SVB, SIFIs, Dodd-Frank, EGRRCPA, HQLA And The LCR

One major question posed by recent events is whether the issues SVB faced would’ve been caught had EGRRCPA not been passed (which raised the threshold for what qualifies as a SIFI).

Bill Nelson at the Bank Policy Institute has an illuminating post arguing that the liquidity coverage ratio (LCR), which would have applied to SVB (SIVB) had it been classified an SIFI, would not have been triggered. People like former Senator Toomey (a cosponsor of the 2018 act) have asserted that the LCR wouldn’t have caught SVB. Here’s the logic I think he, and others, is relying on.

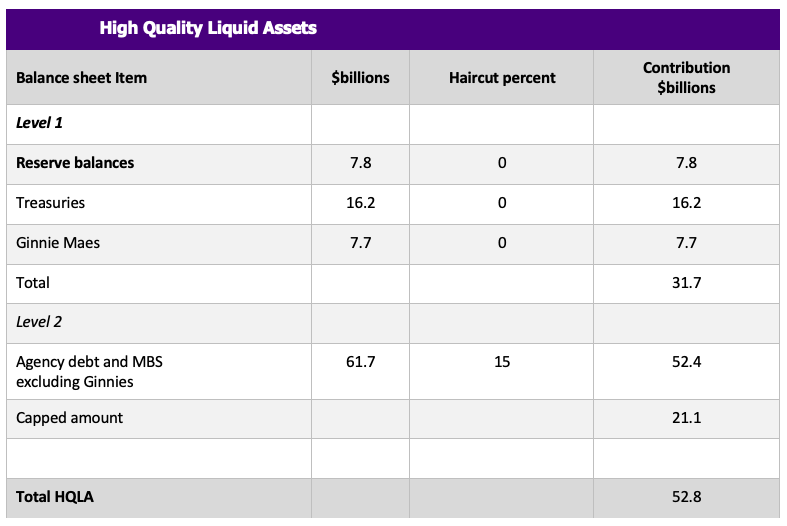

The LCR for the largest institutions is designed to cover 30 days of stress. For smaller and less complex institutions, the LCR’s stress assumptions are relaxed by multiplying projected net cash outflows by 70 percent. Absent S. 2155, SVB would have been subject to this reduced LCR requirement. To estimate SVB’s LCR, it is necessary to estimate the two components, [High Quality Liquid Assets] HQLA and net cash outflows. All data are as of Dec. 31, 2022, and are from SVB’s 10-K and call report. The results are summarized in table 1.

High-quality liquid assets consist of reserve balances (deposits at a Federal Reserve Bank), Treasuries, agency debt and agency MBS, and a few other things. The securities are marked to market. Reserve balances, Treasury securities and Ginnie Maes (which are fully guaranteed by the U.S. government) are included in level 1 HQLA, which must be at least 60 percent of HQLA. Agency debt and agency MBS are included in level 2a and are subject to a 15 percent haircut. SVB had $7.8 billion in reserve balances, $16.2 billion in Treasury securities at fair value and $7.7 billion in Ginnie Maes at fair value, so $31.7 billion in level 1 HQLA. SVB had $61.7 billion in agency debt and agency MBS (excluding Ginnie Maes) at fair value; after the 15 percent haircut, that’s $52.4 billion in level 2 HQLA. Because level 1 HQLA must equal at least 60 percent of HQLA, SVB’s holdings of level 2a HQLA are capped at $21.1 billion. In sum, SVB would have had $52.8 billion in HQLA for LCR purposes.

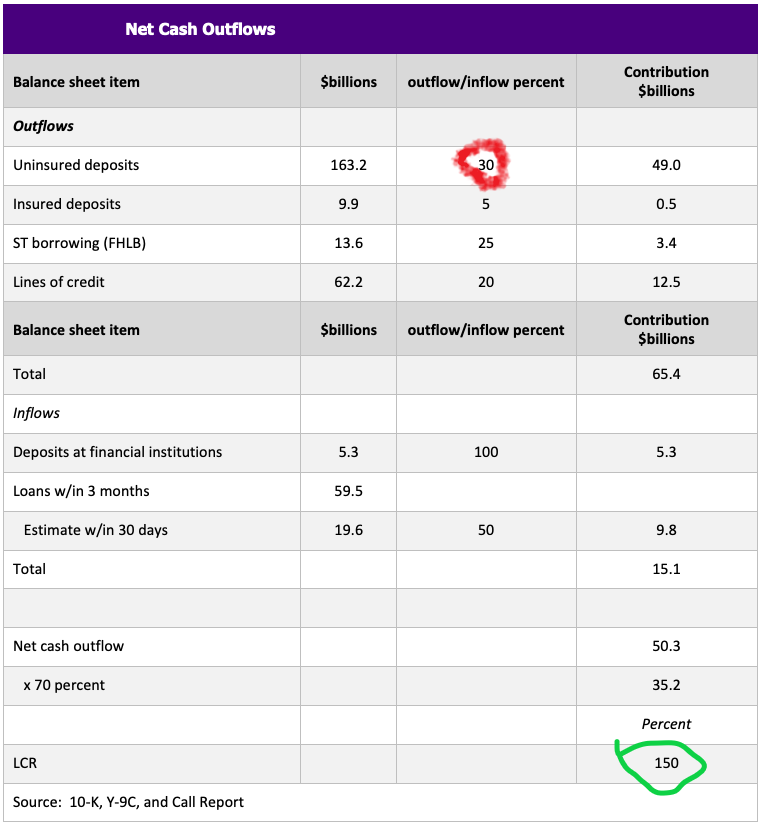

Net cash outflows are more complicated. They are calculated by applying pre-specified factors to various balance sheet and off-balance-sheet items. The factors are chosen to replicate the situation during the GFC, with significant idiosyncratic and market-wide stress. In many cases, the precise factor to apply depends on information that is not contained in the 10-K. An additional restriction in the LCR is that projected inflows cannot exceed 75 percent of projected outflows. As noted, for a bank of SVB’s size and other characteristics, net cash outflows are then multiplied by 70 percent.

First, outflows. SVB has $173.1 billion in deposits, of which $161.5 were domestic. Of domestic deposits, $151.6 billion were uninsured, indicating $9.9 billion were insured. We therefore estimate that $163.2 billion of total deposits were uninsured (total – domestic insured). The outflow rate on uninsured deposits of retail and nonfinancial business customers varies between 10 and 40 percent depending on the characteristics of the depositor and deposit, with the lower outflow rate applied to retail customers including those small businesses that are treated like retail customers. The outflow rate on uninsured deposits of financial business customers varies between 25 percent for operational deposits and 100 percent for non-operational deposits. If we assume a 30 percent outflow rate, that’s a $49.0 billion outflow.[1] The outflow rates on insured deposits are 3-40 percent, where 3 percent is for a stable retail deposit. Assuming an outflow rate of 5 percent results in a $0.5 billion outflow. SVB had $13.6 billion in short-term borrowings, which are almost entirely FHLB advances. The rollover rate on FHLB advances is 75 percent so the outflow from the short-term borrowing is $3.4 billion. SVB had $62.2 billion in lines of credit and letters of credit. The drawdown rate assumption on lines of credit is between 0-30 percent depending on the type and the counterparty. If the drawdown rate is 20 percent, the outflow would be $12.5 billion. Total estimated outflows are $65.4 billion.

Second, inflows. SVB had $5.3 billion in deposits at other financial institutions, all of which are assumed to be an inflow. It had $73.6 billion in loans of which $59.4 billion mature within three months. Half of scheduled repayments on most loans are treated as an inflow. If we assume, conservatively, that one third of the loans that mature within three months mature within one month, the inflow would be $9.8 billion. Total estimated inflows are $15.1 billion.

Estimated net cash inflows is $50.3 billion, or $35.2 billion after multiplying by 70 percent.

SVB’s LCR would therefore have been 150 percent ($52.8 billion/$35.2 billion) on Dec. 31, 2022. The requirement is that the LCR be equal to or above 100 percent.

Table 1 in the article cleary lays out the simple math.

Divide Total HQLA by estimated net outflow leads to the LCR of 150% (circled in green below).

The LCR = 150% depends on a outflows of 30% on uninsured deposits.

Given the rapidity with which SVB lost uninsured deposits, I wondered about the assumption of only a 30% outflow rate on the sum of operational and nonoperational deposits. Taking all the other assumptions Mr. Nelson used, I varied the 30% outflow rate to search for what would yield a LCR less than 100%. The answer is 46%.

In one day (Thursday last week), depositors took out $42 billion according to journalistic accounts, so in a single day, 24% of deposits left. I don’t know what the regulators would’ve assumed in their stress tests, but in any case I’m not sure 30% would’ve been the right number.

So, in my book (taking into account I’m not a regulator, and have no such experience), it’s not clear-cut that having SVB listed as a SIFI wouldn’t have at least made supervisors look at SVB a bit harder. By the way, having 76% of total debt as being held to maturity (i.e., 2.2% securities available for sale) means that the typical LCR based on a calculation based on all high quality liquid assets would have needed a footnote.

By the way, none of this is to deny the fact that concentrating assets in Treasuries and agency debt without hedging interest rate risk seems to have been a dumb idea, given the telegraphing of rising rate.

More By This Author:

“So China Is Now Paying Us Billions Of Dollars In Tariffs”

Back In The Real Economy: Business Cycle Indicators, Mid-March

Banking Turmoil: Deregulation Vs. Monetary Profligacy (Vs. Unanticipated Events)