fed via FRED, CME Fedwatch and author’s calculations.

By years-end, the implied Fed funds is about 180 bps lower than what was seen almost two weeks ago. Bauer and Swanson (AER 2023) estimate a 100 bps shock results in a 0.24 to 0.60 ppts decrease in growth rate. Of course, a 180 bps lower rate is not really a “shock” as considered in the VAR literature (the reduction is based on an inferred reaction function that takes into account dimmer growth prospects), but let’s take this number as a ballpark figure. That implies less pronounced tighteningadds around 0.4 to 1 percentage point growth. Say half of 180 bps is a “shock” in the sense it’s motivated by concern about the banking system. Then that takes the positive impact something between 0.2 to 0.5…

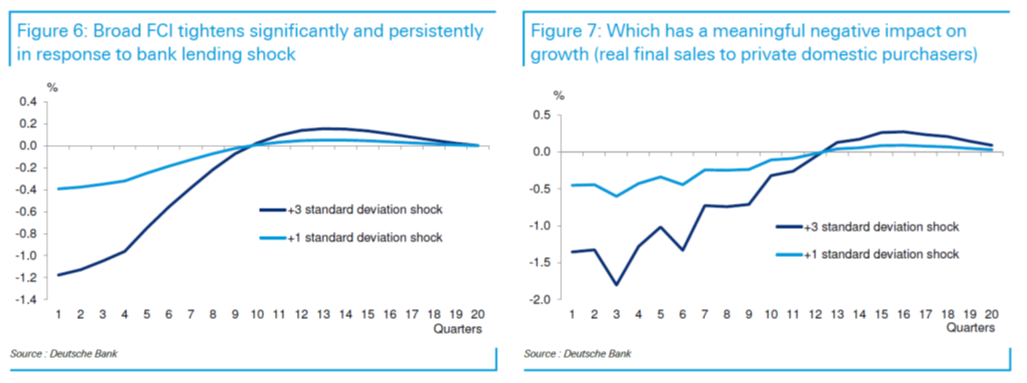

Set against that, the shock to the banking system is likely to reduce bank lending, and hence growth. Luzetti et al. at Deutsche Bank (“(Credit) crunching the numbers”, 20 March 2023) estimate a 10-point increase in the Senior Loan Officer Survey (SLoOS) of lending conditions (which was typical in the 1990s and early 2000s recessions) would result in a 0.4 percentage point growth reduction at a 4 quarter horizon.

(Click on image to enlarge)

Notes: 10 point increase in SLoOS approximately equals 1 std deviation shock to FCI. Source: Luzetti, et al. (2023).

I wouldn’t take these as anything more than a back-of-the-envelope calculation, but it does remind us that there are offsetting effects of recent developments.

More By This Author:

SVB, SIFIs, Dodd-Frank, EGRRCPA, HQLA And The LCRWeekly Macro Indicators and Nowcasts On The Eve Of SVB

“So China Is Now Paying Us Billions Of Dollars In Tariffs”