Tuesday Talk: Wonder Rates

Our world is filled with wonder as recent photographs from the James Webb telescope have shown. But for the moment Wall St. is racked with a more mundane kind wonder, what will become of rates?

Central bankers around the globe have been increasing rates this month, the latest to do so were the European Central Bank with a 50 bp increase and the Hungarian National bank with a 125 bp increase. It is widely anticipated that the Fed will announce another increase of 75 bp at its July FOMC meeting tomorrow, though there has been some speculation that it might be 100 bp, given June's high inflation report. Against that backdrop and continued Russian machinations in Ukraine, Wall Street seems in no mood to keep last week's rally going. However, yesterday's action seemed to be more of a sit and wait till Wednesday session.

Wonder and wait are not expressions normally associated with a market better known for leading by anticipation, unless of course you factor in waiting for an (already), anticipated recession...

Monday the S&P 500 closed at 3,967 up five points for the day. The Dow rose 91 points to close at 31,990 and the Nasdaq Composite closed at 11,783, down 51 points.

Top gainer for the session was Silicon Valley Bank Financial Group (SIVB), up 8.2%, rebounding from a 17% drop on Friday. Other top gainers were fertilizer giants Mosaic and CF Industries as well as energy (oil) sector issues.

Chart: The New York Times

Currently market futures are trading in the red, S&P 500 market futures are down 18 points, Dow market futures are down 125 points and Nasdaq 100 futures are down 80 points.

TalkMarkets contributor Bob Lang says The Bear Market Continues And Challenges Our Patience.

"As the bear market continues, you may find yourself losing patience. You’re in good company. Many traders will start losing money now, simply because they are tired of sitting on the sidelines...We’ve been in this bear market for the better part of seven months. Yes, that long!...Everyone is ready for a bullish trend to take over, and until it does, emotions will rise as the frustration mounts. Don’t be tempted to listen to anyone who issues an end date on this bear market. They don’t know any more than you do."

"Let’s look at the facts. The Fed remains vigilant about fighting inflation. Volatility is low and that means two things: option prices are cheap for both puts and calls, and the market is not anticipating big moves.

What to do now? Continue using the bear market playbook. Hold lots of cash, protect your portfolio with index puts, play it small and tight, sell calls against your stocks, and remove stocks that are not working for you. In addition, start making a wish list of names you want in your portfolio. As this bear market plays out, even the best names are likely to take a hit (and become affordable)."

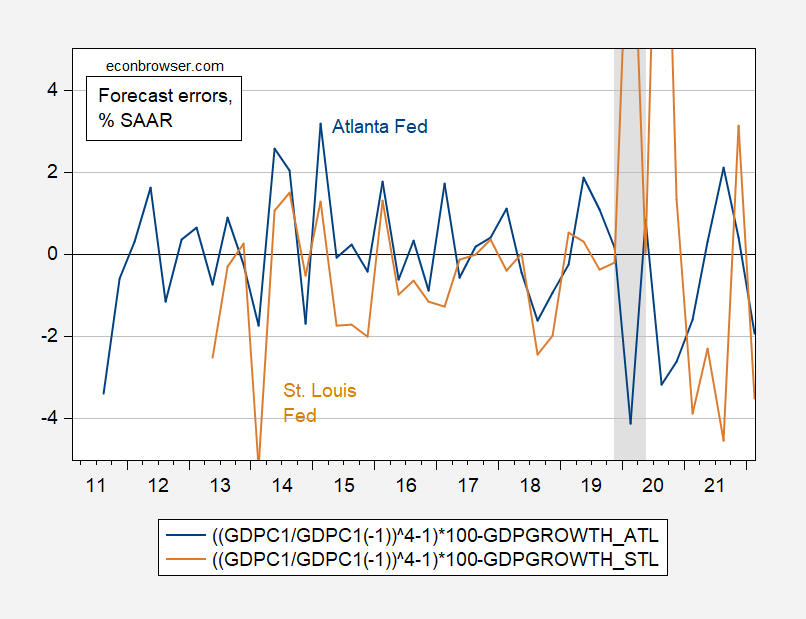

Recession seems to be the word on the lips, tablets and laptops of many these days, but before we take a look at some of those comments, contributor and economist Menzie Chinn takes a closer look at the differences in measuring GDP between Federal Reserve members in Nowcast Errors – Atlanta Vs. St. Louis.

"...for illustrative purposes, here is an easy-to-do comparison (since the data are at FRED) for nowcasts just before the advance release."

"Taking out the three quarters of growth associated with the pandemic’s onset (Q1, Q2, Q3), the (Atlanta Fed) GDPNow and St. Louis mean errors for a common sample of 33 observations are 0.12 and -0.82 ppts respectively (SAAR). The RMSFE’s are 1.4 and 1.8 ppts respectively. In other words, GDPNow underpredicts slightly, while the St. Louis index overpredicts a bit. Adjusting by the bias means that the implied Q2 growth rate for GDPNow is -1.7 ppts, and +3.2 ppts for St. Louis Fed."

That's a mean spread (pun intended).

Contributor Stefan Gleason writes The Official Story About The Economy Doesn’t Add Up.

"On Sunday, Treasury Secretary Janet Yellen went on NBC’s “Meet the Press” and said, “This is not an economy that is in recession.”...

Interpretations of what constitutes a recession differ among economists. Some point to negative Gross Domestic Product readings already in the books as confirmation a recession has started. Others merely see a slowdown...The Alignable small business network’s July hiring report showed that 45% of small businesses are halting new hiring.

According to the report, “This represents a significant hiring shift, and is largely a reaction to mounting labor costs, skyrocketing inflation, fears of a recession, and rising interest rates.”

Large publicly traded corporations are giving of recession warnings. The S&P 500 has fallen over 20% from its high – a classic bear market indicator and recession precursor.

Investors are worried the Federal Reserve’s rate hikes will kill the economy.

And historically, whenever the Fed has embarked on a rate-hiking campaign of this magnitude, it has caused the economy to roll over...

Investors who don’t buy the official story on the economy should prepare accordingly. Whether it’s just a mild recession or a total economic collapse, a deteriorating economy will eventually force the Fed to change course on rate hikes...

The Fed will surely hike rates again at is upcoming policy meeting on Wednesday. Markets have already priced that in.

What they haven’t priced in is the Fed pivoting away from inflation-fighting and toward digging the economy out of a downturn.

Fed chairman Jerome Powell won’t make an announcement to that effect. But markets will interpret any subtle shifts in language toward dovishness to mean central bankers are, in fact, worried about a recession despite official denials."

TM contributor Timothy Taylor asks Is A Recession Defined As “Two Negative Quarters”?

"The US economy is likely to show negative growth in its gross domestic product for the first two quarters of 2022...

My question here is one of nomenclature and analysis: Does two quarters of declining GDP mean that the US economy is in a recession? After all, the unemployment rate in June 2022 was 3.6%, which historically would be viewed as a low level. The number of jobs in the US economy plummeted during the short pandemic recession from 152.5 million in February 2020 to 130.5 million in April 2020, but since then has been rising steadily and is up to $152 million in June 2022. Similarly, the labor force participation rate of the US economy dropped from 63.4% in February 2020 to 60.2% in April 2020, but has rebounded since then and has been in the range of 62.2-62.4% in recent months. So can you have a “recession” that happens simultaneously with low unemployment rates and a rising number of jobs?

The definition of a “recession” is not a physical constant like the boiling point of water. It is quite common to define a recession as “two quarters of negative GDP growth.” But there is actually no US-government approved definition of “recession.” (To use) a recent example, if a “recession” was strictly defined as a decline of two quarters in GDP growth, then the Trump administration would have been justified in saying that the US economy did not have a pandemic “recession” at all."

Taylor goes on to cite several cross-global definitions of recession as one preceded by two quarters of negative growth, and he is careful to cite Julius Shisken's (former head of the Bureau of Labor Statistics) definition of what constitutes a recession, but for one does not think it is helpful be orthodox about this in the current situation.

"As someone who tries to keep my categories clear, I would not yet refer to the US economy as “in a recession,” even if the GDP numbers later this week show two consecutive quarters of decline. In my mind, not all economic distress is properly called a “recession.” The current problems of the US economy, it seems to me, are a mixture of the surge of inflation that is driving down the buying power of real wages for everyone, and the ongoing adjustment of labor markets, supply chains, and firms to the aftereffects of the pandemic. But I also wouldn’t criticize too loudly those who apply the “recession” label based on two quarters of negative real GDP growth. Moreover, efforts by the Federal Reserve to choke off inflation with a series of interest rate increases have contributed to a number of US recessions since World War II, so there is a real risk that in the coming months, the US economy will end up experiencing the combination of lower output and job losses that will qualify as a “recession” by any definition."

The article is a good read, but you get the idea.

The Staff at contributor Schiff Gold seem to be a bit more insistent (and upset) as noted in their headline Taking Gaslighting To New Heights The White House Changes The Definition Of “Recession”.

"You don’t have to worry about that recession anymore. The White House fixed it...

And by “fixed it” I mean it just changed the definition of a recession.

A recession has long been defined as two consecutive quarters of negative GDP growth.

The GDP in the first quarter of 2022 came in at -1.6 percent. At the time, the mainstream generally blew it off, asserting that it was just an outlier.

Now, it’s becoming increasingly clear we’re heading for the second straight negative GDP print. The Atlanta Fed projects another -1.6% decline in Q2. And there is plenty of data up there to back the projection up.

That would mean we’re in a recession now, and we have been all year.

But apparently, the Biden administration has no plans to accept reality. Instead, it wants to alter reality.

The White House propaganda team is working overtime to change the definition of a recession. If it can convince everybody that two consecutive quarters of negative GDP growth isn’t the definition of a recession, it has plausible deniability that the economy is currently in a recession.

With that in mind, the White House published a blog post on July 22 that takes the art of gaslighting to new heights.

Oh my, oh my...

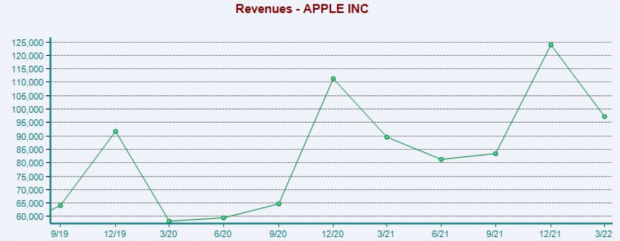

Moving on to less "philosophical" topics TM contributor Derek Lewis takes a look at Apple (AAPL): Apple Q3 Preview: Can The Earnings Streak Continue?

"Apple's slated to release quarterly results on July 28th after the trading session.

The quarterly report will be watched like a hawk and will have widespread market effects. So, how does the tech titan shape up heading into the quarterly release? Let’s take a closer look.

Quarterly Estimates

Analysts have had mixed estimate revisions for the quarter to be reported over the last 60 days, with two upwards revisions and two downwards revisions. The Zacks Consensus EPS Estimate for the quarter resides at $1.13, reflecting a disheartening 13% decrease in quarterly earnings year-over-year.

Image Source: Zacks Investment Research

However, the top-line looks to expand marginally – the $81.9 billion quarterly revenue estimate pencils in a slight 0.5% uptick year-over-year. The chart below illustrates the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Quarterly Performance & Market Reactions

Apple is known for consistently reporting strong quarterly results, which is precisely what it’s done. Over the company’s previous 20 quarters, the tech titan has exceeded the Zacks Consensus EPS Estimate a jaw-dropping 19 times. Just in its latest quarter, Apple posted a robust 6.3% bottom-line beat.

Top-line results have been just as stellar; Apple has recorded nine top-line beats over its last ten quarters.

In addition, the market has reacted well to the company’s quarterly releases as of late – over its last three quarterly reports, shares have moved upwards each time.

Bottom Line

Apple shares have held up relatively well year-to-date, undoubtedly a development that any investor can celebrate...

The tech titan has consistently reported top and bottom-line results above expectations, and the market has reacted well to the company’s quarterly releases as of late. However, earnings are forecasted to drop notably, but revenue is expected to see a marginal increase.

Heading into the quarterly report, Apple is a Zacks Rank #3 (Hold) with an Earnings ESP Score of 0.9%."

Image Source: Unsplash

As always, Caveat Emptor.

That's a wrap for this Tuesday morning.

Have a good one!

More By This Author:

TalkMarkets Image Library

Thoughts For Thursday: Rallies To Nowhere?

Thoughts For Thursday: One To One And One