Banking Turmoil: Deregulation Vs. Monetary Profligacy (Vs. Unanticipated Events)

I keep on hearing this refrain from people like former senator Toomey (on Bloomberg TV today) that the 2018 deregulation had nothing to do with SVB’s travails; rather its problems (presumably also Credit Suisse’s too) was due to monetary and fiscal profligacy. I thought it would be useful to recap the path of expected interest rates.

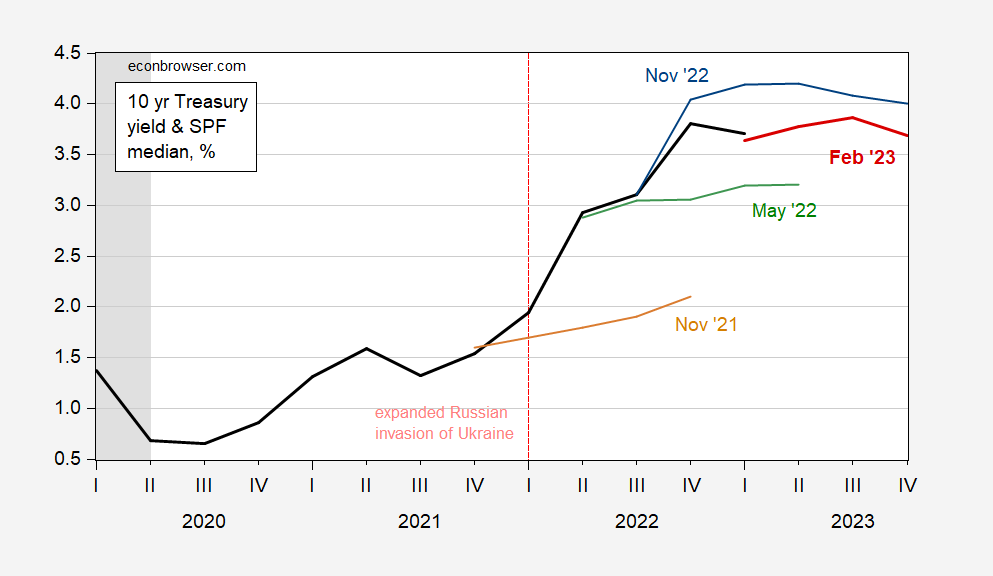

Figure 1: Ten year Treasury yield (black), and median forecast from February 2023 Survey of Professional Forecasters (red), from November 2022 (blue), May 2022 (green), and November 2021 (tan). 2023Q1 observation for data through March 15. Source: Treasury via FRED and Philadelphia Fed SPF (various), and author’s calculations.

While as of 2023Q1, the 10 year interest rate was 2.54 ppts above that forecasted in November 2021 – over a year ago – it is about half a percentage point below that forecasted in November of 2022.

In other words, even before the Russian invasion, banks should have expected a rise in long term bond yields. Certainly by May 2022, the forecast was such that the resulting surprise in Q1 was only half a percentage point.

Surely, had interest rates not risen so much over the past year, the SVB collapse might not have occurred so soon. But given the downturn in the tech sector, SVB (given not subject to annual stress tests, and liquidity requirements) would have probably encountered a run (Toomey’s assurances notwithstanding).

More By This Author:

Yields, Spreads, And Uncertainty/Risk

Implied Fed Funds Peak – From September To May

Month-On-Month Core PPI At 0%