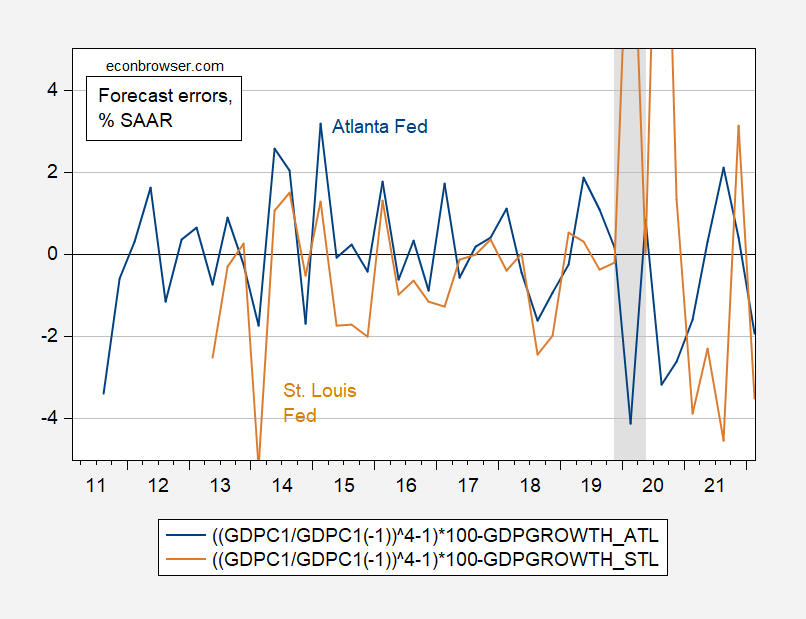

Nowcast Errors – Atlanta Vs. St. Louis

Reader Steven Kopits seems to think the Atlanta Fed’s GDPNow is the only nowcast of relevance. There are actually quite a few, from the tracking GDPs from consulting firms (e.g., IHS Markit formerly Macroeconomic Advisers) to Goldman Sachs, Deutsche Bank, etc. However, for illustrative purposes, here is an easy-to-do comparison (since the data are at FRED) for nowcasts just before the advance release.

Taking out the three quarters of growth associated with the pandemic’s onset (Q1, Q2, Q3), the GDPNow and St. Louis mean errors for a common sample of 33 observations are 0.12 and -0.82 ppts respectively (SAAR). The RMSFE’s are 1.4 and 1.8 ppts respectively.In other words, GDPNow underpredicts slightly, while the St. Louis index overpredicts a bit. Adjusting by the bias means that the implied Q2 growth rate for GDPNow is -1.7 ppts, and +3.2 ppts for St. Louis Fed.

Note that I’ve taken final revised growth rates, instead of advance growth rates in my calculations (because otherwise, I’d have to calculate all of the advance growth rates in the ALFRED spreadsheet), so consider this a quick and dirty analysis. And there is a more fundamental issue of whether pre-pandemic datais useful in this comparison of forecasting ability (which is why I used the last three year’s in a previous post).

More By This Author:

Does A Downturn In Household Survey Employment Presage A Recession?

Will Commodity Prices Continue To Sustain Inflation?

GDP Nowcasts

Disclosure: None.